Kloeckner (KCO.DE) Shares Gain 20% Subject to Takeover

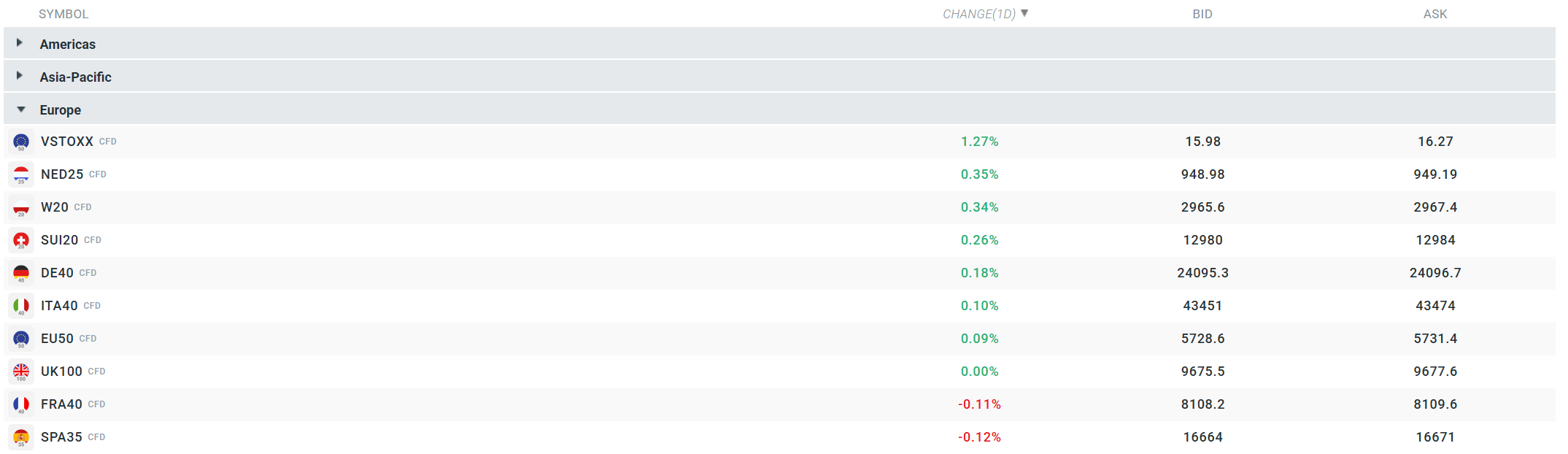

European indices are posting slight gains during the first phase of Monday’s session – the EU50 is up 0.06%, the DE40 is up 0.2%, and the FRA40 is down 0.10%. The limited volatility is currently mainly due to expectations for Wednesday’s Fed decision on interest rates and the influx of corporate news from the US. In this regard, it is worth mentioning that US index contracts themselves are recording gains in the range of 0.20%-0.30% today.

