Trade of The Day – XAG.Silver

Facts:

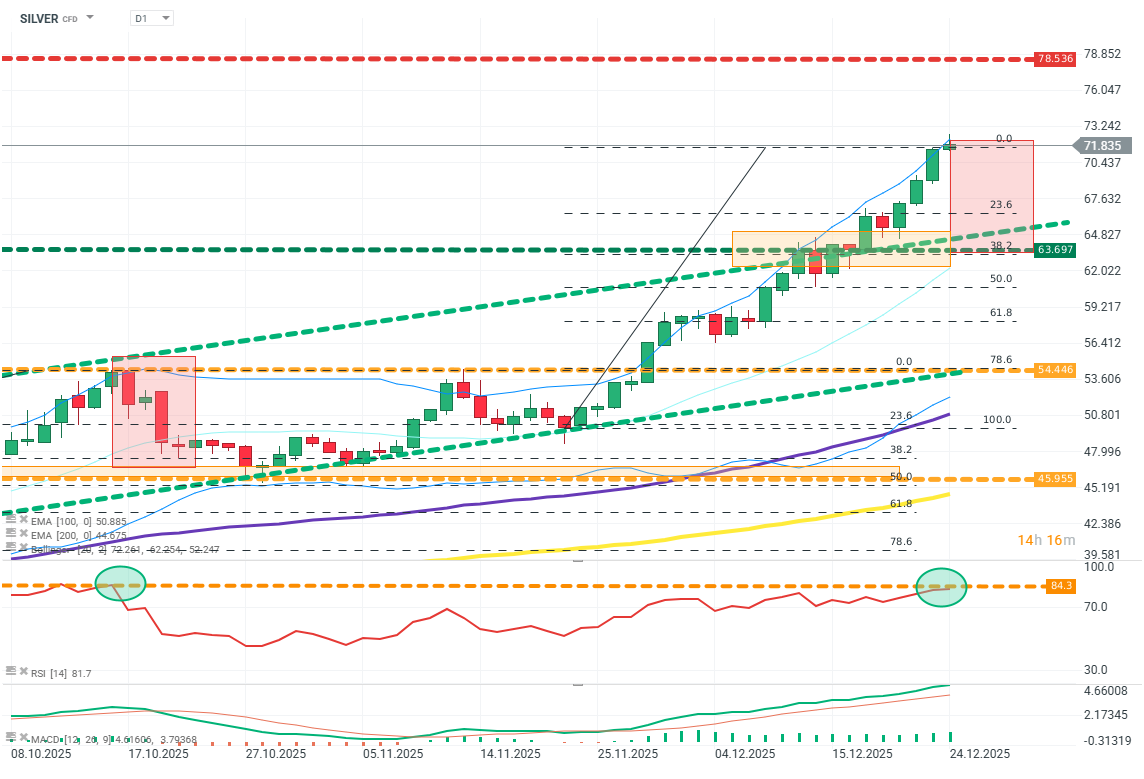

- Silver has reached another all-time high in recent sessions, exceeding $71.

- The RSI (14) indicator shows a value above 80.

- The Gold/Silver Ratio has dropped to around 65.

Trade: Short position (SELL) on SILVER at market price.

- Target: 63.6

- Stop: 78

SILVER (D1)

Source: xStation5

Opinion: Silver has experienced one of the most intense growth periods in history. Several factors indicate that the price of the metal has reached an overvaluation level. The RSI indicator has exceeded 80 and is currently at 81.7. A similar level prompted a correction around October. Additionally, the Gold/Silver Ratio has reached around 65. Such low levels were last recorded in 2021 and 2016, where the market fundamentally cannot accept such a price ratio. The correction scenario is further strengthened by the fact that silver is not the target metal that central banks purchase for security, which is one of the most significant fundamental supports for precious metals.

Methodology and assumptions:

- The recommendation is based on technical chart analysis, particularly EMA averages, RSI, Fibonacci levels, MACD, and fundamental analysis of the precious metals market.

- The target level was determined based on the dynamics and range of previous corrective movements and FIBO levels.

- The protective stop-loss order was determined based on a favorable risk-to-reward ratio.