European equity markets remain in cautious consolidation near historical highs ahead of the calm holiday period. The Stoxx Europe 600 index gains 0.25%, Germany’s DAX rises 0.10%, and Switzerland’s SUI20 is up more than 0.50%. Other European indices post slight losses in the range of 0.00–0.20%.

European indices are supported by gains in pharmaceutical stocks. Government bond yields in the UK, Germany, and the US are falling, easing financial conditions despite persistent geopolitical risks and investors waiting for key macro data from the US.

Macroeconomic data from Europe remain mixed, highlighting uneven growth across the region. In Germany, today’s report showed a sharp decline in import prices (-1.9% y/y), Spain’s economy continued to grow solidly (2.8% y/y), while weaker consumer sentiment in the Czech Republic and rising unemployment in Finland pointed to soft demand in parts of the region. EU car registrations improved on a year-to-date basis in 2025, but trade tensions with China and regulatory pressure in Europe weighed on selected sectors such as luxury goods, banks, and airlines.

European car market

The European automotive market continued its gradual recovery in 2025, with new passenger car registrations in the EU rising by around 1.4% y/y cumulatively through November, marking the fifth consecutive month of growth. Despite the improvement, total sales volumes remain well below pre-pandemic levels, underscoring still-fragile demand. A key structural driver remains electrification: fully electric vehicles (BEVs) account for around 16.9% of EU registrations YTD, while hybrids are the most popular powertrain, reflecting consumer preference for transitional technologies.

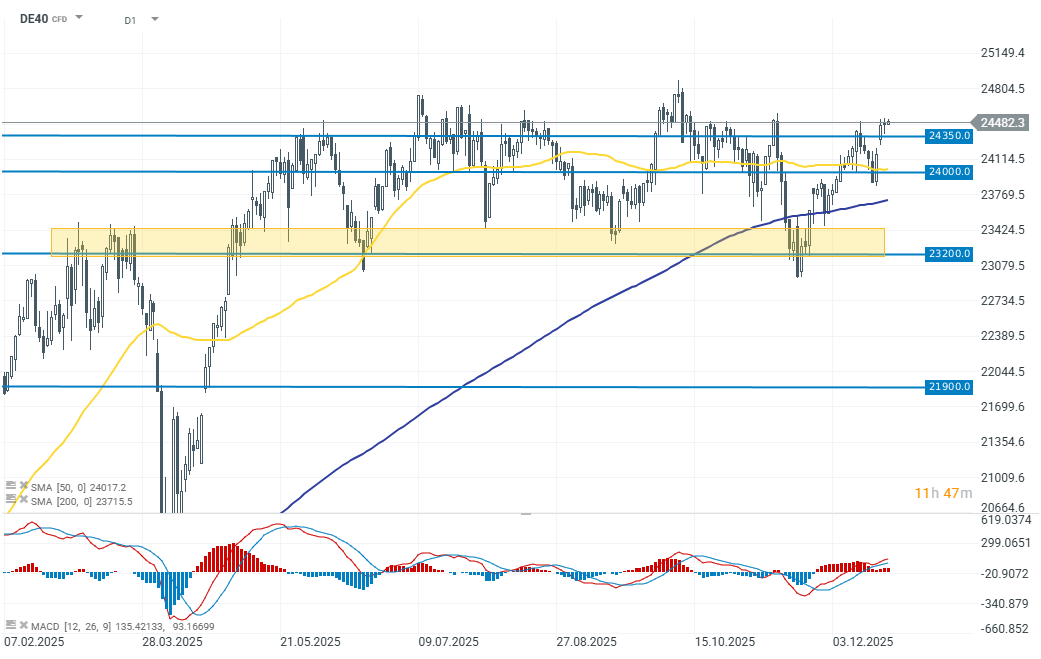

DAX (D1 timeframe)

Germany’s DAX index remains within a long-term consolidation channel. This time, however, prices have managed to return to testing the upper boundary around the 24,500-point zone.

European company news

- Novo Nordisk gains more than 7% after the US FDA approved an oral version of Wegovy, renewing investor optimism and lifting the healthcare sector to the top of European gainers.

- flatexDEGIRO falls 1% after Germany’s financial regulator BaFin imposed a fine for violations of securities trading regulations, dragging the financial sector lower.

- Ryanair shares came under pressure after Italy’s antitrust authority imposed a €256 million fine; the airline announced it would immediately appeal.

- RWE Group has begun commissioning Europe’s largest renewable hydrogen facility in Lingen, marking an important step in its green hydrogen strategy.

- Richemont declines 0.60% alongside other luxury stocks (Hermes) amid concerns that escalating EU–China trade tensions could hurt demand.

- Tesla vehicle registrations in Europe fell sharply again in November, highlighting ongoing demand challenges and continued loss of market share in the region.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.