Trade of The Day – USD/JPY

Facts:

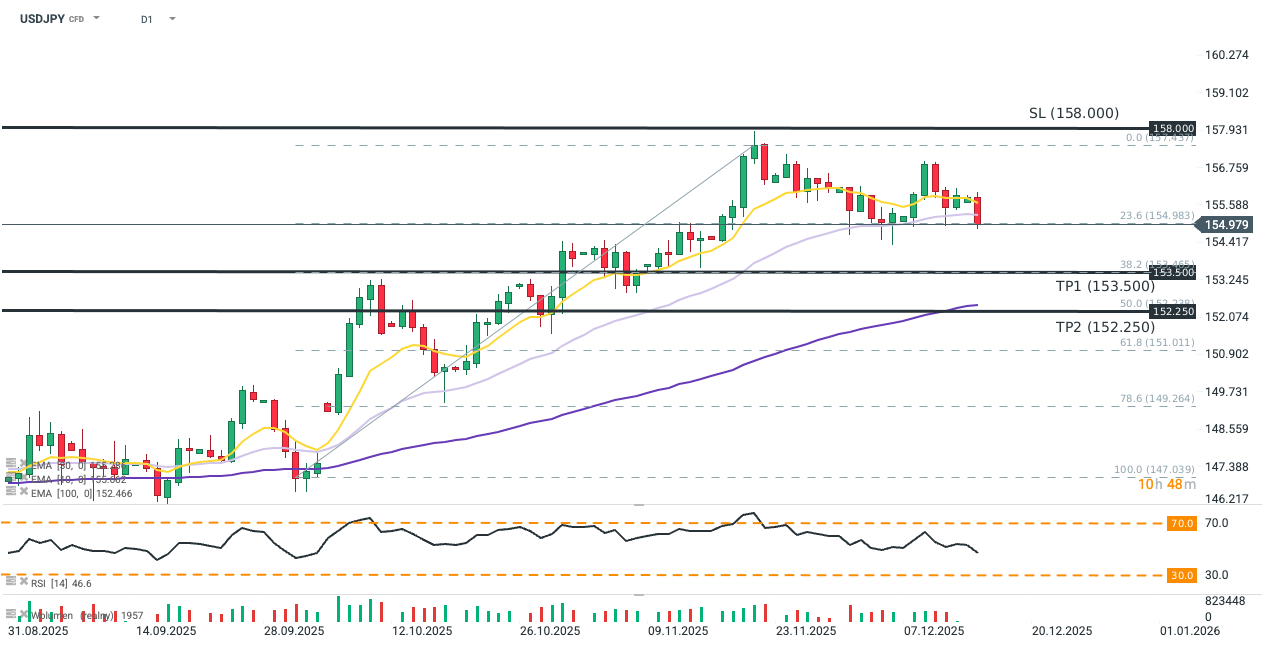

- USDJPY has moved below the 10-day and 30-day exponential moving averages (EMA10 – yellow, EMA30 – light purple).

- The swaps market prices a 94.8% probability of an interest-rate hike in Japan at the upcoming Bank of Japan meeting, and a 50% probability of another hike by mid-2026 (Bloomberg OIS Model).

- Business sentiment among large manufacturers in Japan has risen to a four-year high (Bank of Japan Tankan survey).

Recommendation:

- Short position (SELL) on USDJPY at market price

- Take Profit (TP): 153.500 (TP1), 152.250 (TP2)

- Stop Loss (SL): 158.00

Source: xStation5

Opinion

After three months of weakness against the dollar, the yen is beginning to regain ground amid crystallising expectations around Japan’s monetary policy and a growing sense that the Bank of Japan is behind the curve in responding to elevated inflation and improving producer sentiment. From early September through the end of November, the yen consistently depreciated against the dollar (USDJPY: +6.3% over that period), reflecting uncertainty at the time over the Fed’s next move. The downside was also amplified by the pro-growth narrative of Prime Minister Takaichi, which could have increased pressure on the BoJ to delay further rate hikes.

While the market remains far from the original idea of quarterly policy tightening in Japan (with only a 50% probability of another hike priced for the first half of 2026), the overall macro backdrop suggests the BoJ is lagging in its response to rising inflation. CPI is currently running at 3%, well above the BoJ’s 2% target, and with policy rates at 0.5%, real interest rates remain deeply negative. Moreover, the Tankan survey showed a third consecutive improvement in sentiment among large manufacturers and stronger-than-expected capital investment growth (12.6% vs Bloomberg consensus of 12.1%). This pickup in business activity should heighten the BoJ’s sensitivity to the risk of further economic overheating and increase its willingness to normalise monetary policy, which in turn should support the yen.

Methodology

The recommendation is based on a combination of technical analysis of the USDJPY chart and fundamental analysis of the Japanese and U.S. economies, with a focus on monetary policy. The trade direction was determined using exponential moving averages and market expectations regarding the upcoming BoJ decision and communication. Take Profit and Stop Loss le