Trade of The Day – EUR/AUD

Facts:

- The EURAUD exchange rate has fallen below the 200-day exponential moving average (EMA200; black).

- Latest minutes from the Reserve Bank of Australia meeting: “Inflationary pressures could be a little more persistent than had been previously assessed.”

- ECB’s Isabelle Schnabel: “One should not expect interest rate hikes in the foreseeable future.”

Recommendation:

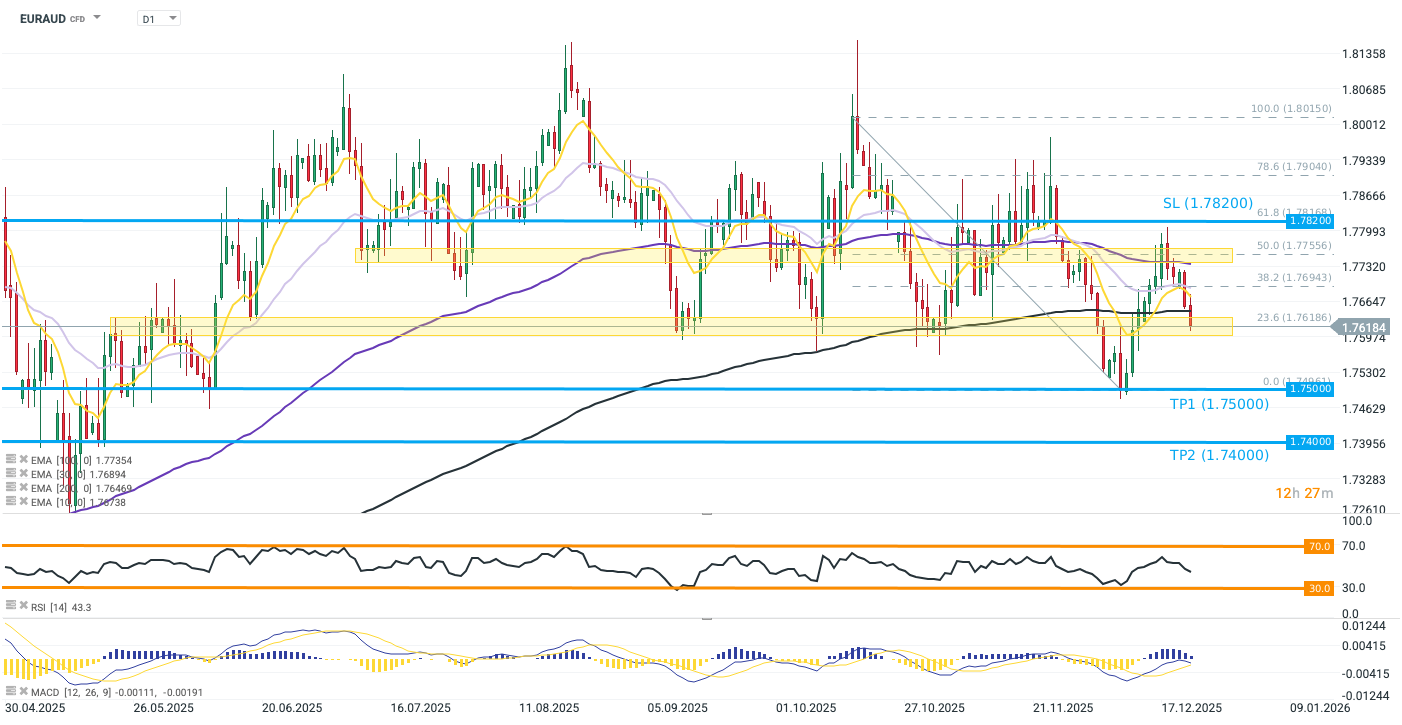

- Short position (sell) on EURAUD at market price

- Take Profit (TP): 1.75000 (TP1), 1.74000 (TP2)

- Stop Loss (SL): 1.78200

Source: xStation5

Opinion:

The end of recent pressure on technology stocks has revived risk appetite in global markets. The Australian dollar has once again become one of the main beneficiaries of improved sentiment, though its upside potential extends beyond the short-term trend. Today’s RBA minutes confirmed a rise in hawkish sentiment within the Australian central bank, pointing to stronger-than-expected inflationary pressures driven by rising real wages and increased credit activity among households and businesses. Importantly, the RBA already expects inflation to exceed its November forecast, meaning that another upside CPI surprise in Q4 could open the door to an interest rate hike as early as the first half of 2026. Currently, the swap market prices in around one and a half hikes (about 40 bp, source: Bloomberg OIS model) by the end of 2026.

While the bullish trend is more evident on AUDUSD, EURAUD is not overbought (RSI remains in the neutral 40–50 range), and weakening bullish momentum signaled by the MACD suggests continuation toward the recent low. A correction in recent euro gains is also supported by the latest comments from Isabelle Schnabel—seen as one of the more hawkish ECB members—who toned down expectations for rate hikes in the euro area. The normalization of ECB expectations combined with the still-rising hawkish potential of the RBA should therefore favor downside pressure on EURAUD.

Short-term risk to the short position lies in a potential increase in risk aversion in equity markets. Over the longer term, Australia’s Q4 CPI data will be key, as a weaker-than-expected reading would likely normalize expectations for RBA hikes. Reduced liquidity during the holiday and New Year period should also be taken into account.

Methodology:

The recommendation is based on technical analysis of the EURAUD chart and fundamental analysis of the Australian and euro area economies (monetary policy). The trade direction was determined using exponential moving averages (a downside rejection from EMA100 and a break below EMA200), MACD (fading histogram), and market expectations regarding central bank communication.

Take Profit and Stop Loss levels were set using Price Action and Fibonacci retracement methodology (TP1 at the last low, TP2 at the next support and psychological level of 1.74000, SL at the 61.