Tesla – “Dark Horse” or “Lame Duck” ?

Tesla recently reached another all-time high. The company has had a very turbulent year; since December 2024, the stock valuation dropped by about 55%, only to return to its previous valuation in less than half a year and then surpass it. Is Elon Musk executing a brilliant strategy for the company’s development in the background, or is the rise in valuations more supported by speculation and unwarranted optimism?

One of the most significant news regarding the company recently was the unprecedented bonus for the company’s CEO, Elon Musk. The controversial billionaire is set to receive a discretionary bonus of up to one trillion dollars if he manages to achieve a series of extremely ambitious goals. The milestones for the bonus are based on the company’s capitalization and another operational goal. Many investors believe in Elon Musk’s managerial skills and that achieving new valuation metrics is just a matter of time with such a generous incentive for the CEO.

For reference, the current capitalization is 1.5 trillion dollars, and EBITDA is about 14 billion. Elon Musk has until 2035 to deliver results.

Does the market have fundamental grounds to discount the possibility of Elon Musk achieving these goals? In short, there is little indication of this. The increases in both 2024 and 2025 lack foundations in financial results or rational company prospects, and Elon Musk himself poses an even greater threat to the company than the Chinese competition, which Tesla has long since effectively lost to.

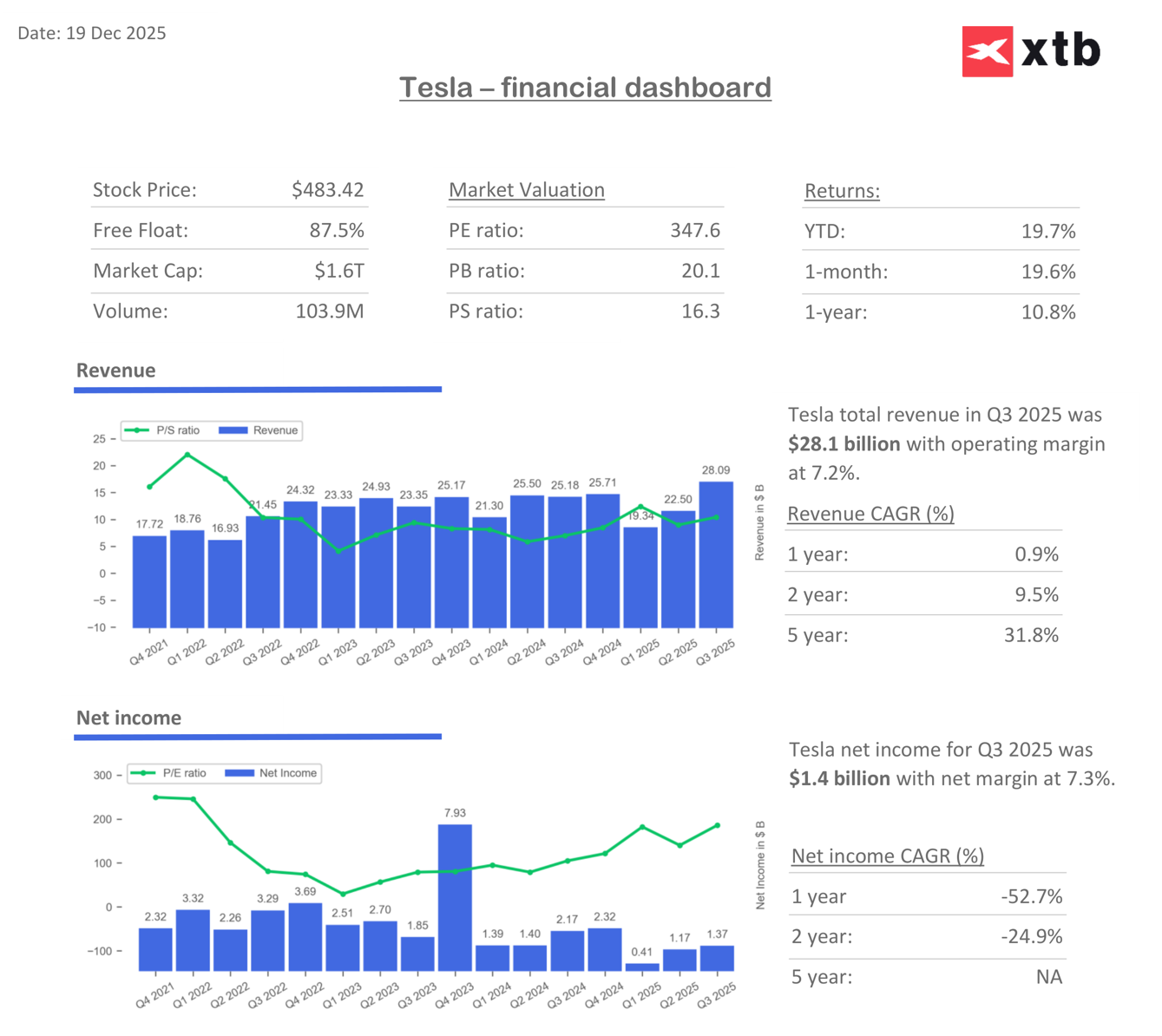

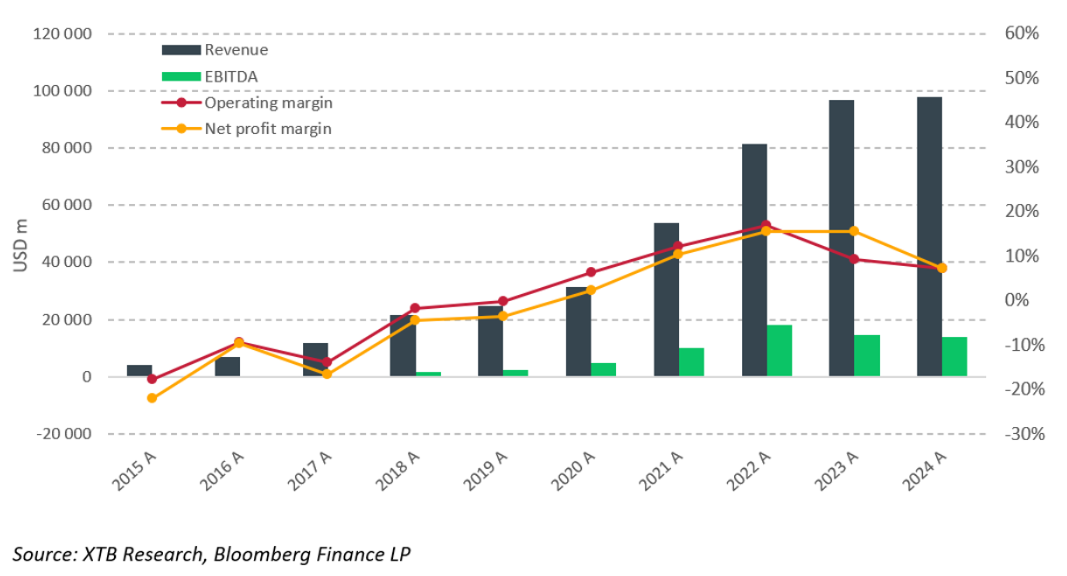

To understand how distant the current company goals are, one must realize where Tesla currently stands. The company reached its peak profitability in 2022. Since then, despite strenuous efforts and business expansion, the company has not even come close to the margin levels it achieved then. On the contrary, most of the company’s profitability indicators are in a downward trend, and there is no sign of a reversal.

