Platinum Joins The Precious Metals Rally

Despite the lack of panic in equity markets after the U.S. attack on Venezuela, precious metals moved sharply higher on a jump in safe-haven demand. While the rally briefly cooled mid-session, buying momentum strengthened again during U.S. trading hours, reigniting volatility across the precious metals complex.

Platinum is currently leading gains (PLATINUM: +7.2% to USD 2,300), absorbing safe-haven flows amid record valuations in gold (about +64% in 2025) and silver (about +148% in 2025). Although platinum’s 2025 performance is broadly in line with its peers (around +130%), prices are still flirting with the 2008 peak, while gold and silver have already spent a year breaking all-time highs.

Platinum still faces a decisive breakout above the historic resistance at 2,300. Source: xStation5

Optimism across precious metals remains strong. Gold is up 2.6% to USD 4,445 per ounce, while silver has surged 6.15% to USD 77.06 per ounce.

Demand for safe havens is likely to persist as long as the White House maintains an aggressive stance toward Venezuela. Following the abduction of Nicolás Maduro, Donald Trump issued a series of threats toward remaining regime representatives in Caracas, warning of even harsher repercussions if Venezuela does not submit to U.S. demands. These threats are sustaining investor fears of further regional destabilization, which in the short term should support precious metal prices until year-end highs are reached.

On the other hand, acting Vice President Delcy Rodríguez has already sought to ease tensions by emphasizing a willingness to cooperate with the United States. A lack of further escalation could therefore trigger a meaningful correction in precious metals, especially given bearish underlying fundamentals such as overbought conditions, declining central bank gold purchases, and a projected end to the platinum deficit in 2026. Continued risk appetite on Wall Street could also gradually divert capital away from precious metals.

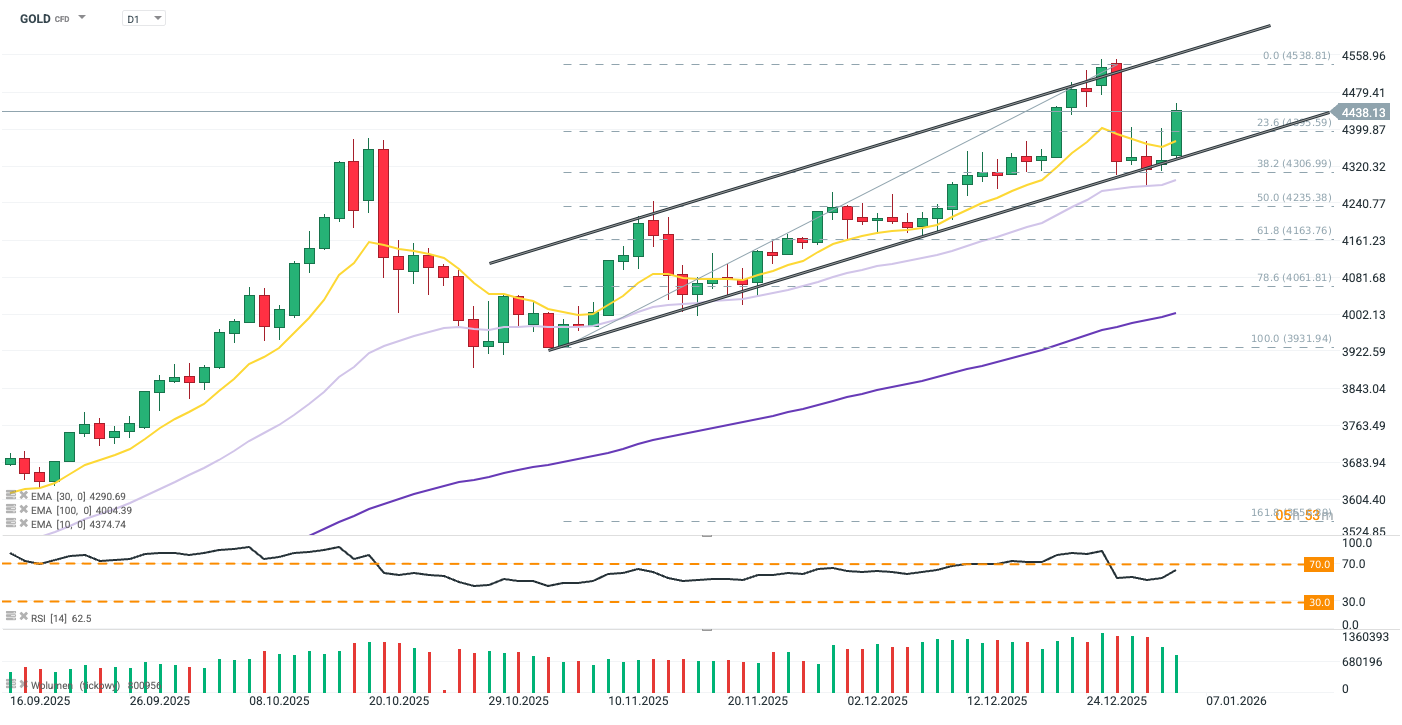

Gold recently halted its correction near the 38.2% Fibonacci retracement of the rally that began in November, while also bouncing off the lower boundary of its upward channel. A move back above the 10-day exponential moving average (EMA10, yellow) would open the way toward the recent peak at 4,540. However, the absence of military escalation between Venezuela and the U.S. could restore downside pressure, potentially pushing prices back toward the 4,300–4,320 area. Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.