Technical Analysis – DAX40

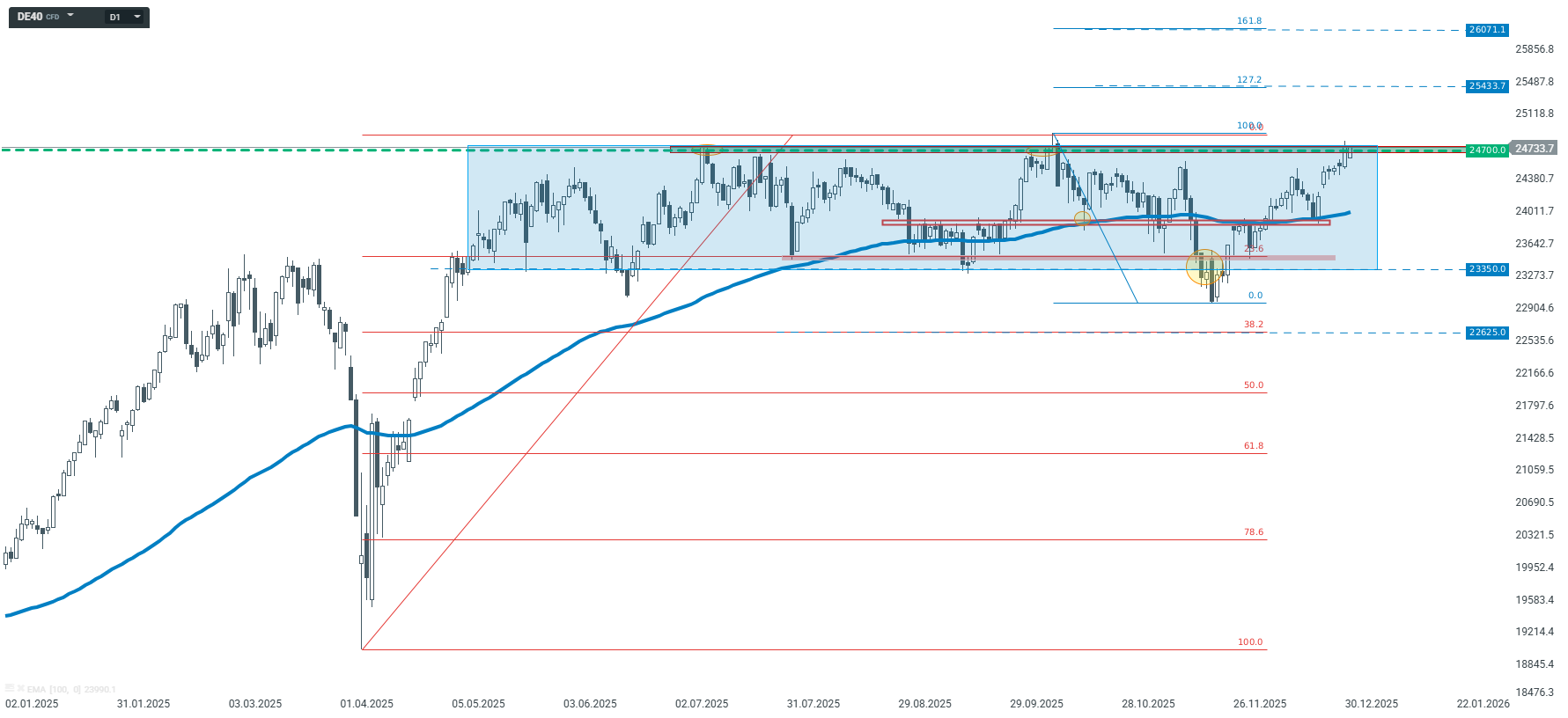

On the D1 interval, the German D40 index has been moving in a wide consolidation for a long time. Practically since May last year, quotations have been oscillating between 24,700 and 23,350 points. Currently, we are observing a test of the upper limit of this pattern. If it breaks above 24,700, the targets for buyers may be 25,430 and 26,070 points, which result from external measurements of the last downward correction — 127.2% and 161.8% Fibonacci retracements, respectively. On the other hand, rejection of this resistance may mean a return to the ongoing consolidation, i.e., further movement within the range marked by the blue rectangle on the chart.

