Trade of The Day – Nasdaq100

Facts:

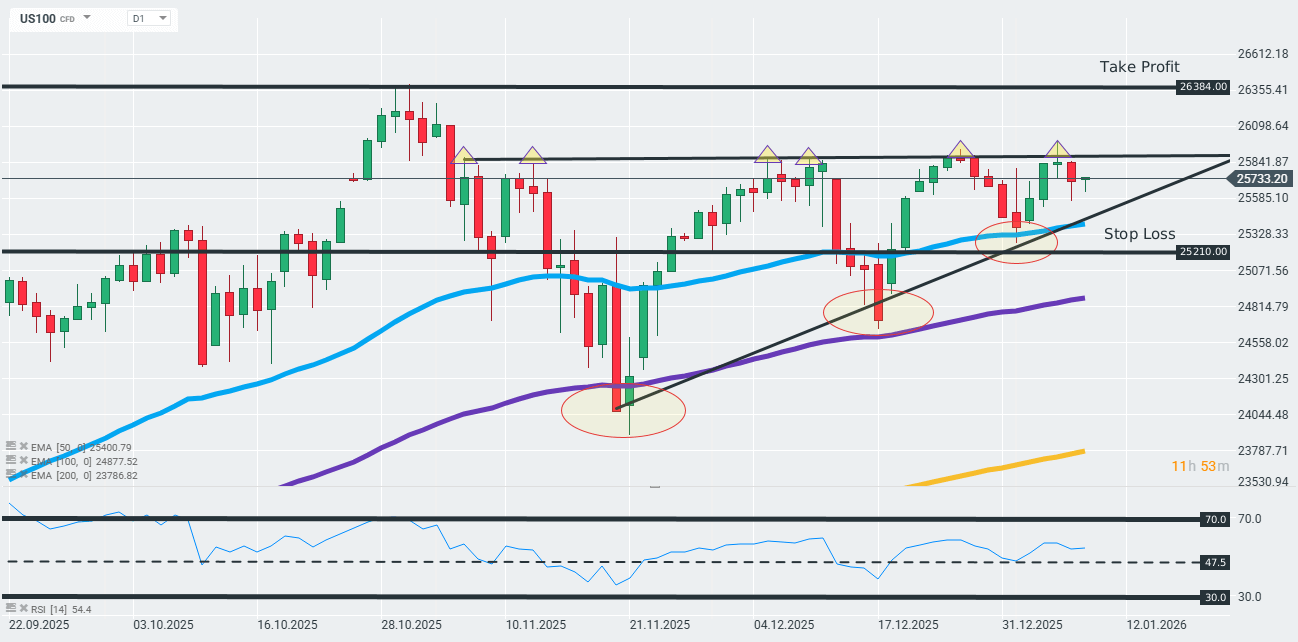

- The US100 is trading near the upper limit of the ascending triangle formation.

- The RSI for the last 14 days remains in the 55-point zone.

Recommendation:

Long position on US100 at market price

- SL: 25,210

- Total points: 26,384

Opinion:

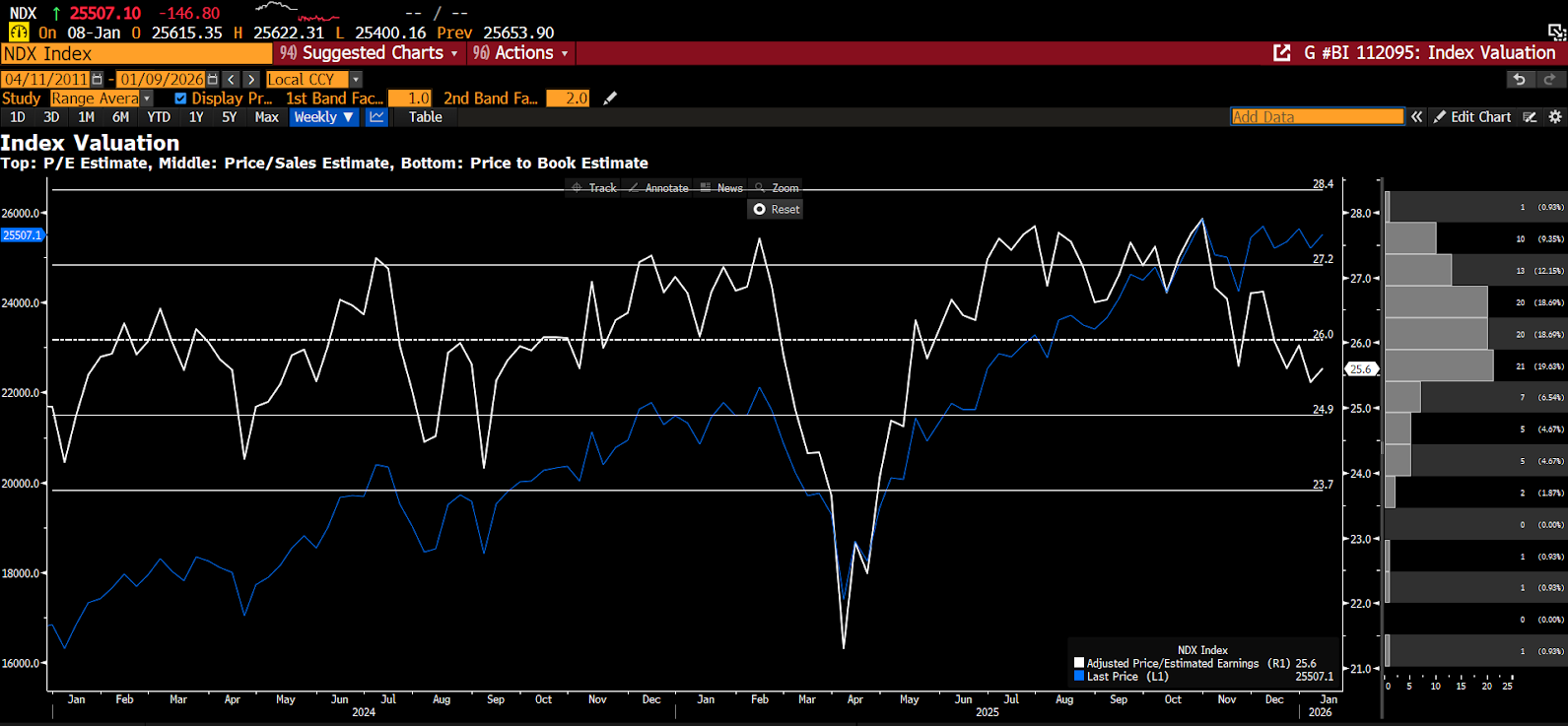

The recommendation is based on the technical formation of an ascending triangle, with the US100 once again testing its upper limit, which increases the chances of a final breakout higher and a potential new ATH. The second element is the fundamental view. The Nasdaq is currently trading below the average forward P/E ratio for 12 months ahead on a more than 2-year average. Wall Street analysts are revising upwards their forecasts for earnings generated by US companies for next year. The US100/gold ratio is hovering near 5-year lows, below the second standard deviation of linear regression for this historical period. Take profit has been placed in the zone of recent highs, while stop loss is slightly below the recent local low below the 50-day EMA. (see attachments below).

Source: xStation

Fundamental attachments:

Nasdaq is currently trading below the average forward P/E ratio for the next 12 months on a 2-year average. Source: Bloomberg Financial Lp

Wall Street analysts are revising upwards their forecasts for profits generated by American companies next year. Source: Bloomberg Financial Lp

The ratio of US100 quotations to gold is hovering close to 5-year lows, below the second standard deviation of linear regression for this historical period. Source: Bloomberg Financial Lp