📆 Bank of England will announce rate decision at 12:00 pm BST today

Bank of England is another major central bank set to announce a rate decision this month, after last week’s decision from the Fed and ECB. It is expected that Bank of England will deliver a 25 basis point rate hike, the second one in a row. However, it is unlikely that it will be the final hike in the current cycle given slow progress on inflation with headline CPI staying above 10% in March. Apart from the decision itself, BoE will also publish minutes today as well as update macroeconomic projections. Money markets currently price in one or maybe 2 additional 25 bp hikes after the one today. If inflation forecasts are revised higher, rate peak expectations may move closer to 5% what could provide support for the British pound. On the other hand, yield spread between the UK and US is so wide that it may support GBP as the Fed is moving closer to rate hike pause.

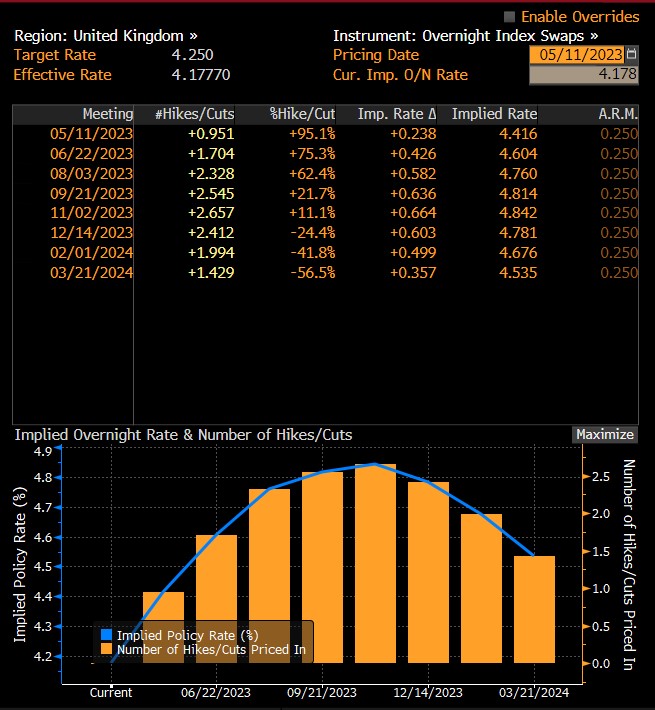

Money markets see possibility of rates hitting 5%

Currently, money markets see 66 basis points of additional tightening this year, what could signal 25 bp rate hikes today, in June and most likely in August as well. Source: Bloomberg

UK inflation remains elevated, signaling a high chance of an upward revision in inflation forecasts. This could set the stage for 3 more rate hikes this year, including today’s. Source: Bloomberg, XTB

Will the distribution of votes change?

Bank of England has been less hawkish since December with vote distribution changing. Silvana Tenreyro and Swati Dhingra have been against rate hikes at the previous 3 meeting. Moreover, Governor Bailey has sounded dovish on a number of occasions, saying that rate hikes are not set in stone. On the other hand, inflation conditions are forcing him to vote in favor of rate hikes. Goldman Sachs sees a small chance for a slight hawkish turn from BoE, with rates reaching 5% later into the year.

UK yields have been on the rise recently and increased quicker than US yields. Spare for a spike in UK yields in September 2022 (driven by concerns over UK pension system), yield spread is currently at the highest level in 10-years and is positive. Given potential for a further drop in US yields, GBPUSD may continue to enjoy upward pressure. Source: Bloomberg, XTB

GBPUSD drops around 0.4% on the day and trades near a key resistance – downward trendline drawn through May 2021 and early-2022 highs. A recent drop on the pair may be driven more by USD strengthening than negative expectations for BoE meeting today. Moreover, a 61.8% retracement of the 2021-2022 downward impulse can be found slightly above the trendline. Should BoE hit a hawkish note today, pair may test the aforementioned resistances with a break above paving the way for a test of 1.30 area. Source: xStation5