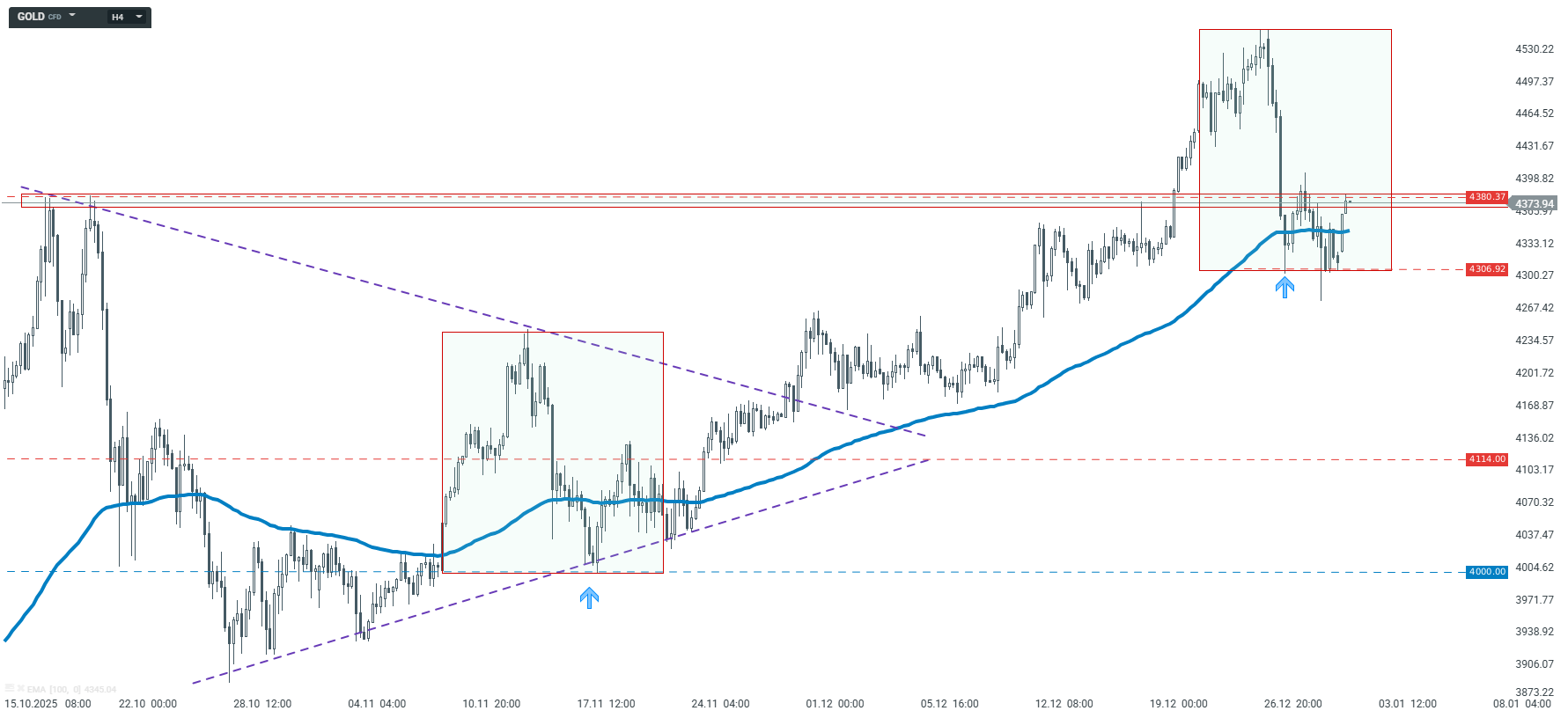

Technical Analysis – Gold.XAU/USD

Gold remains in an upward trend, with the latest impulse developing since the beginning of November 2025. Between November 13 and 18, there was a correction, after which the market broke out with another upward impulse. The latest stronger pullback stopped exactly at the level of the previous correction, at 4,306, which, according to the Overbalance method, suggests the possibility of a continuation of the upward movement. In addition, the price remains above the 100-period average (marked in blue on the chart) and is simultaneously attempting to break above the 4,380 zone resulting from previous peaks. A sustained return above 4,380 would open the way for continued growth and new highs, while a drop below 4,306 would increase the risk of a deeper correction.

GOLD – H4 interval | Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.