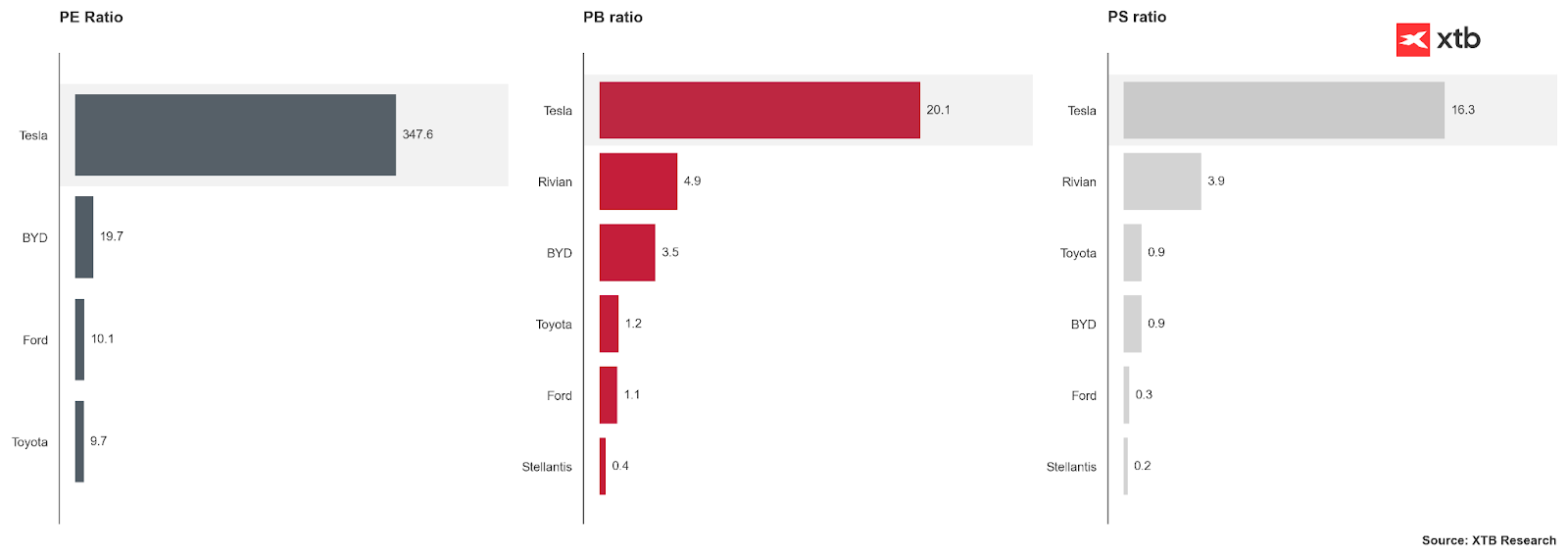

At the same time, as of today, Tesla can boast the title of the most overvalued public company of this size. The only historical rival for this title is the Industrial Bank of Japan from the peak of the 90s bubble in Asia. The company’s P/E ratio today is over 300, while the standard for companies in Tesla’s segment is between 20-35 P/E. Tesla can be described with many adjectives, but “growth company” is not one of them.

