Takaichi’s Party Win Elections in Japan

The so-called “Takaichi trade” has returned to the spotlight following the decisive victory of Prime Minister Sanae Takaichi’s coalition in the lower-house election. The LDP secured 316 of 465 seats, and together with 36 seats won by coalition partner Ishin, the bloc achieved a two-thirds supermajority (over 310 seats). The result removes key legislative hurdles and strengthens expectations for fiscal expansion, including the proposed two-year suspension of the 8% sales tax on food, which markets view as supportive for economic growth but also as a challenge for Japan’s fiscal sustainability.

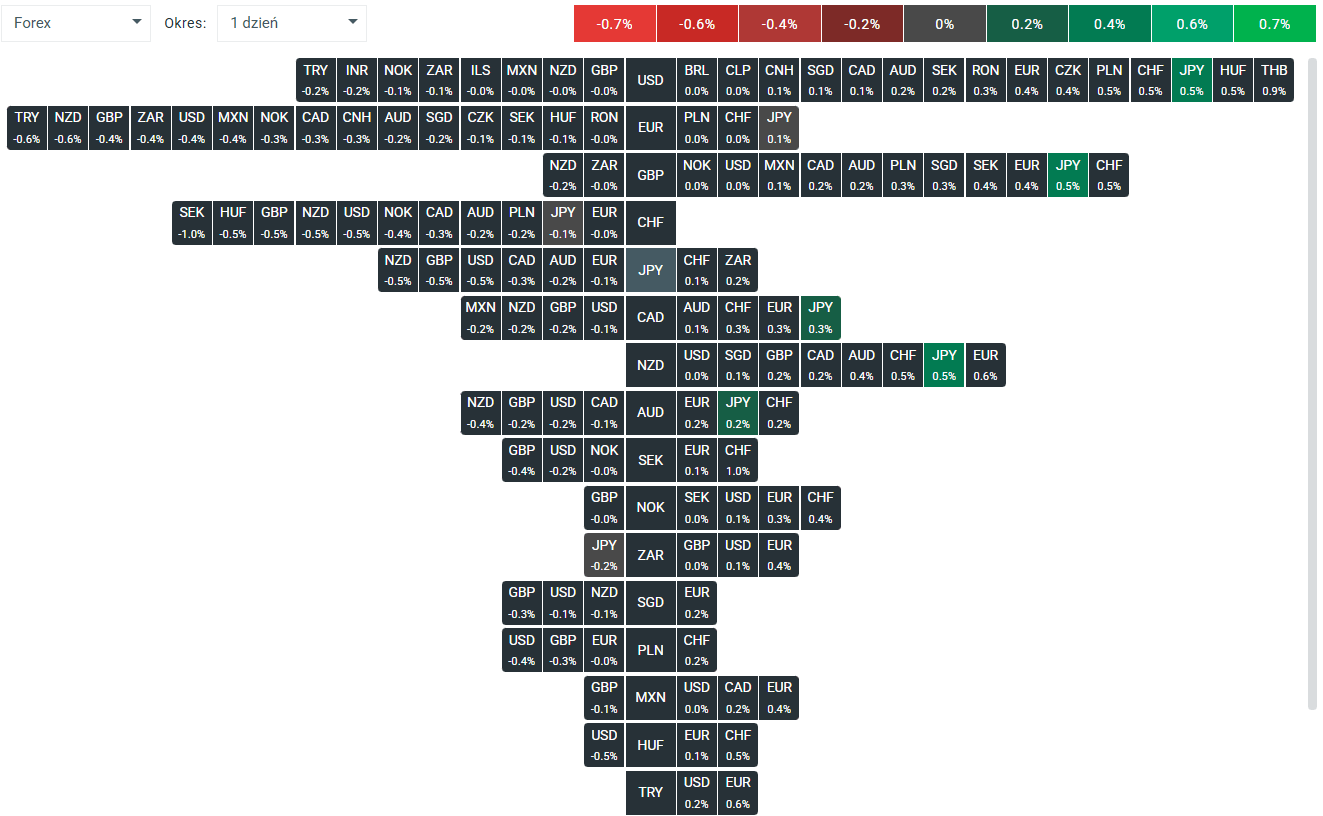

The Japanese yen is one of the stronger G10 currencies today. Source: xStation 5

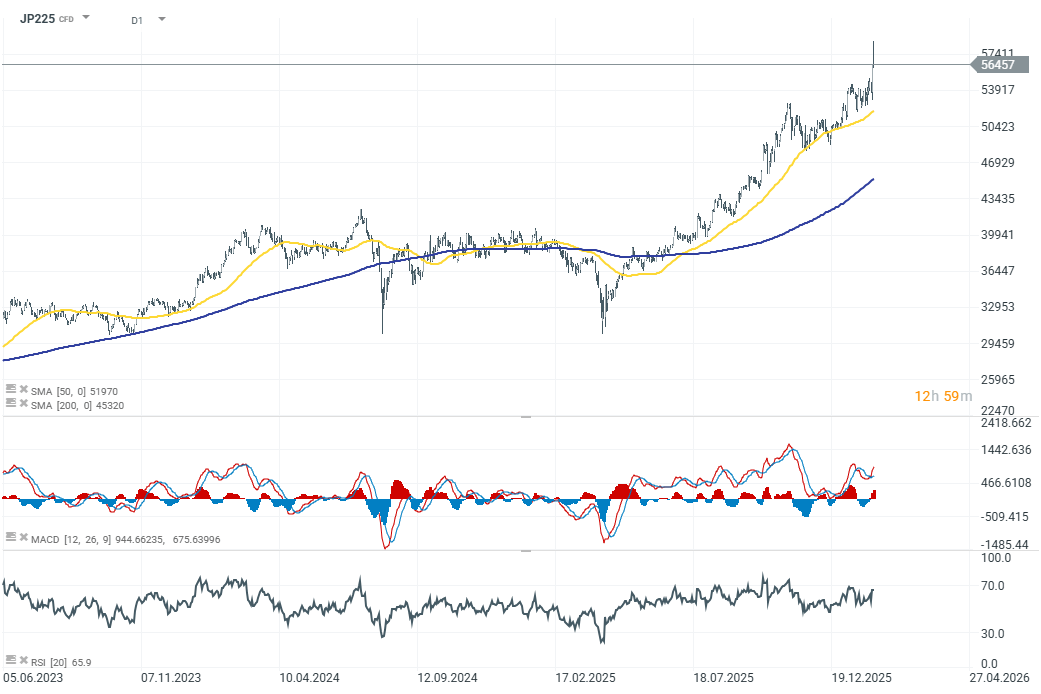

For equities, political clarity provides a short-term positive catalyst. Investors are increasingly positioning into Japanese stocks in anticipation of higher public spending, increased defence outlays, and strategic investments (AI, digitalisation), even as the bond market remains sensitive to the risk of increased debt issuance. The main flashpoint remains the