D40 – D1 interval | Source: xStation5

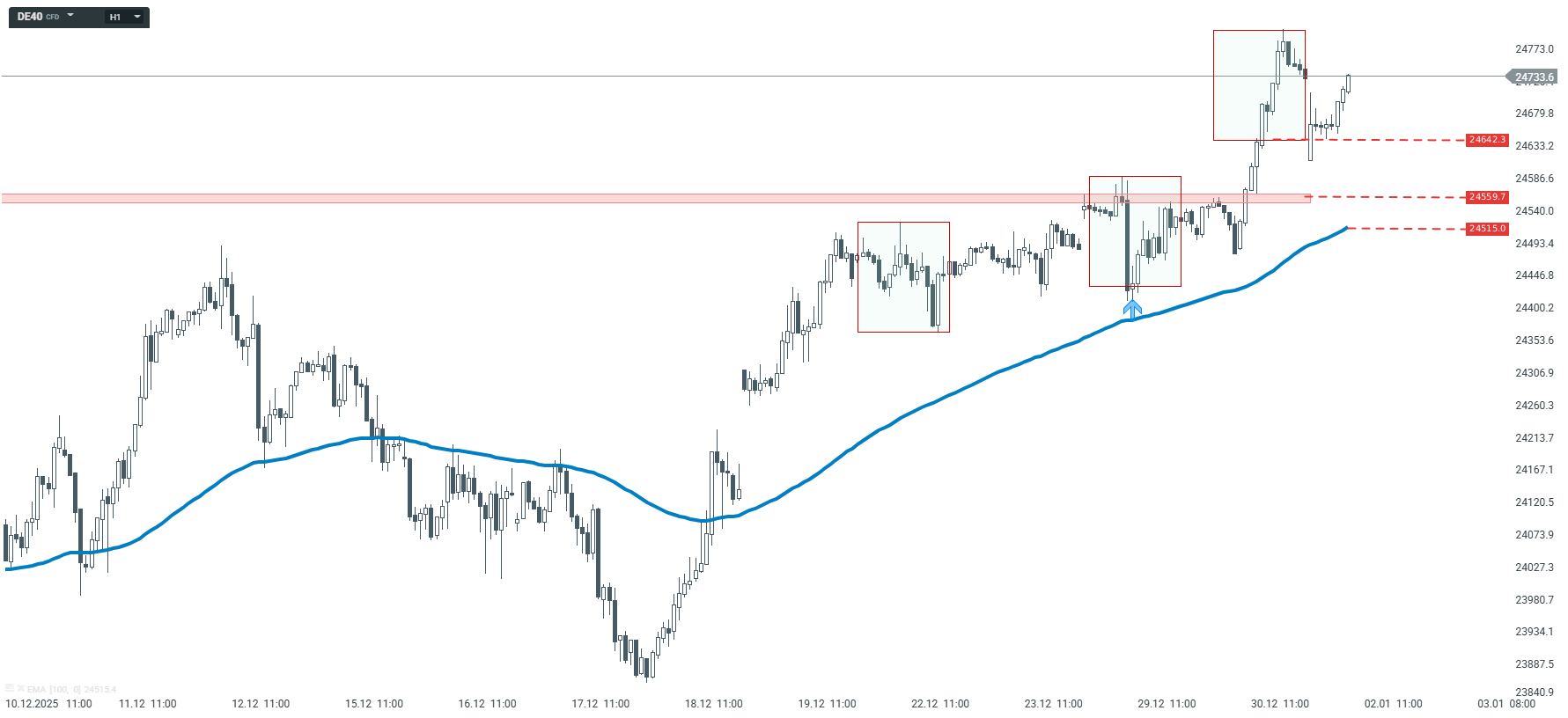

On the H1 interval, however, the quotes are in a local uptrend. The last two corrections were exactly the same range, as marked by red rectangles, and the current correction also fits into this structure. The key support level is at 24,642 points, and as long as it remains intact, according to the Overbalance methodology, the scenario of further increases remains valid. Even if there is a larger correction, attention should be paid to the next levels of defense: horizontal support at 24,560 points and support resulting from the 100-period average, marked in blue on the chart.

D40 – H1 interval | Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.