Trade of The Day – Oil.Wti

Facts:

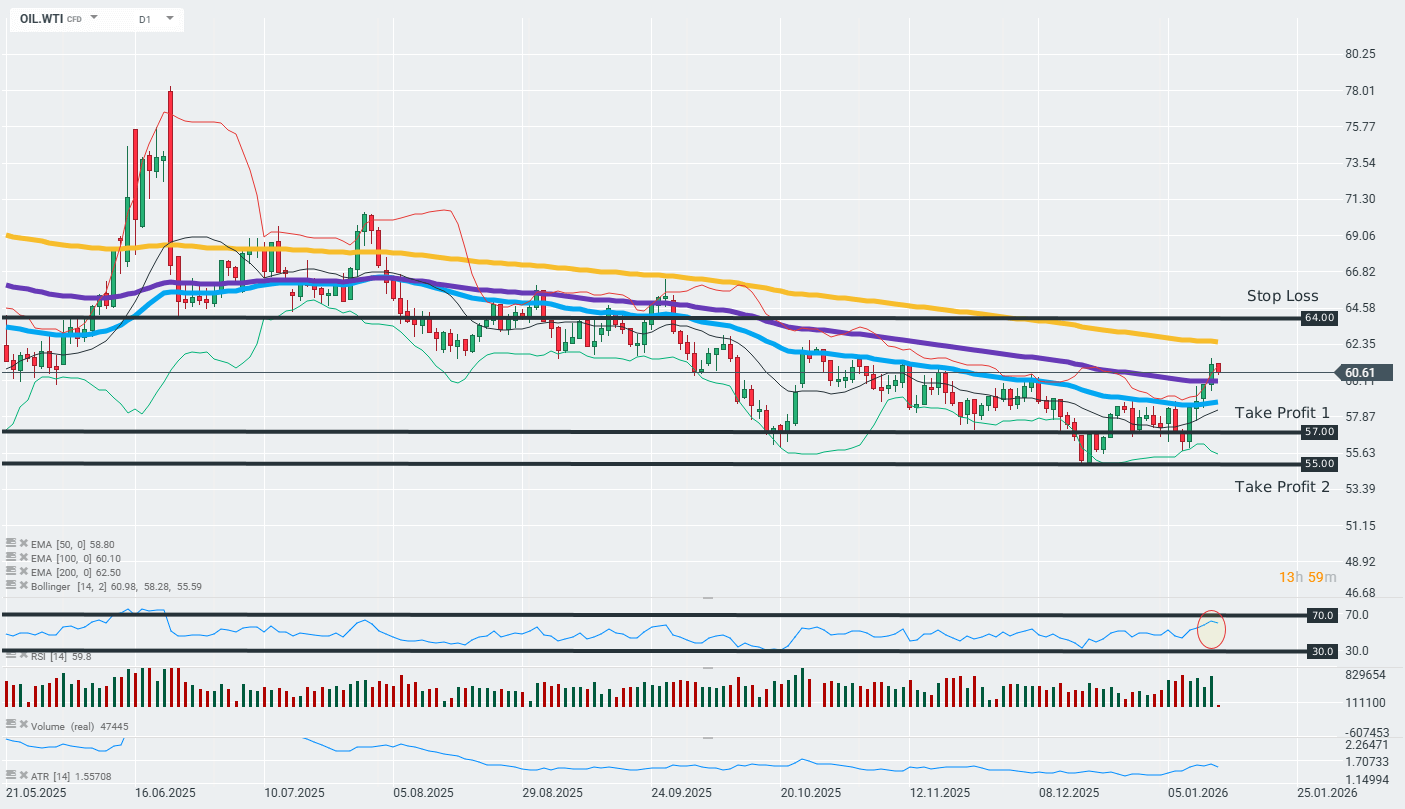

- OIL.WTI breaks above the 100-day exponential moving average

- The RSI for the last 14 days remains in the 61-point zone.

