U.S. CPI Preview – Will Disinflation Trend be Evedient in December

Today at 01:30 PM GMT we will receive the December US CPI print. This is the most important report of the week and, alongside NFP, one of the key releases from the Federal Reserve’s monetary policy perspective.

Inflation in the US likely edged slightly higher at the end of 2025. Consensus expects December CPI to come in at +0.3% m/m for both headline and core inflation. On a year-on-year basis, headline CPI is seen at 2.7%, while core CPI is expected to rebound to 2.7% from 2.6% in November. This modest uptick is mainly attributed to normalization after an unusually weak November reading, rather than the start of a new wave of inflationary pressure.

November CPI was distorted by the US government shutdown, which delayed price data collection and forced the Bureau of Labor Statistics (BLS) to rely on imputations—particularly in shelter components. According to Bloomberg Economics, this may have understated inflation by around 20 bps. As a result, the December report may appear to signal a return of price pressures as these one-off effects unwind. Some banks also point to the possibility of lingering distortions, suggesting that the first truly “clean” data may not arrive until February.

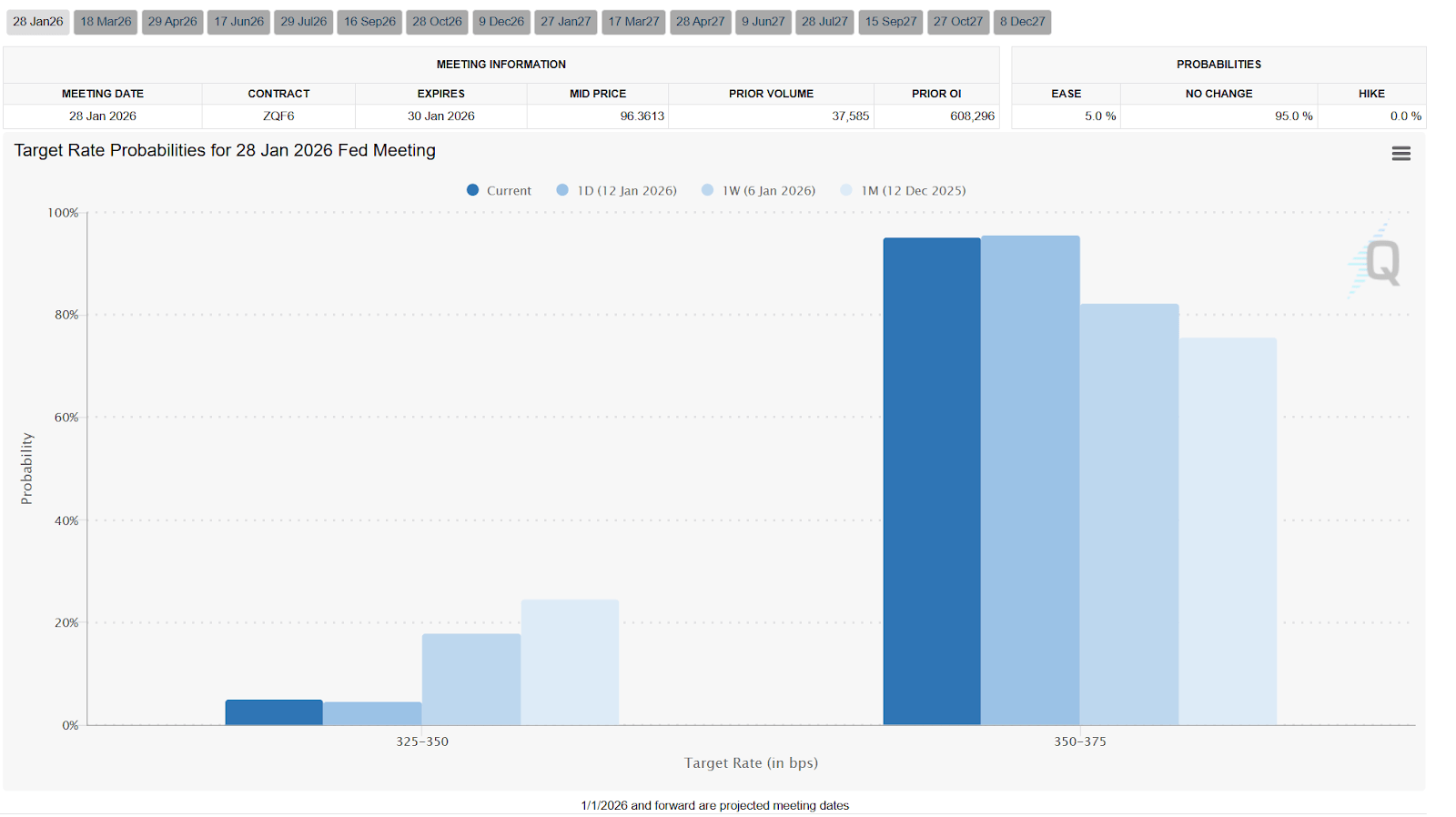

Markets price roughly a 95% probability that the Fed will keep interest rates unchanged at the upcoming meeting. Policymakers will monitor the impact of tariffs on prices, but most forecasts assume that inflation will gradually cool in 2026. Disinflation in housing and softer wage pressures are expected to outweigh tariff effects.

Interestingly, market pricing for the January decision has become increasingly hawkish day by day. This shift may help explain the recent rebound in the US dollar. Source: CME FedWatch Tool.

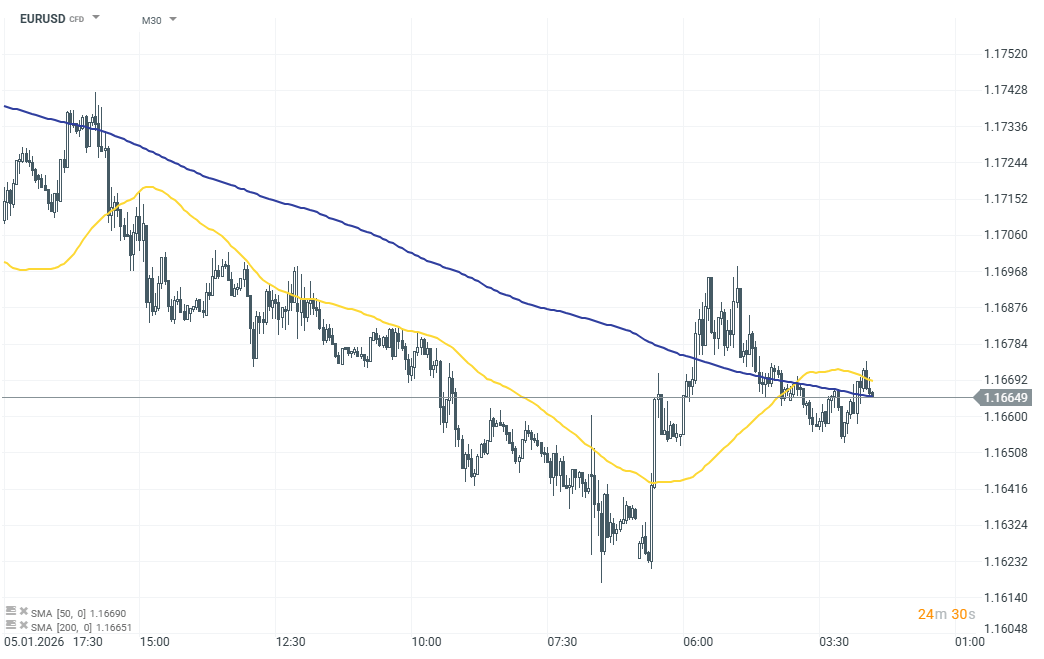

EURUSD (D1 timeframe)

The dollar remains relatively calm ahead of the release. EURUSD is trading slightly lower, down 0.02%. The pair is also influenced by heightened geopolitical uncertainty and ongoing developments around the US central bank, which may temper the market reaction to the CPI report.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.