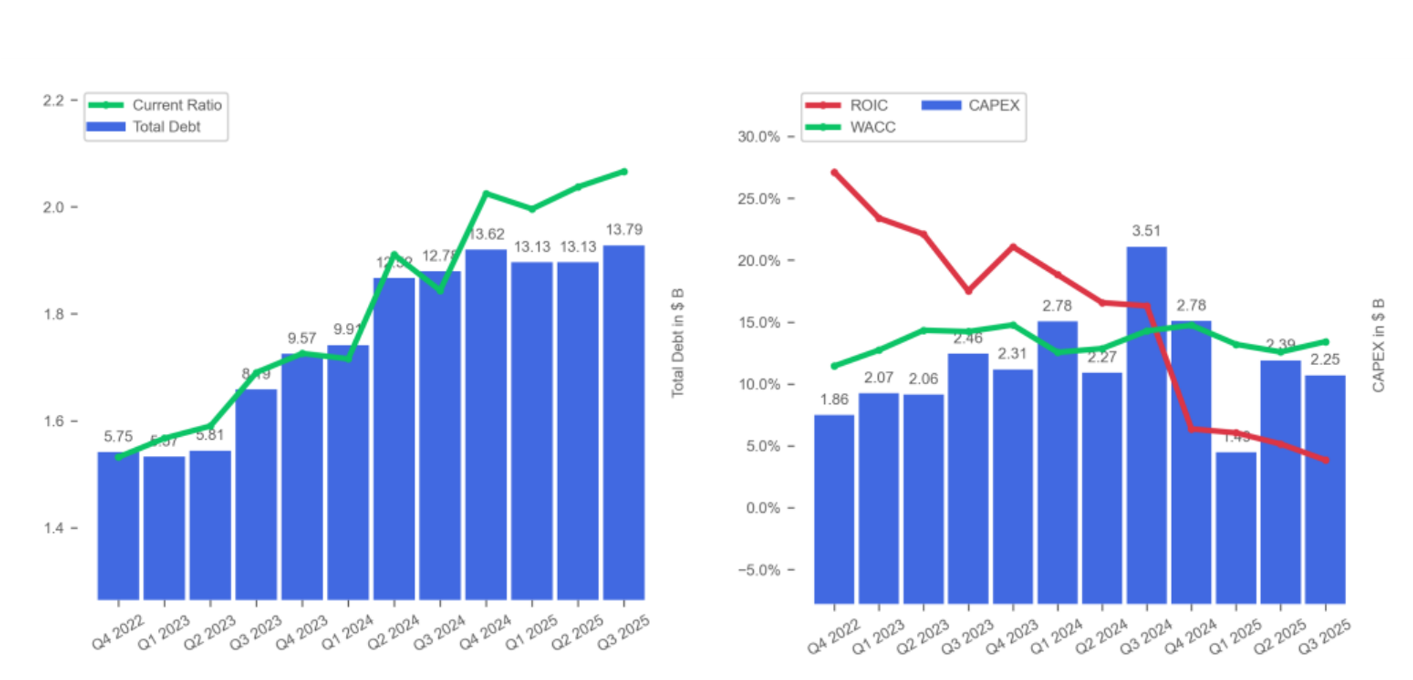

However, the company’s debt is growing. The company’s debt has almost doubled since 2022, and the ROIC indicator is consistently declining. It is worth noting that the ROIC indicator has been below WACC since Q3 2024, which means that the company generates a return on invested capital lower than the cost of obtaining that capital. This leads to value destruction for shareholders, not value creation.

Tesla is as far from meeting the criteria for this award today as Mars is from realizing the long-promised colonization that Elon Musk has been talking about for at least a decade. Starting with capitalization, the CEO’s reward package predicts a capitalization between 2 and 8.5 trillion. This means a real company growth of about 25% to about 530%, assuming the current — extreme P/E valuation level (300+) remains, which corresponds to a increase in revenues and profits. This would mean revenues between about 122 billion to over 510 billion dollars, profits at the level of about 8.5 billion to 37 billion, and EBITDA between about 14.5 billion dollars and 65 billion dollars.

It is worth noting that even assuming a fivefold increase in the company’s EBITDA, it barely meets the first milestone, due to the fact that both the margin, EBITDA, and the company’s profits are declining with alarming regularity despite the increase in valuations.

Further problems arise from the products and markets associated with the milestones. Delivering 20 million cars, despite being an ambitious goal, is one of the more reasonable and realistic ones on the list. Tesla has sold 8.4 million cars so far. This means that over the next 10 years, it must sell 11.6 million vehicles, averaging over a million vehicles per year. The problem here is that both the American and European markets are already saturated, and the target EV customer has been alienated by Musk due to his political involvement. Meanwhile, the growing Asian markets and potentially African ones will most likely fall into the hands of the Chinese, whose cars are often an order of magnitude cheaper and better suited to local conditions.

FSD, or “Full-Self-Driving,” despite over a decade of development, is still not a fully autonomous system. Moreover, Musk’s autonomous vehicles (as well as his competitors’) regularly cause violations and accidents, for which Tesla is constantly in the spotlight of regulators. At the same time, Tesla is no longer the only company in this segment. Google has entered it, whose Waymo beats Tesla in most benchmarks. Achieving a million FSD subscriptions is the best possible scenario, 10 million is just an unrealistic dream.

Almost identical challenges await Tesla in the Robo-Taxi segment. Tesla’s technology is not ready for mass and autonomous use, margins are disappointing for investors, and prices for customers are piling up regulatory challenges, while competition specialized in narrow niches is breathing down Tesla’s neck or has already surpassed it. Today, robo-taxis operate only in a few American cities — where they cause constant problems. However, it is worth mentioning that if Tesla finds a way to refine its FSD systems and if it manages to systematize the process of introducing its robo-taxis to subsequent states and cities in the USA, the possibilities for scaling the business are enormous and may at least partially justify today’s valuations. The often-raised issue of “building trust” among customers for autonomous taxis is often mentioned, but even independent studies show that such vehicles are safer than regular drivers — despite the problems.

