Gold.XAU tumbles to three-week low on Fed chair nomination

- Gold faces some selling pressure in Monday’s early European session.

- Reports that Kevin Warsh would be nominated as the next Fed chair weigh on the Gold price.

- Geopolitical risks and sustained buying by central banks might cap the downside for XAU/USD.

Gold price (XAU/USD) slumps to a three-week low below $4,550 during the early European trading hours on Monday, pressured by some profit-taking. The precious metal extends the decline after reaching historic highs last week amid signs of political stability in the United States (US) as Kevin Warsh was selected to be the next Fed chair, easing concerns over the US central bank’s independence.

On the other hand, ongoing geopolitical tensions, including US-Iran tensions, could underpin traditional safe-haven assets such as Gold. Traders will closely monitor the developments surrounding US-Iran negotiations, along with further clarity on Warsh’s policy direction. Additionally, rising demand from major central banks might contribute to the precious metal’s upside.

The US ISM Manufacturing Purchasing Managers Index (PMI) data will be released later on Monday. The figure is expected to improve to 48.3 in January from 47.9 in December. If the report shows surprise to the downside, this could drag the US Dollar (USD) lower and lift the USD-denominated commodity price, as a weaker USD makes greenback-priced gold more attractive for foreign buyers.

Daily Digest Market Movers: Gold remains under pressure after historic plunge

- Trump said over the weekend that the US will “hopefully” make a deal with Iran. Meanwhile, Iranian Supreme Leader Ayatollah Ali Khamenei warned that any attack on his country would spark a regional conflict, as the US continues to build up its forces nearby.

- “Investors and global central banks have… favored gold as their reserve currency of choice, which they believe insulates them from US policy dependence,” said Emma Wall, chief investment strategist at Hargreaves Lansdown. “Certain nations will have observed the threat of Russia having its US dollar assets seized by global players supportive of Ukraine, and subsequently considered the metal a more attractive neutral reserve,” she added.

- US President Donald Trump nominated Kevin Warsh to succeed Jerome Powell as the next Fed Chair. He is scheduled to take office in May 2026.

- The US Producer Price Index (PPI) climbed 3.0% year-over-year (YoY) in December, beating estimates of 2.7%, according to the Bureau of Labor Statistics on Friday. The PPI rose 0.5% month-over-month (MoM) in December, above the market consensus and the previous reading of 0.2%.

- Hotter-than-expected US producer price inflation could further strengthen the case for the Fed to hold rates steady while policymakers monitor how inflation trends.

- Markets see nearly an 87% chance of interest rates staying at the current 3.50%–3.75% range, with the first 25-basis-point (bps) reduction likely in June.

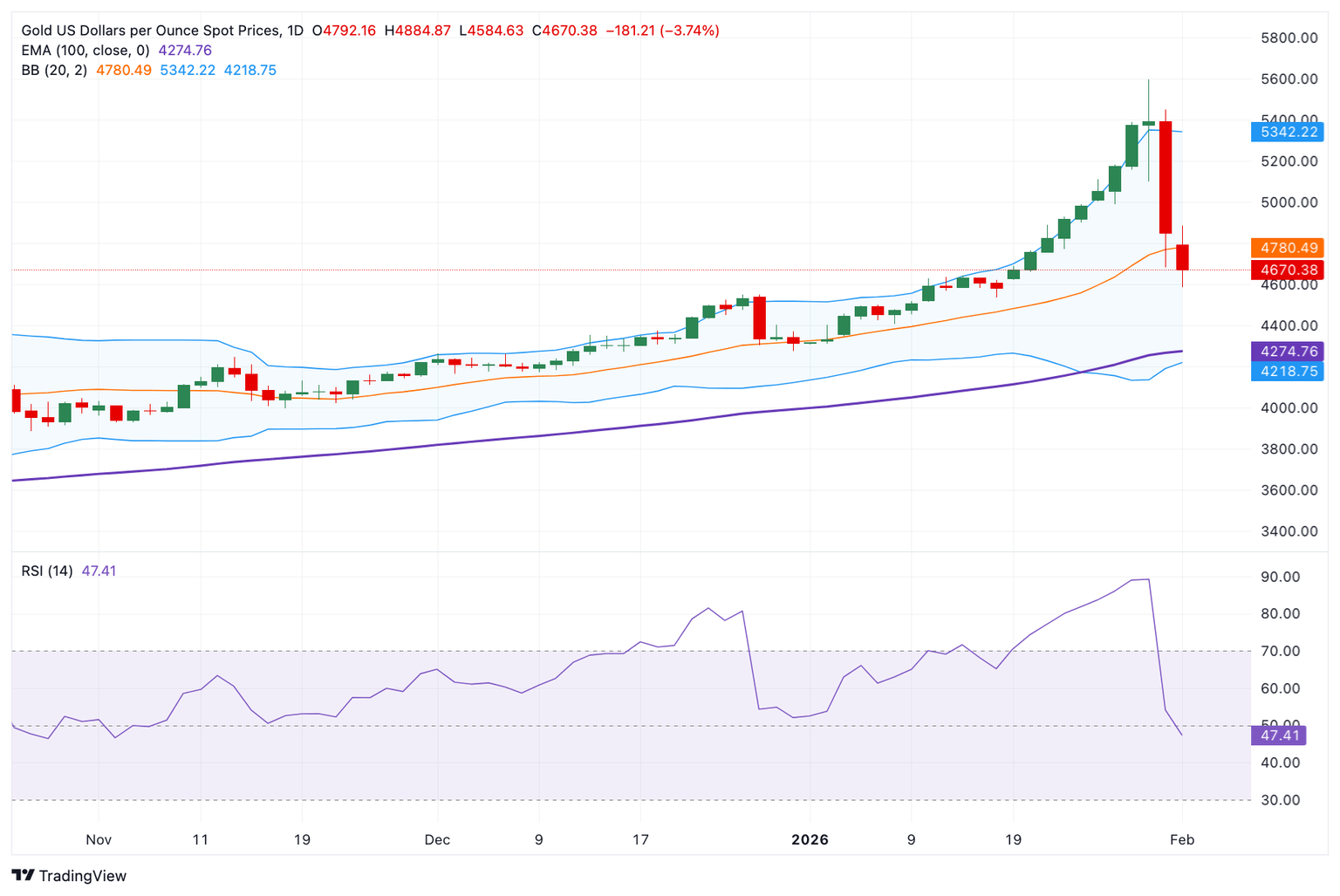

Gold keeps a bullish vibe in the longer term, but a neutral RSI warrants caution for bulls

Gold trades in negative territory on the day. However, in the longer term, the path of least resistance is to the upside, as the yellow metal is well-supported above the key 100-day Exponential Moving Average (EMA) on the daily chart. The Bollinger Bands widen, suggesting a strong trend continuation.

Despite the bullish trend, the 14-day Relative Strength Index (RSI) hovers around the midline, indicating that further consolidation or a temporary sell-off cannot be ruled out.

Green candlesticks and sustained trading above the February 2 high of $4,885 could make another run toward the $5,000 psychological level. The next upside barrier to watch is the January 27 high of $5,182.

On the flip side, the first downside target for Gold is seen at the January 19 low of $4,620. Any follow-through selling below the mentioned level could expose the January 12 low of $4,513. The key contention level emerges at the 100-day EMA of $4,275.