Wall Street – U.S. Banks Push Wall Street Lower

US equities kicked off the Tuesday trading mixed, initially lifted by the cooler-than-expected core inflation data that reaffirms investors in the disinflationary process after shutdown-distorted reading in October. The Russell 2000 gained the most (US2000: +0.2%), with higher hopes of further Fed easing benefiting smaller companies, largely dependent on costs of credit. US100 and US500 trade flat, while US30 is down 0.4% mainly on US banks correcting after JPMorgan’s and BNY’s earnings.

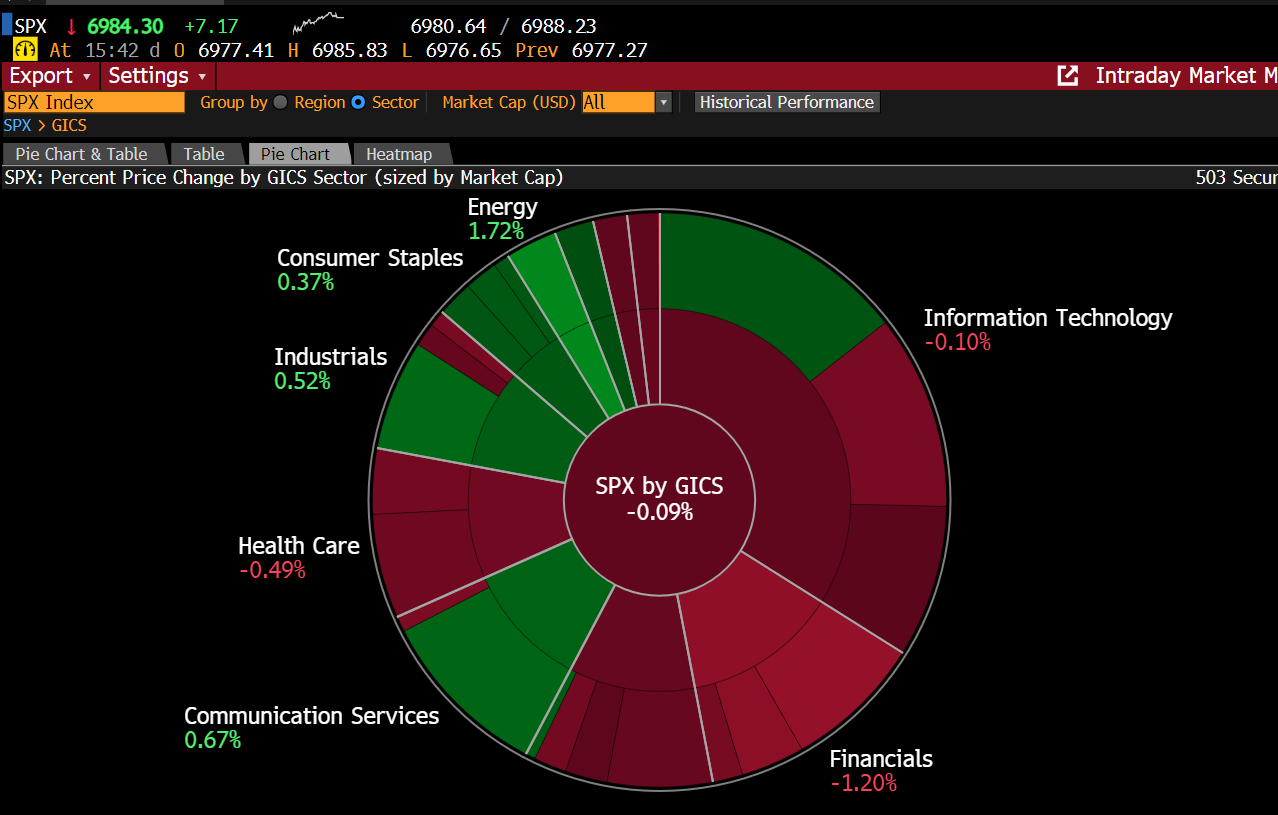

Among S&P 500 sectors, the US financial companies weigh the most on the performance of the index. Source: Bloomberg Finance LP

Inflation: Cooler Core, Hotter Monthly

December’s core CPI rose less than expected, gaining 0.2% monthly and 2.6% annually (est.: 0.3% MoM and 2.7% YoY), signaling continued progress in the disinflation process. Headline number met estimate at 2.7% annually. While shelter costs remained sticky (+0.4%) and food prices jumped 0.7%, deflation in used cars and communication helped temper the overall reading.

Despite the cooler core data, traders expect the Federal Reserve to hold interest rates steady this month, with the next cut likely delayed until June as inflation remains above the 2% target. Notably, the monthly CPI accelerated from 0.2% to 0.3%, potentially motivating Fed taking a pause before further cuts.

