Gold sticks to intraday losses amid modest USD bounce; dovish Fed limits further decline

- Gold struggles to capitalize on an intraday uptick to a fresh weekly high on Thursday.

- A positive risk tone and a modest USD recovery exert some pressure on XAU/USD.

- Dovish Fed expectations should cap the USD and offer support to the XAU/USD pair.

Gold (XAU/USD) touches a fresh daily low during the early European session on Thursday, though it lacks follow-through and rebounds slightly from the $4,200 neighborhood. The US Dollar (USD) attracts some buyers and recovers a part of the previous day’s post-FOMC slump to its lowest level since October 24. This, in turn, fails to assist the commodity in capitalizing on its modest intraday uptick to the weekly high.

The upside for the USD, however, seems limited amid bets for more interest rate cuts by the US Federal Reserve (Fed), which continues to act as a tailwind for the non-yielding Gold. Apart from this, persistent geopolitical uncertainties stemming from the protracted Russia-Ukraine war limit the downside for the safe-haven commodity, warranting some caution before positioning for any meaningful depreciation.

Daily Digest Market Movers: Gold remains depressed amid recovering USD

- In a widely expected move, the US Federal Reserve lowered borrowing costs by 25 basis points at the end of a two-day policy meeting on Wednesday and projected just one more rate cut in 2026. Investors, however, remained hopeful about two more rate cuts in 2026 in the wake of Fed Chair Jerome Powell’s dovish remarks.

- Powell told reporters during the post-meeting press conference that the US labor market has significant downside risks and the US central bank does not want its policy to push down on job creation. This, in turn, dragged the US Dollar to its lowest level since October 24 and pushed the Gold to a fresh weekly high on Thursday.

- Powell, however, declined to offer guidance on the timing of the next rate cut and signaled a tougher road ahead for further reductions. Moreover, two hawkish dissents were opposing even Wednesday’s move, fueling uncertainty about the pace of Fed policy easing next year and acting as a headwind for the non-yielding yellow metal.

- Furthermore, a positive risk tone turns out to be another factor driving flows away from the safe-haven precious metal. That said, slow progress in the Russia-Ukraine ceasefire talks keep geopolitical risks in play and might hold back traders from placing aggressive bearish bets around the commodity and limit deeper losses.

- Ukrainian drones hit and disabled a tanker involved in trading Russian oil in the Black Sea. This marks the third sea drone strike in two weeks on vessels that are part of Russia’s so-called “shadow fleet”. Meanwhile, President Vladimir Putin had said that Russia would seize Ukraine’s Donbas region by military or other means.

- The mixed fundamental backdrop warrants some caution for the XAU/USD bears. Market participants now look to Thursday’s US economic docket – featuring the release of the usual Weekly Initial Jobless Claims and Trade Balance data. This, along with USD price dynamics, should provide a fresh trading impetus to the commodity.