Recently, Tesla, trying to regain investor faith and attention, has started entering robotics and has immediately set ambitious goals at the level of delivering a million “Optimus” robots. The problems in this segment are an amplification of the company’s previous troubles from other segments that it has never addressed. Tesla is trying to use the scale effect and brand to break into another industry — an industry where demand is limited, and competition often surpasses Tesla’s products in terms of price and/or quality. Humanoid robot technology is still in its infancy, competition is experienced and rapidly developing, and the market itself can very quickly drastically change or completely disappear due to social and regulatory pressure. Goldman Sachs estimates that the humanoid robot market will be about 1.4 million units annually in 2030. This means that Tesla would need about ¾ of the entire — still hypothetical — market to meet its promises. At current prices of about 30,000 dollars per unit — this means revenues of about 30 billion dollars compared to Tesla’s current revenues of about 90 billion. Potential profits from such an undertaking, however, remain in the realm of speculation. Assuming a margin of 15% (the level Tesla recently achieved on its cars), this means a profit of about 4.5 billion dollars. Adding this to the profit from the previous year, which is about 7.3 billion, means that if Tesla sold a million Optimus robots today, it would still earn less than at the end of 2022. Elon Musk insinuates that margins on humanoid robots will be greater than 15% due to their adaptation within the company, but this promise also makes no sense. Tesla can already boast one of the highest robotization rates in the world, which in some plants reaches 95%. Will automating the remaining 5% allow for multiplying margins? There is no indication of this. Industrial robots have been a common sight in car and electronics factories for over 30 years — Tesla is trying to reinvent the wheel and makes promises without backing.

However, a light at the end of the tunnel for Tesla is a segment that does not fit Elon Musk’s flamboyant and pompous personality. It is the “Power-Storage” segment. One of the key advantages that allowed Tesla to actually introduce electric vehicles on the roads was the expertise the company developed in the field of energy storage. Batteries are something Tesla does longer, better, and cheaper than the competition, the segment brings real profits today, margins are almost twice as high as those in the case of EVs, and most importantly — this segment has a clear growth path. Energy transformation, both locally and globally, can give Tesla a chance to use its real, not imagined strengths. The “energy banks” market has growth prospects of 20-30% annually (up to about 100 billion dollars globally in 2035), the issue of a several-fold increase in revenues from this segment is not promises without backing but the use of existing advantages.

The biggest threat to Tesla currently is not the quality of its products, which often leaves much to be desired, nor is it the Chinese competition, which regularly brings Tesla’s margins and profits to ever lower levels. The biggest threat to Tesla is Elon Musk, who is considered by many to be its most important “asset.”

Many believe in Elon Musk’s resourcefulness and ingenuity and that he will deliver results by all possible means. Many point to the possibility of “accounting optimization” that will help Tesla achieve milestones at least “on paper.”

This would be an option worth considering, were it not for the fact that Tesla’s accounting policy has been operating on the edge of legality since the company’s early years. This includes, among others, the conflict between Tesla and the SEC in 2016, when the oversight commission ordered urgent and broad modifications to the company’s reporting standards. Tesla’s regulatory risk is difficult to assess because it is unprecedented. There are currently hundreds of investigations and lawsuits against Tesla, Elon Musk, and related entities, involving almost every regulatory body in the USA. All this in conditions already after the dismantling of many of these institutions by unconstitutional “D.O.G.E” and with the support of the current Republican government. How will the company’s situation change if the Republicans lose the elections in 2028 — as current analyses of the so-called “mid-terms” and local elections indicate?

The nail in the coffin for any attempts to justify Tesla’s valuation increases as a fundamental trend, rather than speculative, is the structure of the company’s growth over the past year. Institutional investors are currently the majority shareholders, and their net inflows in 2025 amount to about 60 billion dollars. However, this does not mean they are “buying” Tesla. These purchases are usually for indices and ETFs in which Tesla’s share is enormous. The sentiment of actively managed funds is overwhelmingly negative, with net outflows at about 15 billion. Retail investors currently account for 16% of all turnover compared to the standard 8% in the S&P500 — as Reuters has established. On the options market, 80% of turnover is retail investors betting on speculative company growth.

