German Markets Retreat Ahead of The Fed

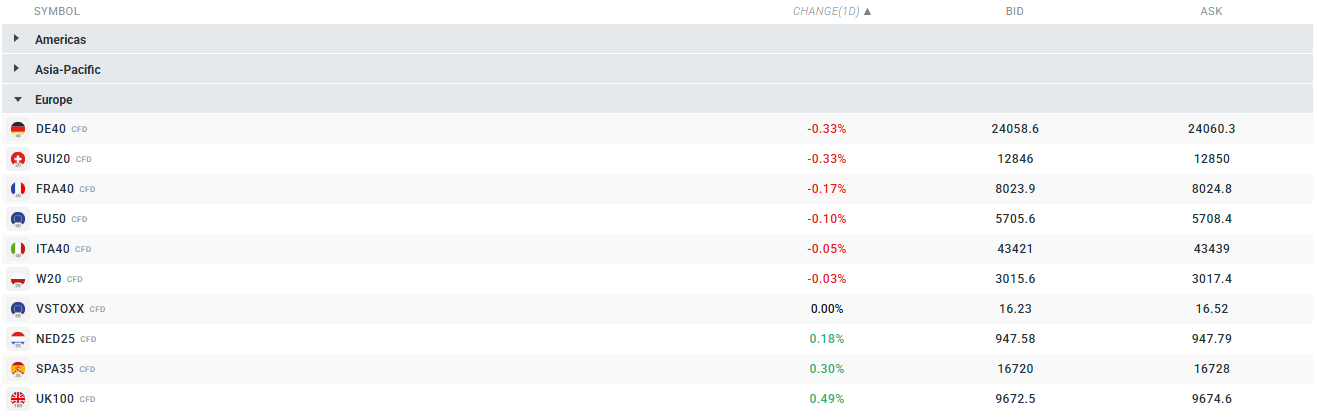

European indices are recording slight declines during the first phase of Wednesday’s session – the EU50 is down 0.1%, the DE40 is down 0.33% and the FRA40 is down 0.17%. The limited volatility is currently mainly due to expectations regarding the Fed’s decision on interest rates and the publication of new economic forecasts/dot plot.

Source: xStation

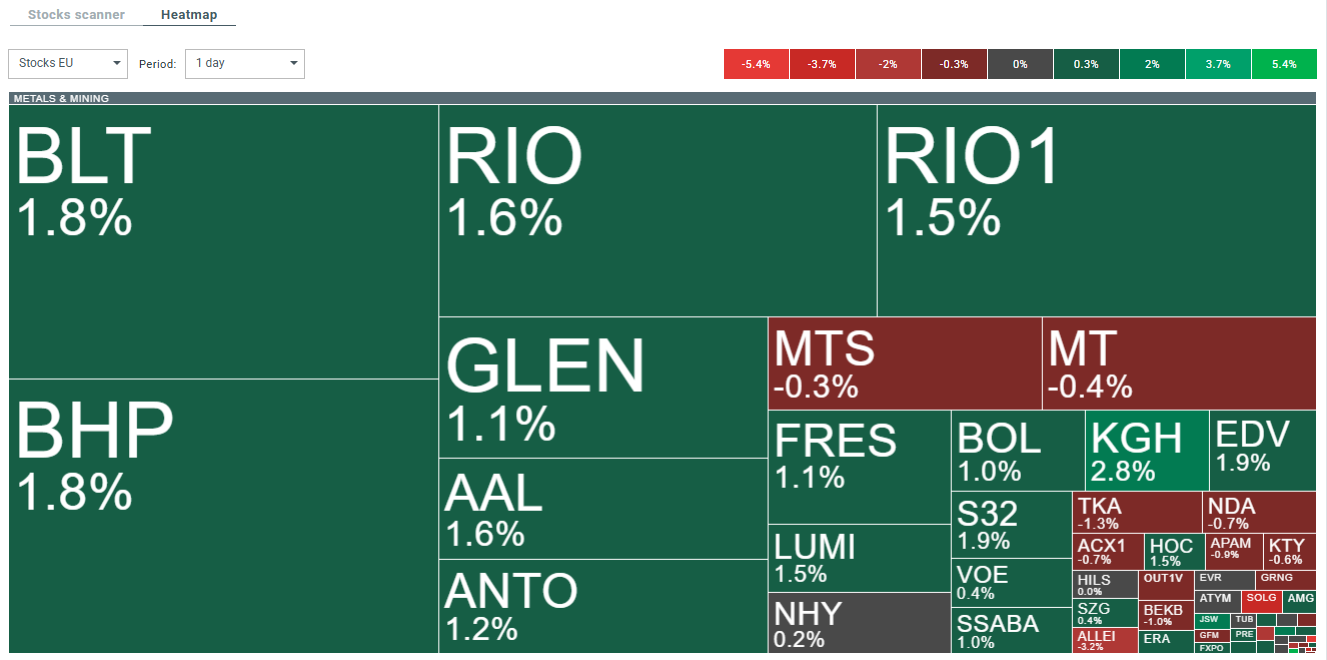

Current volatility observed on the broader European market. Source: xStation

Today, the DAX is losing its bullish momentum, which managed to push the contract above the 50-day exponential moving average (blue curve on the chart) and the 100-day exponential moving average (purple curve), which, from a technical perspective, were significant barriers indicating a short-term downward trend on the instrument. -day exponential moving average (purple curve), which, from a technical perspective, were significant barriers indicating a short-term downward trend in the instrument. However, breaking above this zone negates this scenario, and if DE40 remains above the aforementioned curves, the contract could theoretically start a new upward impulse with a range up to the recent historical highs on the contract. Source: xStation

Company news published today:

Gerresheimer (GXI.DE) shares fell nearly 10% yesterday following the publication of a report by Morpheus Research, which announced a short position in the company. The report accuses the company of problems with a key CagriSema contract, undisclosed issues with the acquisition of Bormioli, and aggressive accounting practices supporting poor financial results. Gerresheimer has announced its full cooperation with BaFin and commissioned an external legal analysis to “fully and transparently clarify the matter”. The company’s new management declares that it will take “the necessary steps” to regain investor confidence and continues with its plans to sell the moulded glass division. Despite an initial slump, the share price limited its losses to around 1.8%, but the company’s shares are down 66% since the beginning of the year. Today, the shares are rebounding by 0.63%.

The buyers managed to absorb all the selling pressure from yesterday’s session. Source: xStation

Shares in European precious metals mining companies are rising as the price of silver exceeded £47 per ounce for the first time due to limited supply and expectations of further easing by the Fed.

Source: xStation

What does the sell side say?

European car manufacturers have seen a rebound — the Stoxx 600 Autos & Parts index has risen 13% since mid-October — but they still face a second consecutive year of declines, which would be the first such occurrence in more than two decades.

Source: Bloomberg Financial Lp

Analysts point out that although demand is gradually improving, particularly thanks to cheaper electric models, most of the good news is already reflected in valuations, which have returned above their long-term averages.

Source: Bloomberg Financial Lp

The industry remains structurally weak due to declining market share, especially in Asia, growing competition from China and customs costs. Earnings forecasts have stabilised, but no clear improvement is yet in sight — Barclays believes that the potential turning point in earnings momentum has already been factored into share prices. Citi has lowered its sales forecasts for German manufacturers in China, and Deutsche Bank predicts “stable but unspectacular” demand in 2026. One positive factor is the possible easing of regulatory pressure — Bank of America assumes that the ban on the sale of combustion engine cars may be postponed by at least five years, which supports companies such as BMW, Renault, Volkswagen and Ferrari.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.