Eurozone Manufacturing PMI Misses Estimates

08:50 AM BST, France – PMI Data for December:

- HCOB France Manufacturing PMI: actual 50.7; forecast 50.6; previous 47.8;

08:55 AM BST, Germany – PMI Data for December:

- HCOB Germany Manufacturing PMI: actual 47.0; forecast 47.7; previous 48.2;

09:00 AM BST, Euro Zone – PMI Data for December:

- HCOB Eurozone Manufacturing PMI: actual 48.8; forecast 49.2; previous 49.6;

The euro area PMI weakened stronger than expected as production fell for the first time from Februrary 2025, driven by a sharp deterioration in demand, especially exports. New orders declined faster, prompting deeper cuts to purchasing, inventories and employment. Supply chains tightened and input costs rose, yet firms kept discounting prices. Despite current weakness, business optimism jumped to multi-year highs.

Contrasting changes in France and Germany

France was one of the bright spots of the report, with its PMI rebound driven by a sharp pickup in export demand, helping stabilise output and soften the decline in overall orders. Employment returned to growth, inventories were run down, and purchasing cuts eased. Cost pressures moderated, enabling modest price rises, while domestic demand and political uncertainty capped confidence

Germany’s PMI fell as demand weakened further, led by a sharp acceleration in export order declines. Output slipped after a long expansion, prompting deeper cuts to jobs, purchasing and inventories. Supply bottlenecks and rising input costs added pressure, while intense competition forced further price discounting despite higher costs.

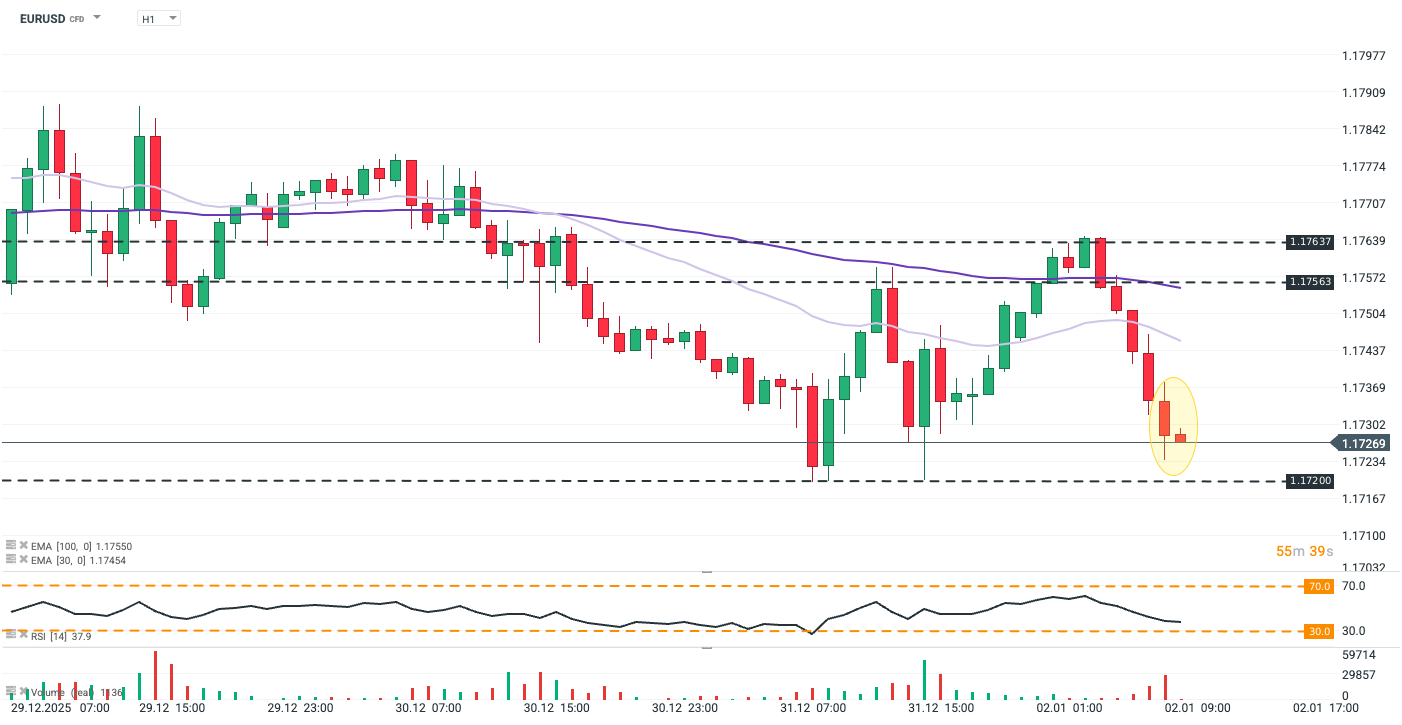

EURUSD (D1)

EURUSD extended its losses following the data release after earlier failing near key resistance around 1.1765. The pair has fallen roughly 0.5% over the past week, reflecting broader dollar strength amid more restrained US rate-cut expectations for Q1 2026. Immediate support sits near 1.1720, while a near-oversold RSI (approaching 30) should spark caution before chasing further downside.

Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.