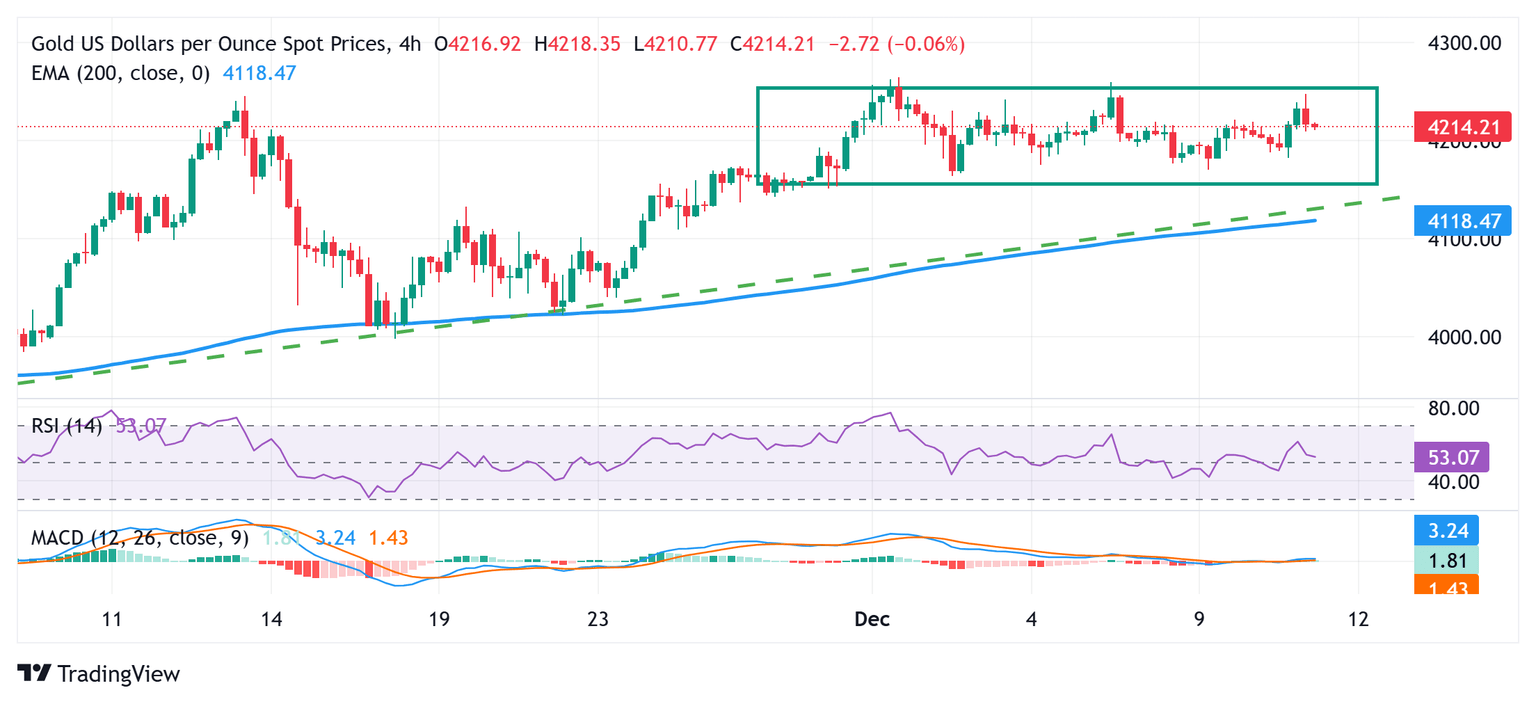

Gold could challenge $4,170-4,165 support once $4,200 is broken

The intraday pullback from the vicinity of a resistance marked by the top boundary of a two-week-old trading range warrants some caution for the XAU/USD bulls. However, positive oscillators on the daily chart suggest that any further decline below the $4,200 mark could be seen as a buying opportunity and find decent support near the $4,170-4,165 region. A convincing break below the latter, however, might expose the $4,125-4,120 confluence – comprising the 200-period Exponential Moving Average (EMA) on the 4-hour chart and an ascending trend line extending from the late October swing low.

On the flip side, bulls need to wait for sustained strength and acceptance above the $4,245-4,250 supply zone. The subsequent move up has the potential to lift the Gold price to the $4,277-4,278 intermediate hurdle en route to the $4,300 mark. Some follow-through buying will be seen as a key trigger for the XAU/USD bulls and pave the way for additional near-term gains.

US Dollar Price Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.05% | 0.06% | 0.00% | 0.17% | 0.55% | 0.23% | -0.07% | |

| EUR | 0.05% | 0.11% | 0.04% | 0.22% | 0.59% | 0.27% | -0.02% | |

| GBP | -0.06% | -0.11% | -0.06% | 0.11% | 0.48% | 0.16% | -0.13% | |

| JPY | 0.00% | -0.04% | 0.06% | 0.20% | 0.58% | 0.23% | -0.04% | |

| CAD | -0.17% | -0.22% | -0.11% | -0.20% | 0.38% | 0.05% | -0.24% | |

| AUD | -0.55% | -0.59% | -0.48% | -0.58% | -0.38% | -0.32% | -0.61% | |

| NZD | -0.23% | -0.27% | -0.16% | -0.23% | -0.05% | 0.32% | -0.29% | |

| CHF | 0.07% | 0.02% | 0.13% | 0.04% | 0.24% | 0.61% | 0.29% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).