GBP/JPY Price Forecast: Looks set for fresh rally above 212.20

- GBP/JPY strengthens on the Japanese Yen’s continued underperformance.

- BoJ’s Ueda has kept the door open for further interest rate hikes.

- The Pound Sterling is expected to remain on the sidelines in a light UK economic calendar week.

The GBP/JPY pair posts a fresh multi-year high at 212.15 during the Asian trading session on Tuesday. The pair trades firmly as the Japanese Yen (JPY) underperforms across the board, even as Bank of Japan (BoJ) Governor Kazuo Ueda has signaled that there will be more interest rate hikes in the near term.

Japanese Yen Price Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the weakest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.06% | -0.05% | 0.05% | 0.02% | -0.17% | -0.18% | -0.03% | |

| EUR | 0.06% | 0.02% | 0.09% | 0.08% | -0.10% | -0.12% | 0.03% | |

| GBP | 0.05% | -0.02% | 0.08% | 0.07% | -0.12% | -0.13% | 0.01% | |

| JPY | -0.05% | -0.09% | -0.08% | -0.03% | -0.21% | -0.23% | -0.08% | |

| CAD | -0.02% | -0.08% | -0.07% | 0.03% | -0.18% | -0.20% | -0.05% | |

| AUD | 0.17% | 0.10% | 0.12% | 0.21% | 0.18% | -0.01% | 0.13% | |

| NZD | 0.18% | 0.12% | 0.13% | 0.23% | 0.20% | 0.01% | 0.14% | |

| CHF | 0.03% | -0.03% | -0.01% | 0.08% | 0.05% | -0.13% | -0.14% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

“BoJ expected to continue raising interest rates if economy and prices move in line with our forecast,” Governor Ueda said on Monday, and added that adjusting the degree of monetary support will help achieve “sustained growth and stable inflation”.

This week, investors will focus on the Overall Household Spending data for November, which will be published on Friday. The data is expected to have declined at a moderate pace of 1% against a 3% contraction in October.

Meanwhile, the Pound Sterling (GBP) trades higher against its peers, except antipodeans, as the market sentiment turns positive after the risks of a United States (US)-Venezuela clash subsiding. The British currency is expected to be majorly driven by market expectations for the Bank of England’s (BoE)monetary policy outlook amid a light United Kingdom (UK) economic calendar week.

GBP/JPY technical analysis

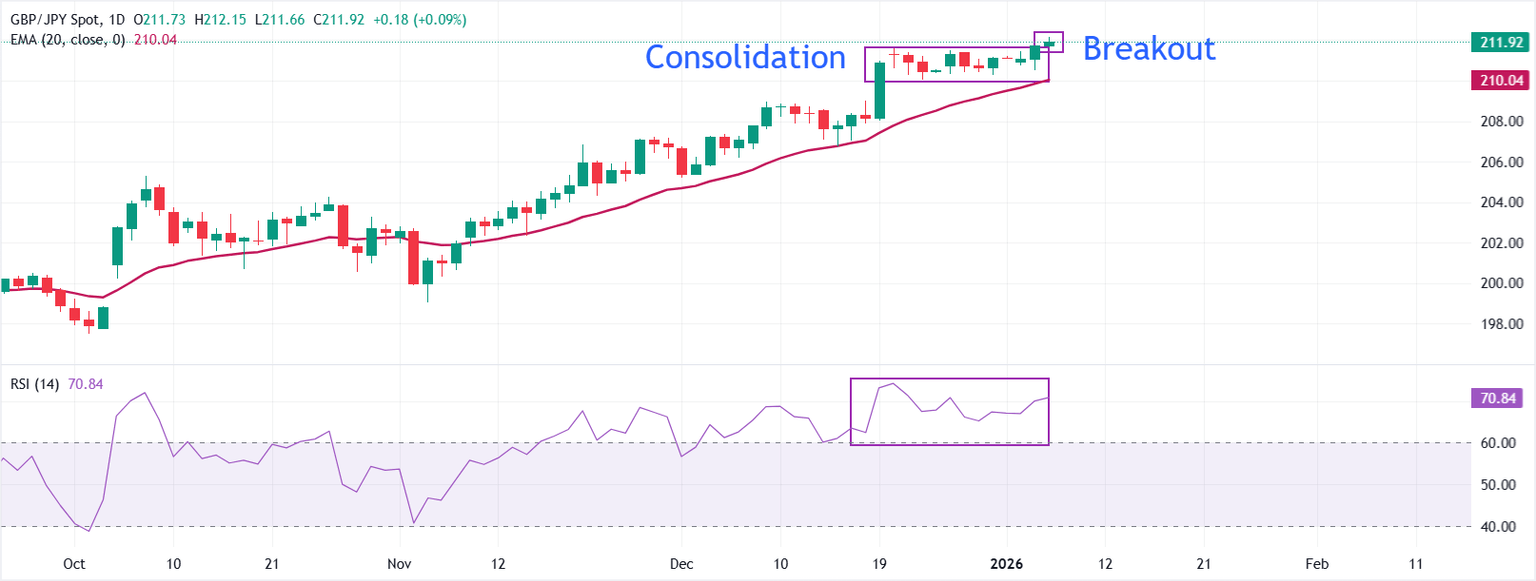

In the daily chart, GBP/JPY trades at 211.92 as of writing. The 20-day Exponential Moving Average (EMA) rises and provides support at 210.04. Price holds above this rising gauge, preserving the bullish bias.

The 14-day Relative Strength Index (RSI) at 70.84 is positive but carries risks of stretched momentum.

As long as the pair remains above the ascending 20-day EMA, the trend is positive and could extend towards 215.00. While a close below 210.04 could invite a corrective pullback towards the December 19 low of 208.00.