Recommendation:

Short position on OIL.WTI at market price

- SL: 64.00

- TP1: 57.00

- TP2: 55.00

Opinion:

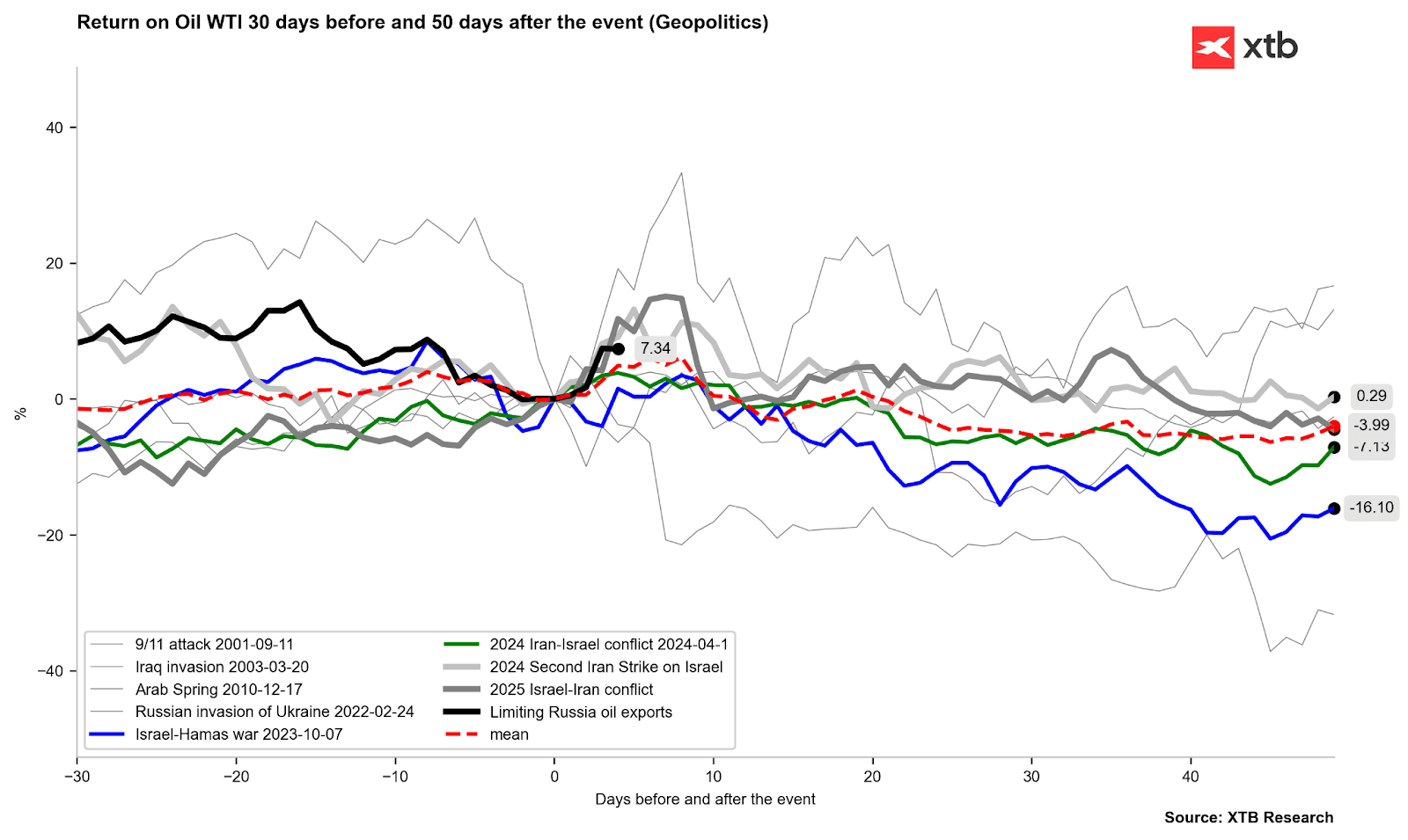

The recommendation for a short position on WTI crude oil is based primarily on fundamentals indicating a clear oversupply of the commodity in the coming quarters. The International Energy Agency forecasts a record supply surplus in 2026 of around 3.8-4 million barrels per day, which corresponds to nearly 4% of global demand. Similarly, the EIA assumes that oil production will grow faster than consumption, which should lead to further rebuilding of stocks and downward pressure on prices. An additional factor is the continuing weakness of demand growth in China and other key economies, coupled with increased production in the US and South America. Importantly, historical experience shows that geopolitical shocks related to Iran – even those that generated sharp price increases – were mostly short-lived, and prices returned to their previous trend based on the balance of supply and demand once tensions subsided.

