Brent OilCrude OilMarketsTechnical AnalysisWTI Oil

Trade of The Day – OIL.WTI

Facts:

- According to IEA (December 2025): Global supply will exceed demand by over 3.8 million b/d in 2026.

- According to EIA (December 2025): Global supply will exceed demand by over 2.20 million b/d in 2026.

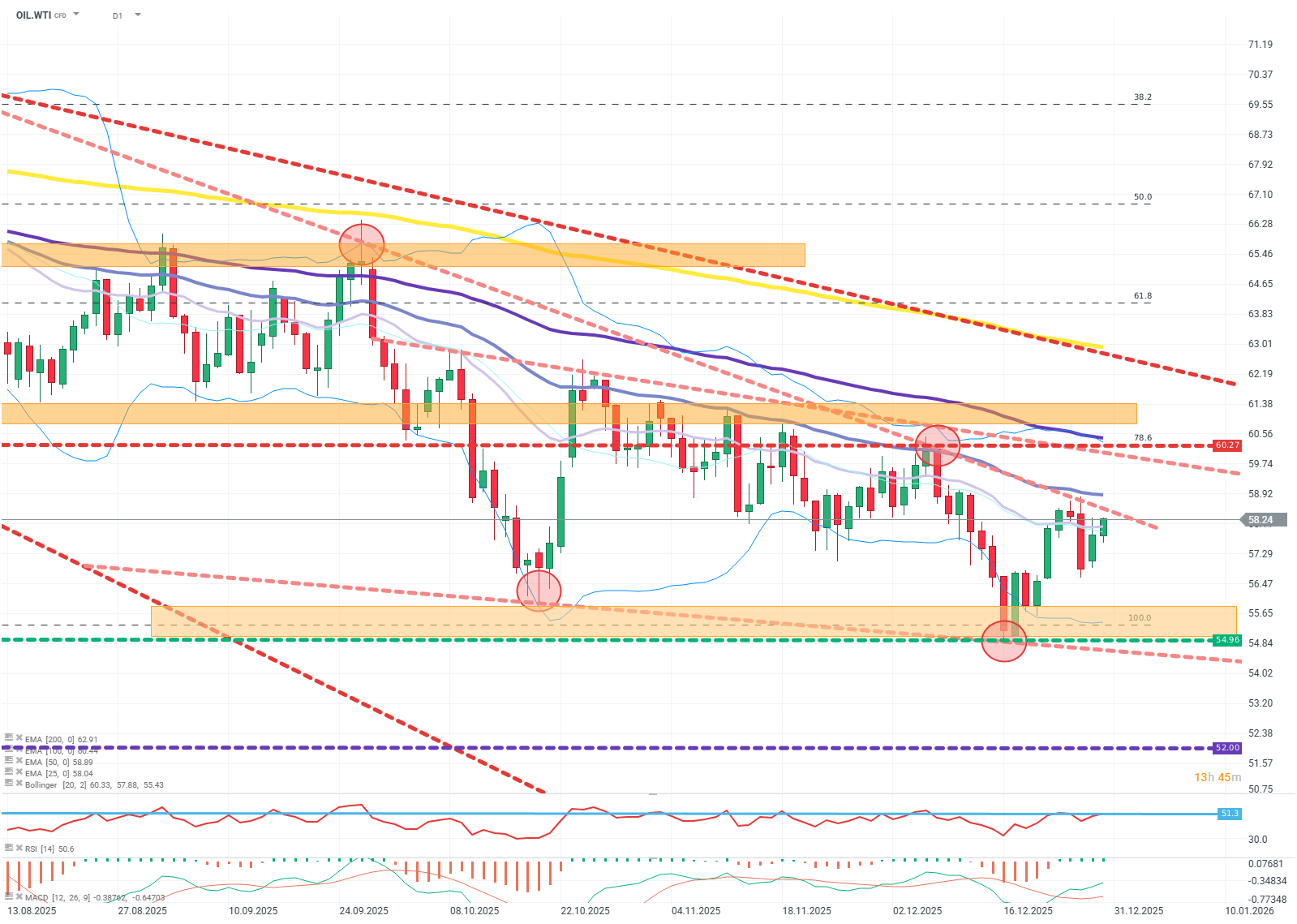

- The price of OIL.WTI has been moving in a downward channel since January 2025.

- Since October, the price has been moving in a consolidation channel between FIBO levels 61.8 and 100 from mid-2025.

- The structure of EMA averages remains bearish.

Trade: Short position on OIL.WTI at market price

- Target: 55

- Stop: 60

OIL.WTI (D1)

Source: xStation5

Opinion: Oil has had a weak year, and everything indicates that the next year will be even worse for raw material producers. Signals of prolonged and deep oversupply of raw material are coming from all empirical sources, the raw material has no room for upward movement, and the consensus of major analytical centers places raw material prices between 52-50 dollars in 2026. Therefore, the recommended strategy is to sell all attempted price increases.

Methodology and assumptions:

- The recommendation was based on technical analysis of the chart, particularly EMA averages, RSI, Fibonacci levels, and fundamental analysis of the precious metals market.

- The target level was determined based on the dynamics and range of previous corrective movements and FIBO levels.

- The defensive stop loss order was determined based on a favourable risk-to-reward ratio.