Currently, the company would need not one but a series of breakthroughs to justify even part of its current valuations. However, the chances of achieving even more conservative valuation milestones presented by the management — are currently slim, though not impossible.

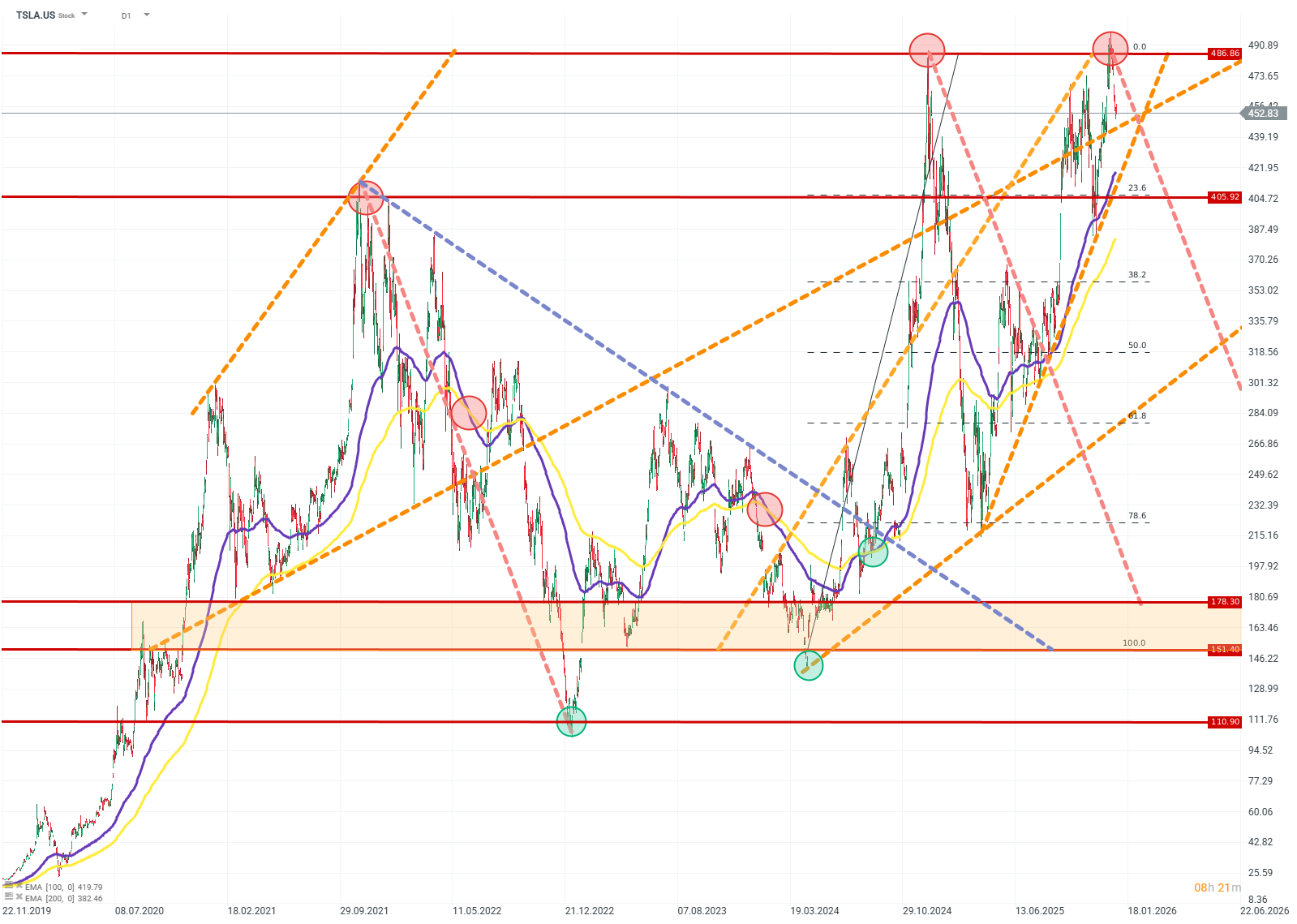

TSLA (D1)

Source: xStation5

Kamil Szczepański

XTB Financial Market Analysists

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.