UBS (UBSG.CH) shares rose sharply after Swiss lawmakers proposed easing planned stringent capital requirements. A key element of the proposal is allowing the bank to use AT1 (Additional Tier 1) bonds instead of issuing new equity (shares) to meet the new safety standards. The government’s earlier plan, pushed by Finance Minister Karin Keller-Sutter, would have required UBS to raise up to $26 billion in additional capital, which would have been a huge burden on shareholders. The new proposal is a political compromise:

- UBS may use AT1 bonds to cover its requirements.

- The bank may continue to include certain programme assets and tax relief in its capital.

- In return for these concessions, the expansion of UBS’s investment banking division is to be curtailed.

What are AT1 bonds?

AT1 (Additional Tier 1) bonds, also known as hybrid bonds or CoCos (Contingent Convertibles), are a specific type of debt issued by banks to strengthen their capital base. These are risky instruments that offer higher interest rates than standard bonds. In a crisis situation (e.g. when a bank’s capital falls below a certain level), these bonds may be written off (their value falls to zero) or converted into shares. They act as a “safety buffer” – absorbing losses and protecting depositors and taxpayers from having to bail out the bank. The approval to use AT1 is beneficial for UBS, as issuing debt is usually cheaper and less dilutive for existing shareholders than a forced issue of new shares.

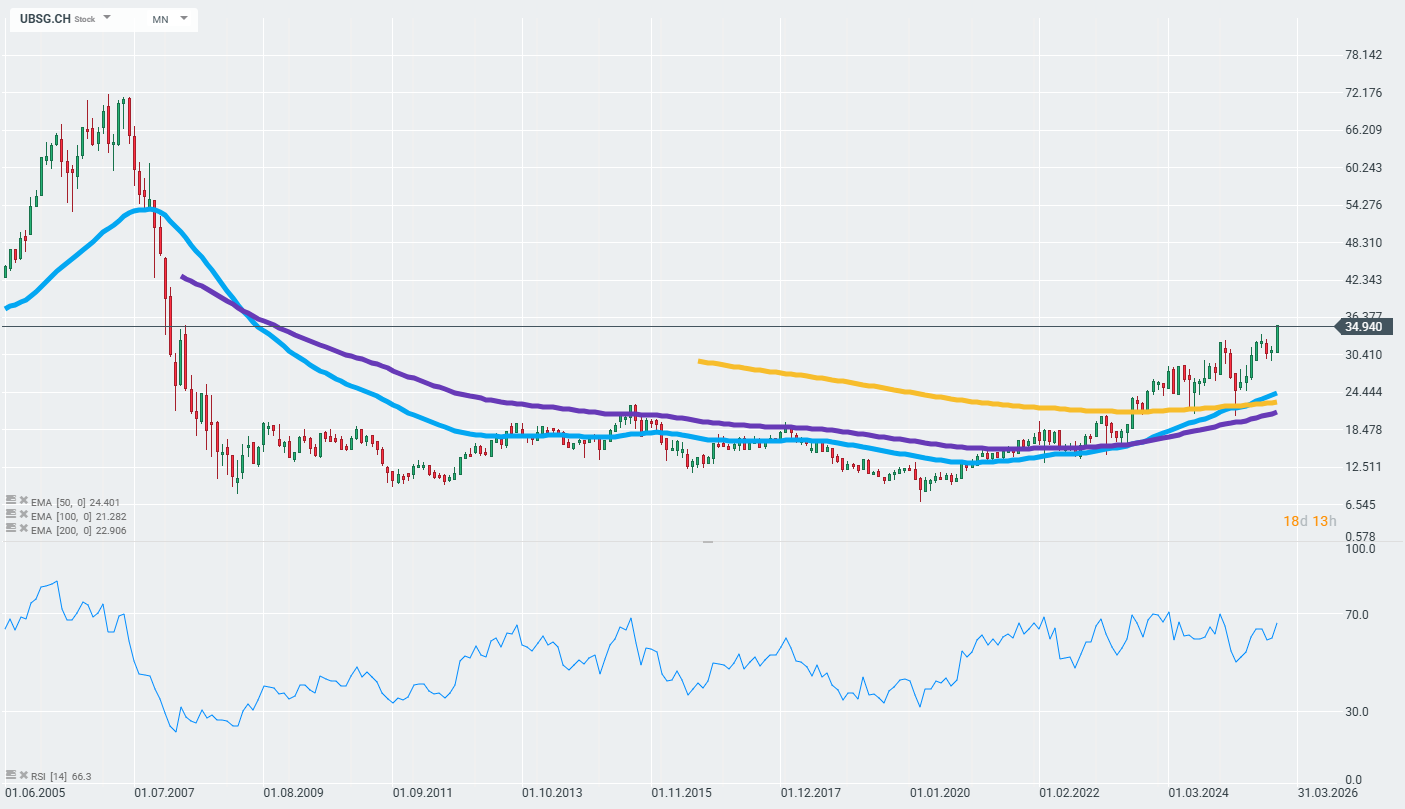

The market reacted euphorically to these reports, interpreting them as the removal of a huge regulatory risk (capital “overhang”). UBS’s share price jumped 5%, reaching its highest intraday level since 2008.

Investors interpret this move as a signal that Switzerland does not intend to “strangle” its largest bank with excessive regulations, and that the threat of a massive capital increase of USD 26 billion has been largely averted. Source: xStation

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.