Source: XTB Research

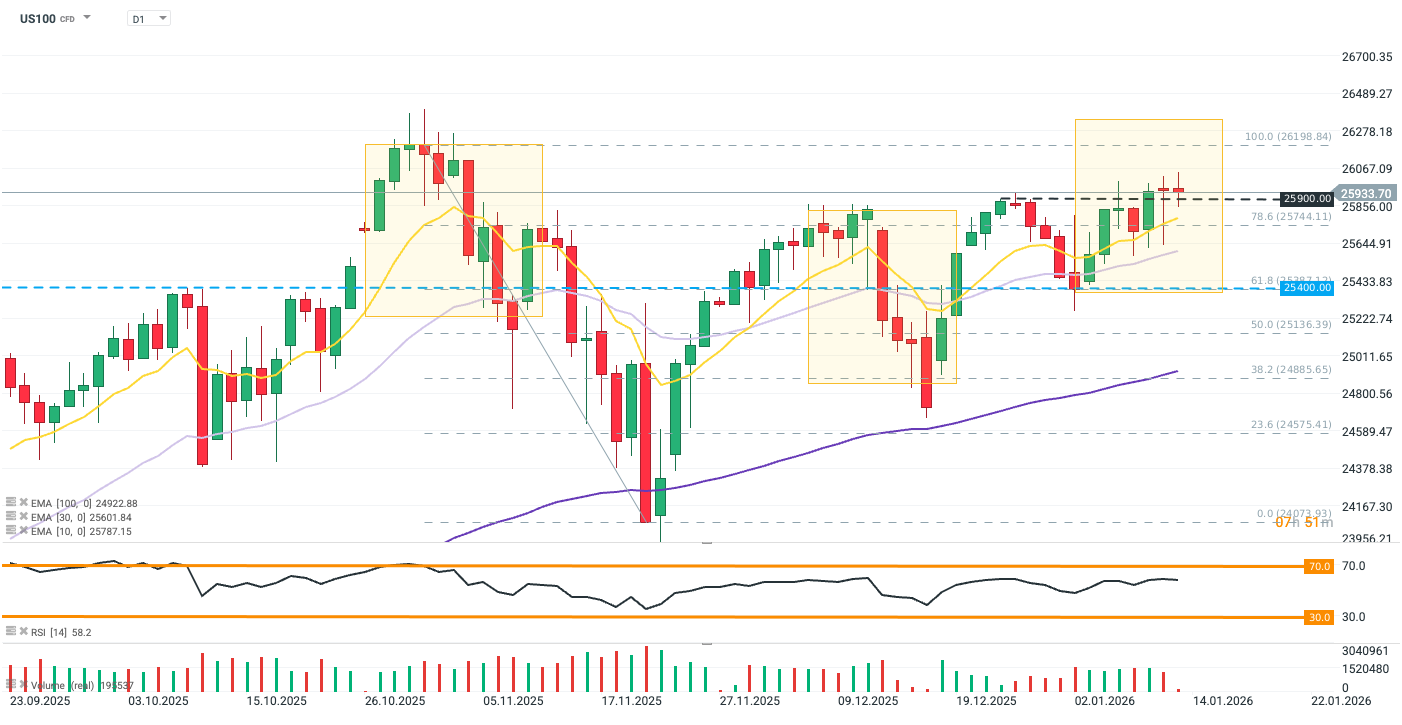

US100 (D1)

Nasdaq futures capped early trading gains, though the contract still maintains a bullish momentum on the daily chart, currently trading around 25,930, firmly positioned above key moving averages. The index has successfully consolidated above the 78.6% Fibonacci retracement level at 25,744, which now acts as immediate support alongside the 30-day EMA (yellow line) at approximately 25,605. With the RSI reading of 59.3, the oscillator suggests room for further upside before reaching overbought territory. Bulls are likely targeting the recent swing high at 26,198 (100% Fibo). Conversely, a failure to hold current levels could trigger a pullback toward the critical support zone at 25,400, coinciding with the 61.8% Fibonacci level.

Source: xStation5

Company news:

- Bank of New York Mellon (BK) posted strong fourth-quarter results, with profit jumping to $2.02 per share from $1.54 a year earlier. Driven by rallying equity markets and higher rates, assets under custody rose 14% to $59.3 trillion, while Net Interest Income surged 13%. Consequently, BNY raised its medium-term return on tangible common equity target to ~28%. The stock is down 0.4%

- Delta Air Lines (DAL) shares are down 1.4% after its 2026 profit guidance missed analyst estimates, overshadowing a projected 20% earnings growth. The carrier is pivoting to affluent travelers to counter weak economy demand, reinforcing this high-end strategy with an order for 30 Boeing 787 jets. Management highlighted a stark divergence between robust premium spending and a struggling lower-end consumer.

- Google (GOOGL) is reportedly shifting the development and manufacturing of its high-end smartphones—including the Pixel, Pixel Pro, and Pixel Fold—to Vietnam this year. According to Nikkei Asia, this move transfers the critical “New Product Introduction” (NPI) phase for flagship devices out of China, although the lower-end Pixel A series will remain there for now.

- JPMorgan Chase (JPM) reported a decline in fourth-quarter profit to $13 billion ($4.63 per share), down from $14 billion a year earlier, due to a $2.2 billion credit provision tied to its new Apple Card partnership. Excluding this one-time charge, profit would have increased to $14.7 billion ($5.23 per share), fueled by strong trading results. The stock is down 2.9%

- L3Harris Technologies (LHX) surged is up 2.1% after announcing a unique $1 billion partnership with the Department of War to invest in its missile solutions unit. This business will be spun off as a separate publicly traded company in late 2026, with L3Harris retaining majority control. The deal aims to boost solid rocket motor production for the “Arsenal of Freedom”.

- Ormat Technologies (ORA) is seeing a surge in institutional demand, with RWC Asset Management increasing its stake by 8.8% and AQR Capital boosting holdings by over 300%. Hedge funds now control 95.5% of the company. These aggressive stock acquisitions follow a strong Q3 earnings beat and multiple analyst upgrades, pushing shares near 52-week highs. The stock is up 2.3%

- Travere Therapeutics (TVTX) shares plunged almost 30% after the FDA requested additional information to assess the clinical benefit of its kidney disease drug, Filspari. This request casts uncertainty on the January 13 approval deadline. Despite the drop, retail sentiment paradoxically turned “extremely bullish,” while the company confirmed $410 million in 2025 sales.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.