tax plan: estimates point to an annual fiscal gap of around ¥5 trillion, prompting markets to closely watch how the government plans to fund it without undermining confidence in Japan’s already very high public debt.

The main Japanese equity index, JP225 (Nikkei 225), is up just 0.25% today. However, that was enough to push the index to record highs. Source: xStation 5

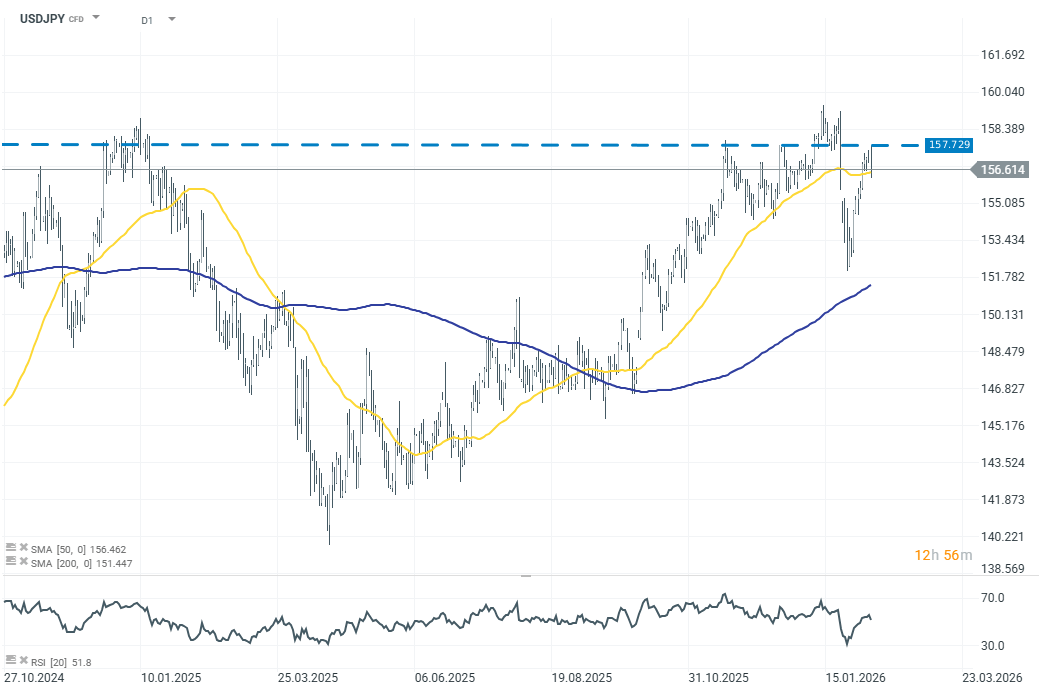

The yen, meanwhile, remains the key “shock absorber”—and authorities are clearly drawing a line against disorderly currency weakness. In thin and volatile Monday trading, USDJPY briefly rose to 157.729 before quickly retreating; following a series of intensified warnings, the pair fell by around 0.4% to 156.620, stabilising near the 5-day moving average (~156.600). With a coordinated message from the Prime Minister’s Office, the Ministry of Finance, and senior FX officials stressing “urgency” and opposing one-sided moves, intervention risk has clearly increased, which should cap near-term upside in USDJPY despite the expansionary policy outlook expected after Takaichi’s victory.

Source: xStation 5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.