L3Harris Technologies LXH.US Rollercoaster, Nearly 13% Gains Wiped Out Despite a $bn Government Investment

Shares of L3Harris Technologies LXH.US (a manufacturer of advanced defence systems) rose by an impressive 13% at the start of today’s session on Wall Street after announcing plans to float its missile business in the second half of 2026. This move reflects growing investor interest in the defence sector, driven by global geopolitical tensions and increased US defence spending. Of particular importance is the strategic partnership with the US Department of Defence, which guarantees stable orders and a long-term revenue stream for the spun-off company.

The market has clearly recognised the potential of the missile segment’s IPO – the transaction will not only be a way to optimise L3Harris’ corporate structure, but above all will allow for the immediate raising of capital for the dynamically developing area of defence technologies. The increase in the value of the parent company’s shares reflects investors’ belief that the missile segment has significantly higher growth potential than the company’s other divisions, and that its prospects are secured by contracts with the federal government.

But that’s not all, as the company’s shares are also responding to a £1 billion government investment in Missile Solutions L3Harris. The investment is set to be a game-changer in US defence strategy and is potentially an even stronger catalyst for share growth than the prospect of an IPO alone. The Department of Defence, guided by its new “Go Direct-to-Supplier” strategy, is moving to direct financing of key suppliers, guaranteeing them stable, long-term orders for Tomahawk, PAC-3, THAAD and Standard Missile missiles.

The structure of the transaction – a convertible preferred share that will automatically convert to common shares during the IPO in the second half of 2026 – means that the government is not only subsidising production expansion, but also participating in the potential profits from the public debut. This model combines guaranteed demand from the Pentagon with the potential for revenue from future market valuation, virtually eliminating all business risk for the new company. The investment also signals the Trump administration’s determination to rapidly strengthen the defence industry’s production capacity, especially in the face of geopolitical tensions, creating a scenario of significant growth momentum for the defence sector in the coming years.

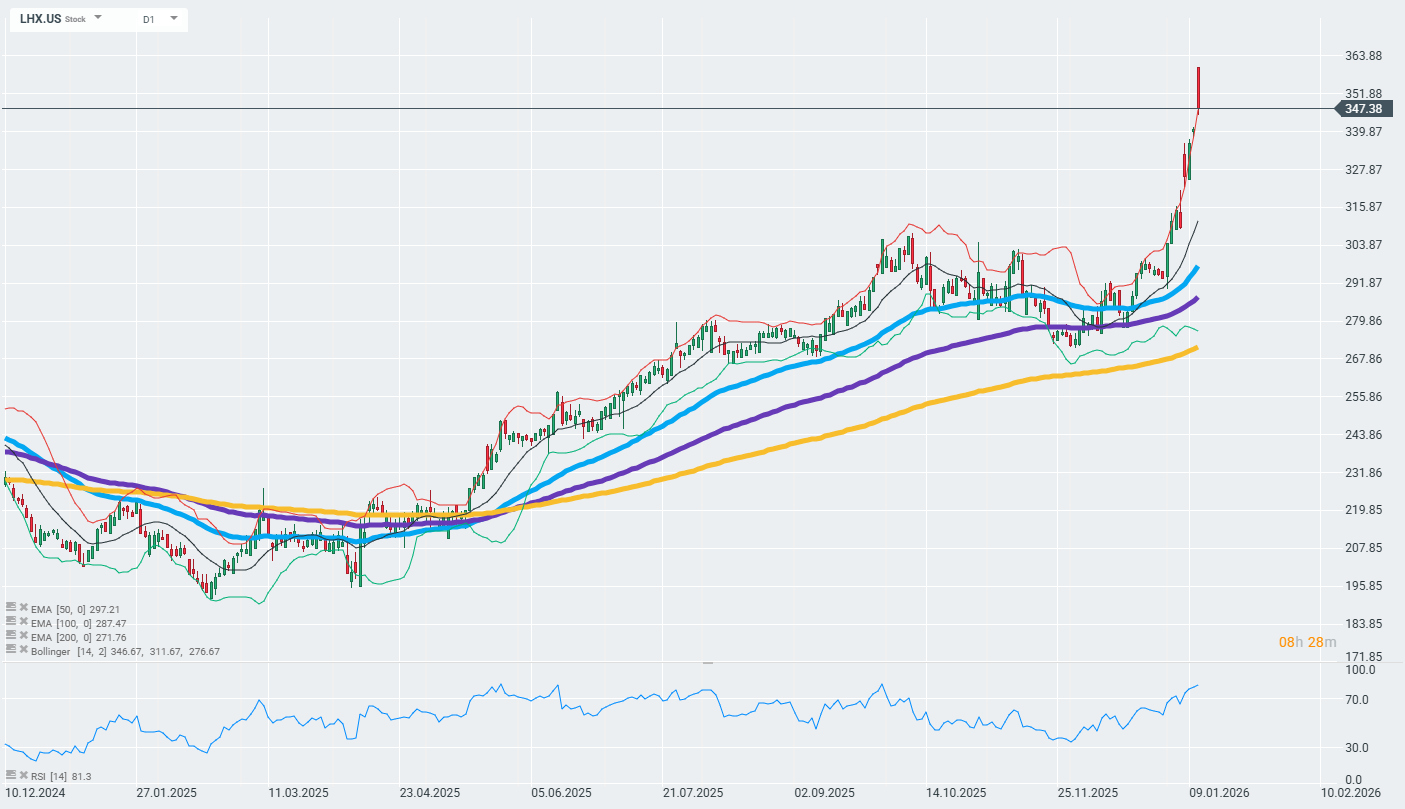

The company’s shares started trading with a huge upward gap, which, however, is now reduced to almost a minimum, which may indicate that the above information had already been priced in by the market earlier. However, these movements do not change the fact that the shares are in an upward trend (looking at exponential moving averages), but with considerable short-term growth momentum, which may be limited. The RSI for the 14-day average is currently breaking through the 83-point level.

Source: xStation

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.