Let The AI Battle Commence – Huawei v Nvidia

Huawei has announced groundbreaking AI software that could double the efficiency of its Ascend chips. This is a significant step in the context of export restrictions to China and geopolitical tensions, as it allows the Chinese manufacturer to maximize the use of its available hardware resources. The “software-first” strategy enables Huawei to scale existing chips through clustering and software optimization, enhancing the company’s competitiveness in AI, including cloud and inference applications.

Until now, Nvidia has been the virtually undisputed leader in the Chinese AI chip market, offering the highest computational power and a well-established developer ecosystem. However, the increasing efficiency and scalability of Ascend chips, combined with state support for the Chinese producer, are beginning to shift the dynamics of competition. Huawei is gaining adoption among major cloud companies in China and steadily increasing production of its chips, which in the longer term could limit Nvidia’s previously dominant position in the region.

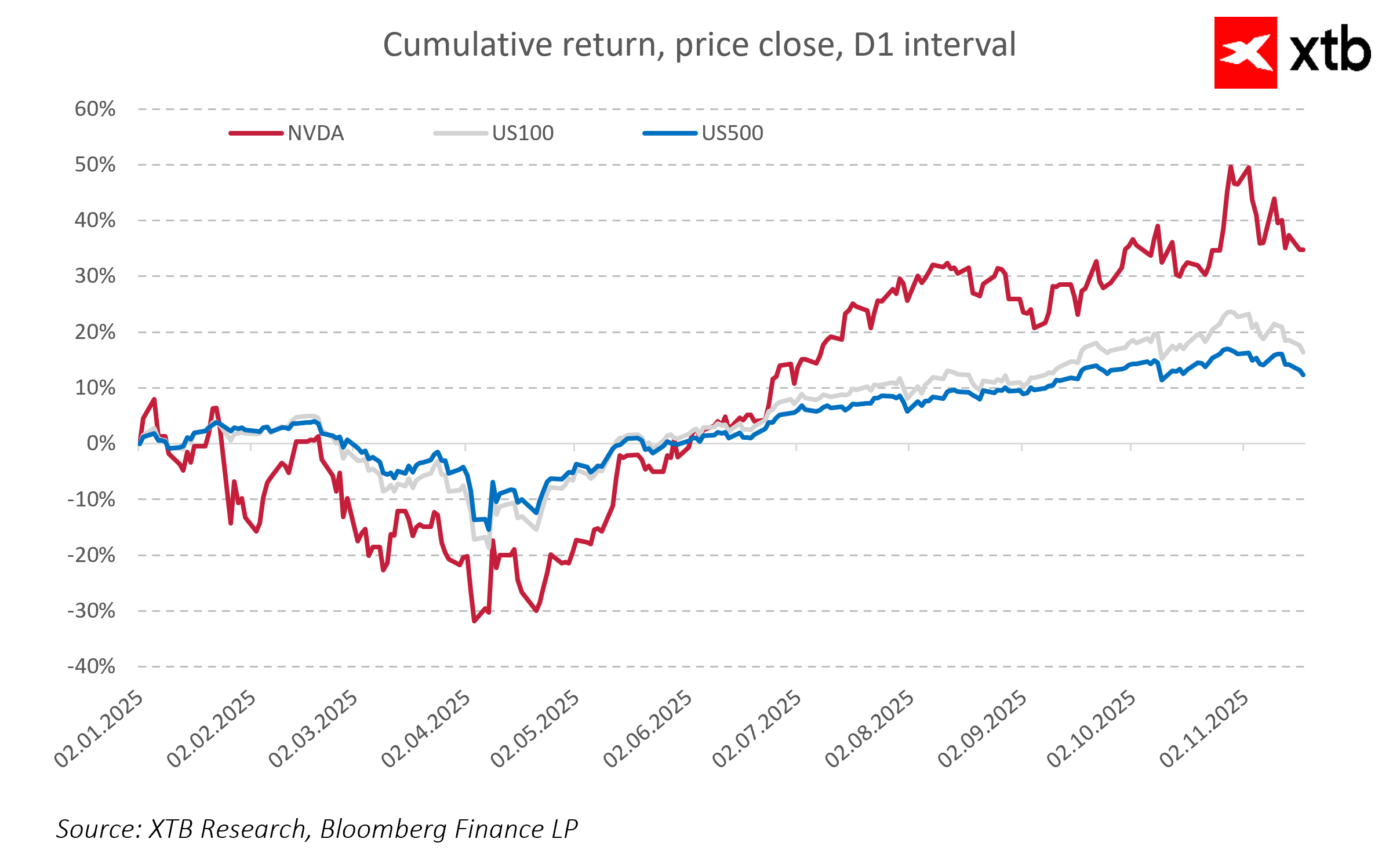

It is worth noting that although Nvidia still dominates globally, the Chinese market is becoming increasingly difficult to maintain without local partners or appropriate strategic adaptations. The efficiency and scalability of Ascend chips, combined with growing demand from local customers, could in practice take away part of Nvidia’s market share in China, particularly in inference and cloud AI segments. For Nvidia, this means closely monitoring local developments, adjusting pricing and technology strategies, and facing the potential risk of losing its competitive edge in a key Asian region.

Currently, the AI technology boom appears to be at a crossroads. Markets are cautious about technology company valuations, while the rapid pace of innovation and rising competition in China are adding further volatility. In this context, Huawei may set new standards and accelerate local AI adoption, which on one hand intensifies competition, and on the other highlights that Nvidia can no longer treat the Chinese market as a fully secure space for its growth.

In practice, the question of whether Nvidia is losing the Chinese market is no longer theoretical. The growing influence of Huawei and other local players demonstrates that even global leaders must account for regional shifts in power, as the AI market in China becomes an arena of increasingly fierce competition.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.