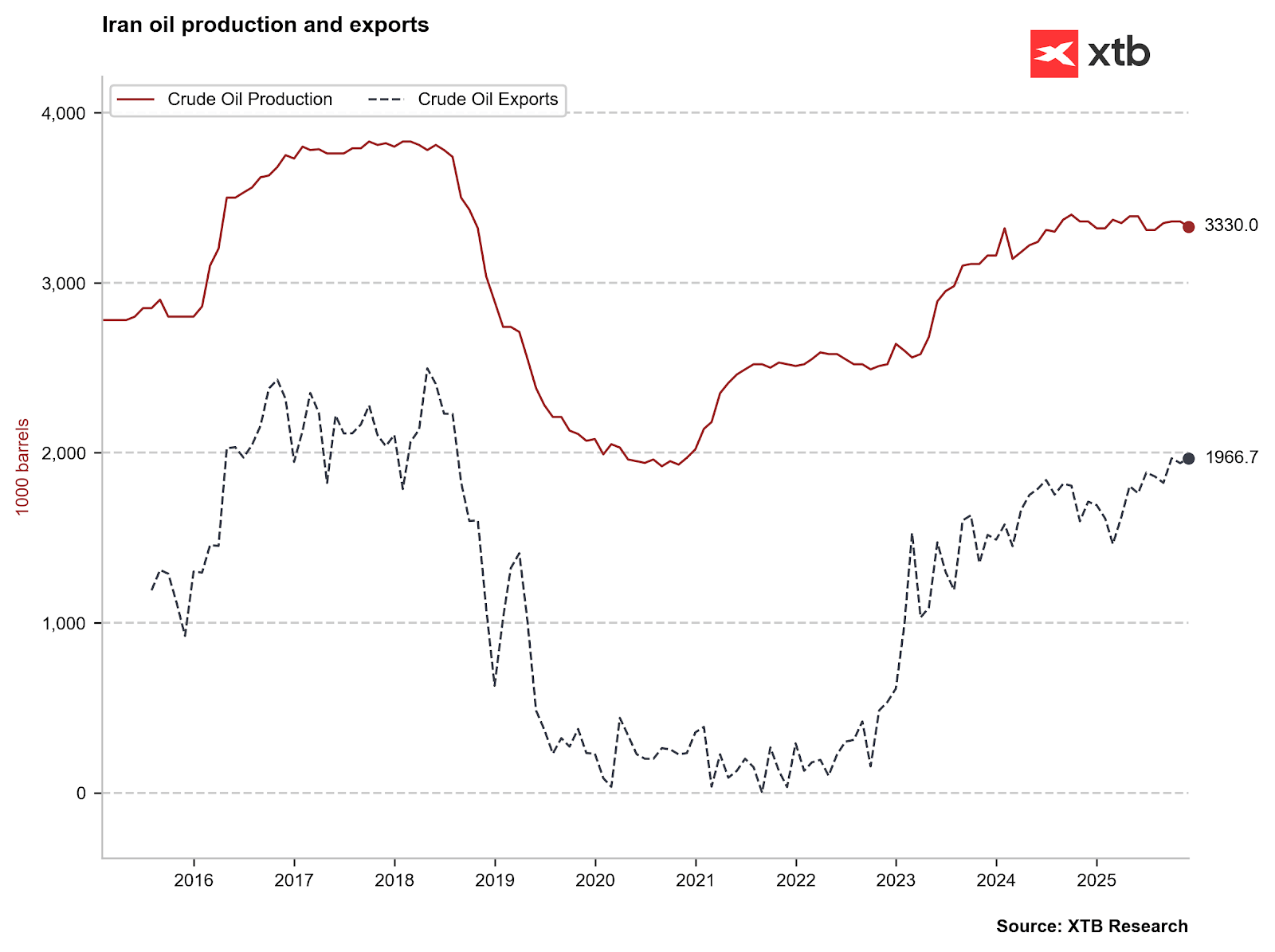

The current tensions in Iran and the risk of escalation in the Strait of Hormuz are increasing the risk premium, but at the same time it is difficult to consider a complete blockade of this route as a baseline scenario – Iran would then cut itself off from key export revenues, further deepening its own economic crisis. Venezuela also looms in the background: an agreement to transfer 30-50 million barrels of Venezuelan oil to the US means a potential additional supply stream to the global market, which could neutralise part of the geopolitical price premium. As a result, the current surge in WTI prices, driven by emotions and political risk, seems to be an interesting opportunity to build short positions, assuming that in the medium term, the market will once again be influenced by the cold fundamentals of oversupply.

Take Profit 1 was set in the zone of recent numerous lows of the consolidation zone, while Stop Loss was set at a 1:1 ratio to this zone in terms of range relative to the current price. Take Profit 2 was set in the zone of lows from 2025.

Source: xStation

Fundamental attachments:

In the past, the impact of geopolitical hotspots related to Iran on oil has been short-lived, though in most cases violent. Source: Bloomberg Finance LP, XTB

Oil oversupply on the Iranian market. Source: XTB