European stock markets started the day on a positive note, buoyed by a rebound in precious metals markets. By midday, however, the initial optimism had largely faded.

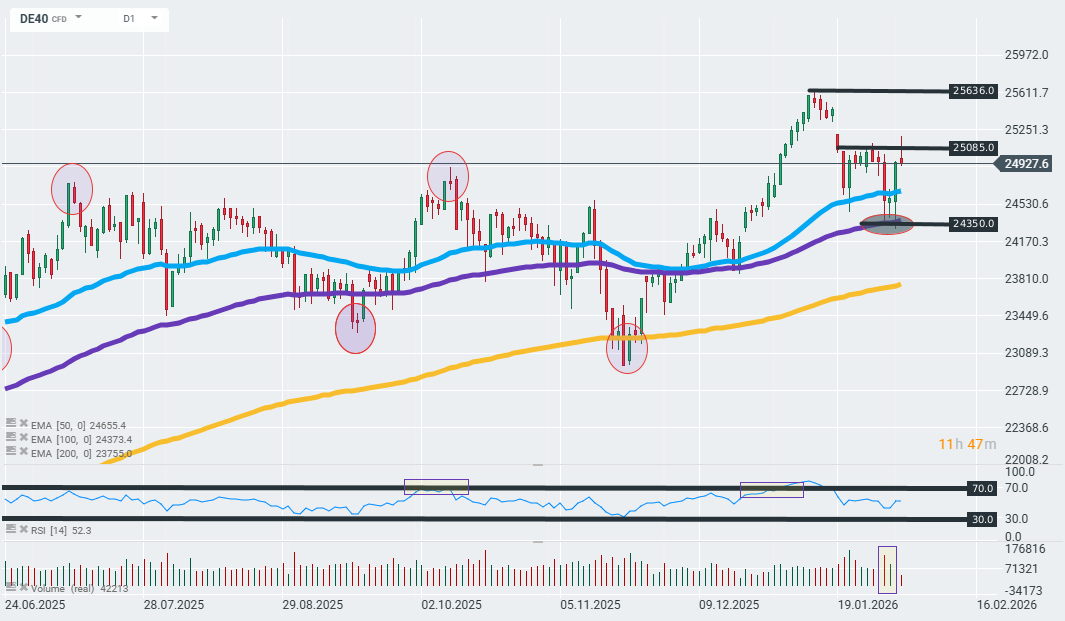

The DE40 contract erased all of its daily gains after briefly breaking above the upper limit of the recent consolidation area near 25,100 points. From a technical point of view, however, the instrument still maintains a short-term upward trend (50-day EMA, blue curve).

