European Markets in Consolidation

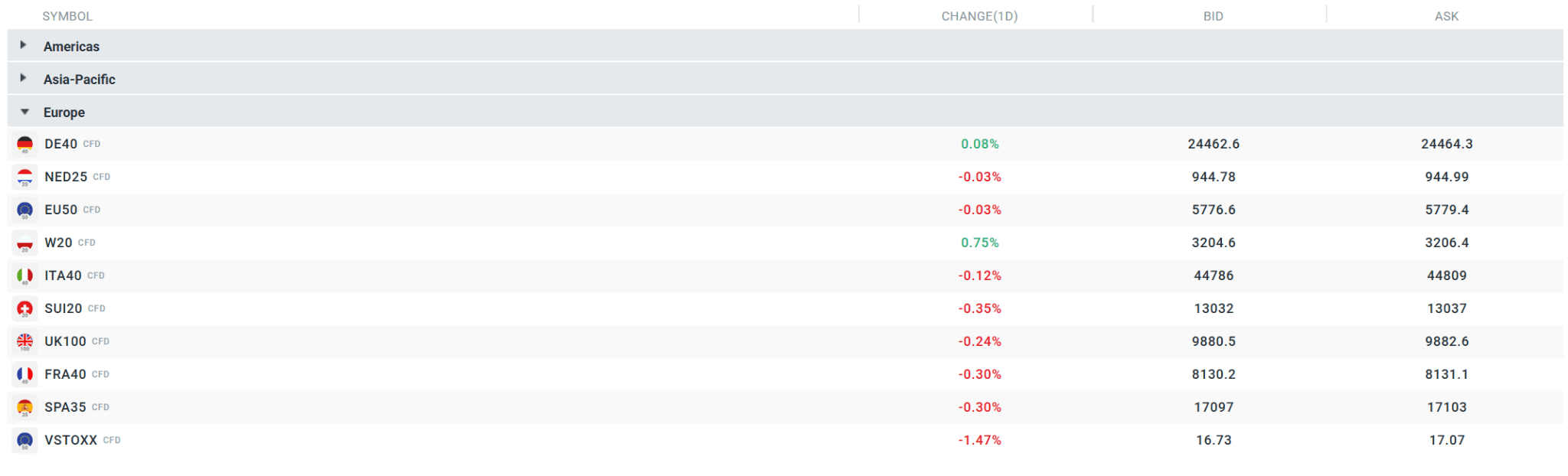

European indices erase most of their early session gains, with many local markets turning negative in the first phase of Monday’s trading session. The German DAX gains just 0.03%, while the French CAC40 loses 0.34% and the British FTSE100 declines 0.43%.

However, market attention is slowly shifting toward expectations regarding the economic backdrop that will accompany stock markets next year. From a market perspective, three areas appear crucial for 2026: valuations and positioning, the real state of the economy vs. earnings expectations, and the sustainability of the AI narrative and sector rotation.

