Investment Banking – JP Morgan’s Net Income Down 7%

JPMorgan Chase kicked off the earnings season with a mixed signal, leaving the stock flat in the premarket trading (currently at around $325). The bank capped a record 2025 with its highest-ever annual revenue of $182 billion, despite a fourth-quarter profit hit from its strategic takeover of the Apple Card portfolio.

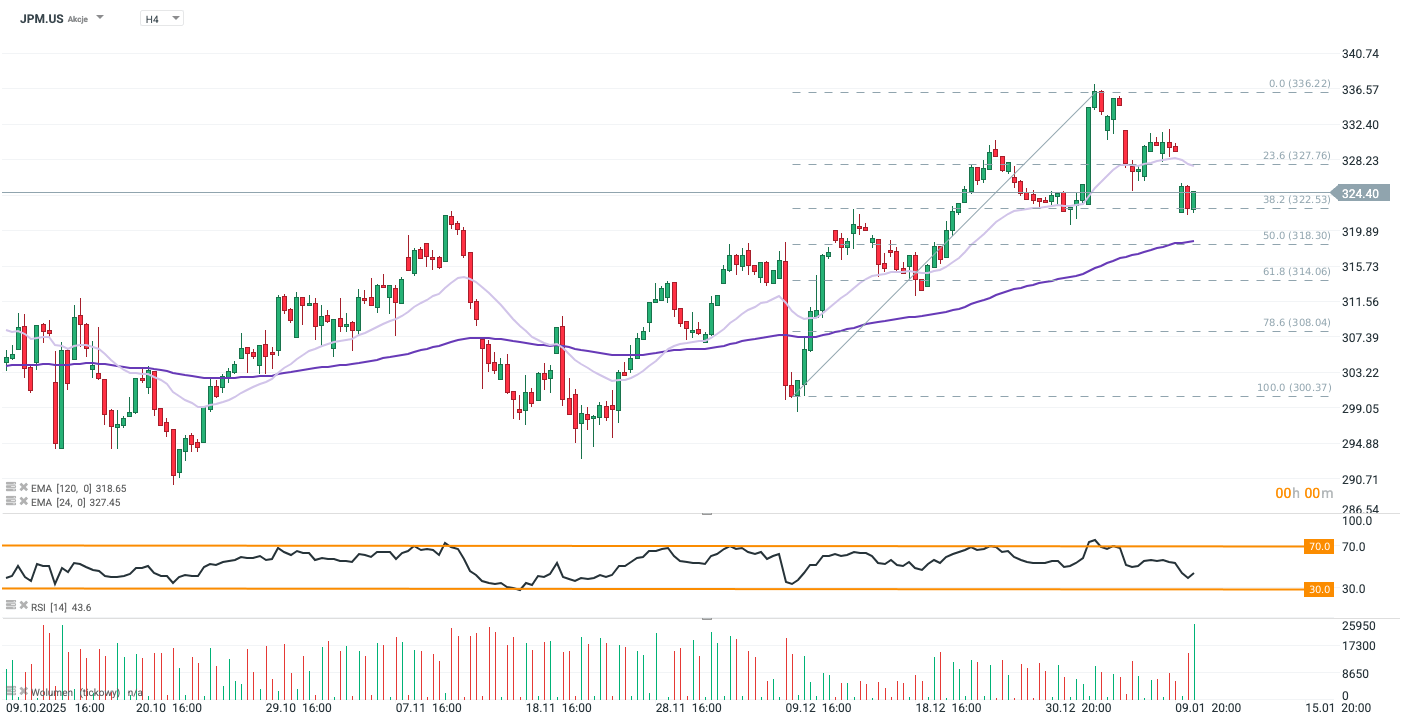

JPM stock has retreated to the 38.2% Fibonacci retracement level, weighed down by pre-earnings caution and President Trump’s recent comments on credit rate caps. The decline broke through immediate support around $330—a key level coinciding with the 30-day Exponential Moving Average (EMA30). This breach suggests that a quick return to recent highs is unlikely, potentially setting the stage for a deeper bearish test of the 100-day moving average (EMA100). Source: xStation5

Caution despite many beats

The bank reported Q4 net income of $13 billion, down 7% from the previous year. However, excluding the $2.2 billion provision for the Apple deal, EPS of $5.23 comfortably beat Wall Street’s $4.85 forecast. (total EPS: $4.63). CEO Jamie Dimon cited a “resilient” economy but warned of “sticky inflation” and geopolitical hazards.

Shares initially rose 1% after volatility from President Trump’s proposed credit card rate caps, as the bank issued strong 2026 guidance projecting $95 billion in net interest income. Nevertheless, the overall EPS miss and premium-client-driven performance spark caution among investors, in spite of Jamie Dimon’s optimism regarding the U.S. economy, bringing stock’s premarket down to around 0.15-0.2%.

Top Line Results

- Net Income: $13.03 billion, down 7% y/y.

- EPS (Earnings Per Share): $4.63, down 4% y/y.

- Note: EPS was $5.23 excluding significant items.

- Adjusted Revenue: $46.77 billion vs. Estimate $46.35 billion. (BEAT)

- Managed Net Interest Income: $25.11 billion (+7% y/y) vs. Estimate $24.99 billion. (BEAT)

Trading & Banking Highlights

- Equities Sales & Trading: $2.86 billion (+40% y/y) vs. Estimate $2.7 billion. (BEAT)

- FICC Sales & Trading: $5.38 billion (+7.5% y/y) vs. Estimate $5.27 billion. (BEAT)

- Investment Banking Revenue: $2.55 billion (-1.9% y/y) vs. Estimate $2.65 billion. (MISS)

- Note: Both Equity and Debt underwriting revenues missed estimates, with Equity underwriting down 16% y/y.

Credit & Balance Sheet

- Provision for Credit Losses: $4.66 billion (includes Apple Card reserves) vs. Estimate $4.68 billion.

- Net Charge-Offs: $2.51 billion vs. Estimate $2.56 billion. (BETTER THAN FEARED)

- Assets Under Management: $4.79 trillion vs. Estimate $4.73 trillion.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.