Source: xStation

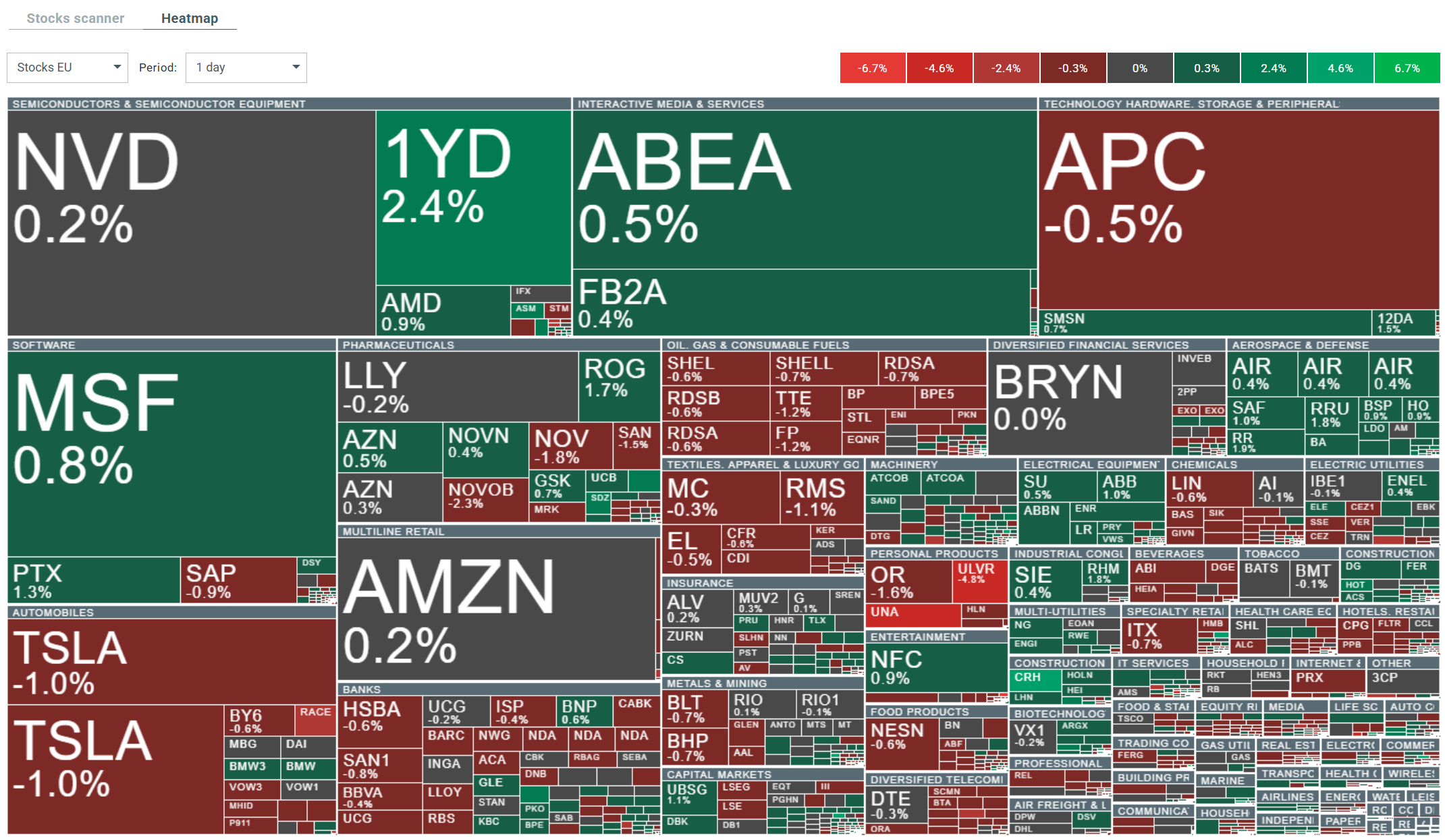

Current volatility observed on the broader European market. Source: xStation

During Monday’s session, the DAX broke above the 50-day exponential moving average (blue curve on the chart) and the 100-day exponential moving average (purple curve), which, from a technical perspective, were significant barriers indicating a short-term downward trend in the instrument. However, breaking above this zone negates this scenario, and if the DE40 remains above the aforementioned curves, this contract could theoretically start a new upward momentum with a range reaching the recent historical highs on the contract. Source: xStation

Company news published today:

German metals producer Kloeckner (KCO.DE) has confirmed that it is in advanced talks regarding a voluntary takeover bid from US-based Worthington Steel. The transaction is currently undergoing due diligence, and there is no certainty that the deal will ultimately be concluded. A significant increase in share prices of nearly 20% reflects the market’s enthusiasm for the potential acquisition and the possibility of consolidation in the metal processing sector.

Source: xStation

Morgan Stanley has downgraded its recommendation for Ferrari (RACE.IT) from “overweight” to “equal-weight” with a target price reduced to USD 425 from USD 520, citing the supercar manufacturer’s strategic decision to strictly limit production growth until 2030. The bank’s analyst points out that while the volume reduction strategy is positive for the long-term value of the brand, it will significantly limit revenue growth in the near term. Morgan Stanley forecasts Ferrari’s net sales growth at constant exchange rates at 6.4 per cent in fiscal year 2026, below the consensus of 8.2 per cent, with estimated volume growth of only 1.5 per cent CAGR through 2030 compared to a historical 6 per cent between 2012 and 2022. Key risks include pressure on the residual value of vehicles in secondary markets and the performance of Ferrari’s first electric vehicle, which is due to be launched in the second half of 2026. Shares are down 3% today.

Unilever (ULVR.UK) completed the spin-off of its ice cream business on 6 December, and The Magnum Ice Cream Company (TMICC) began trading on the Amsterdam, London and New York stock exchanges on 8 December. The newly spun-off company is the world’s largest independent ice cream manufacturer, managing a revenue portfolio of €7.9 billion and holding a 21% share of the global market, with four of the five largest ice cream brands on the planet: Wall’s, Magnum, Ben & Jerry’s and Cornetto. TMICC shares began trading at €12.96, indicating a market capitalisation of €7.93 billion, slightly higher than the company’s valuation within Unilever. All Unilever shareholders holding shares on 5 December received TMICC shares at a ratio of one TMICC share for every five Unilever shares. The spin-off strategy aims to accelerate operational decisions and unlock the growth potential of a business that has shown different supply chain dynamics compared to other Unilever segments, both in personal care (Dove, Axe) and food. ULVR shares, on the other hand, are not performing very well today, as they are down by nearly 4%.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.