Source: xStation

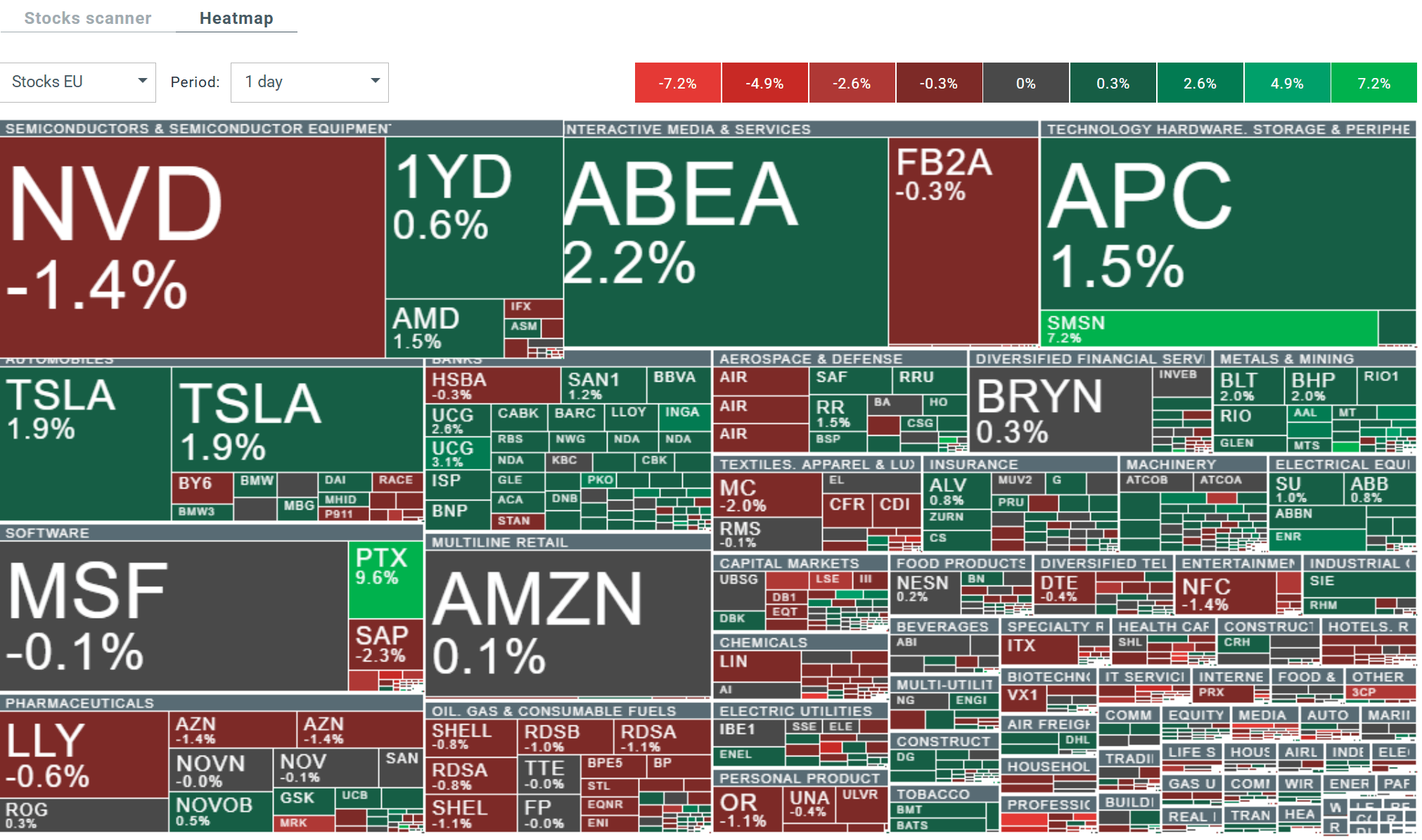

As we mentioned earlier, today’s sector-specific highlights include significant gains in the mining/metallurgy and technology sectors. See the volatility heat map below.

Source: xStation

Improved sentiment in the global technology sector is driving today’s rally in risky assets. News of SpaceX and xAI merging to create a £1.25 trillion artificial intelligence and space exploration giant has boosted overall sentiment, with an initial public offering expected this year. Valued at $1.25 trillion, Musk’s new company would be worth more than Eli Lilly and more than three times as much as Palantir.

The sector is also being boosted by the rise in ASML’s share price.

Swatch (UHR.CH) is introducing AI-DADA, a tool that allows you to design your dream watch using artificial intelligence – without any artistic skills. Just enter a short description of the effect you want to achieve (maximum 300 characters) and the algorithm will generate a unique design in less than two minutes. Each proposal is unique, and the design process itself is intuitive and free of charge. The company’s shares are up 4% today following this announcement.

In the United States, futures on major indices suggest further price increases, with today’s session bringing a number of important reports – we are awaiting results from AMD, Pfizer, Merck, Mondelez and PepsiCo.

On Tuesday, the dollar is one of the weakest currencies in the G10 group, contributing to a revival in the precious metals market and improving overall investor sentiment. Only the Japanese yen and the British pound are performing worse. We are seeing gains in Antipodean currencies following the rebound in metals and the unexpected interest rate hike in Australia.

The main news this morning is the significant increase in the value of precious metals. The price of gold rose by over 5% today, and silver by 9%.

This week, the publication of economic data on the US economy has been delayed, and NFP data will not be released due to the government shutdown.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.