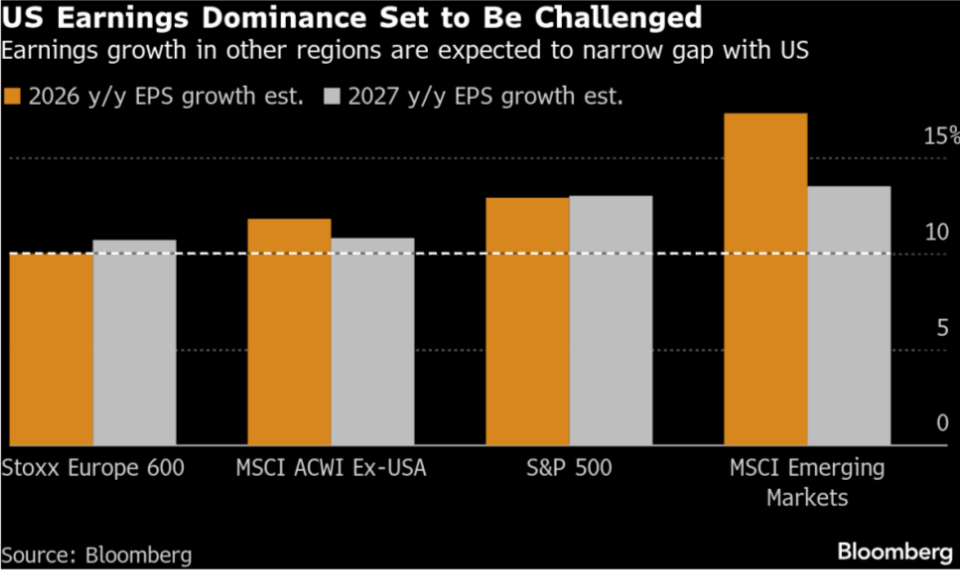

In terms of earnings expectations for companies from individual countries, the European Union does not look bad, with forecasts for both 2026 and 2027 pointing to growth in earnings per share. In the case of the US, however, analysts expect stagnation.

Source: Bloomberg Financial Lp

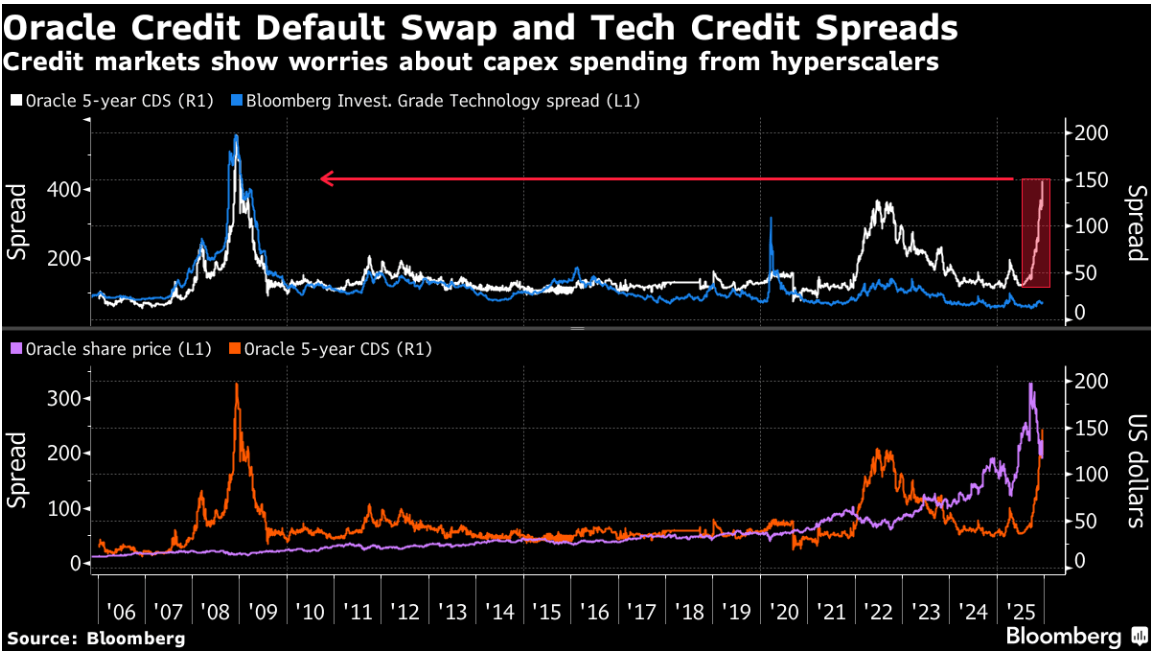

The market sees the greatest threat in technology companies, particularly those focused on AI technology. Increased interest in protecting against the bankruptcy of companies such as Oracle has led to a significant rotation of capital from tech to other sectors of the economy in recent weeks. Source: Bloomberg Financial LP

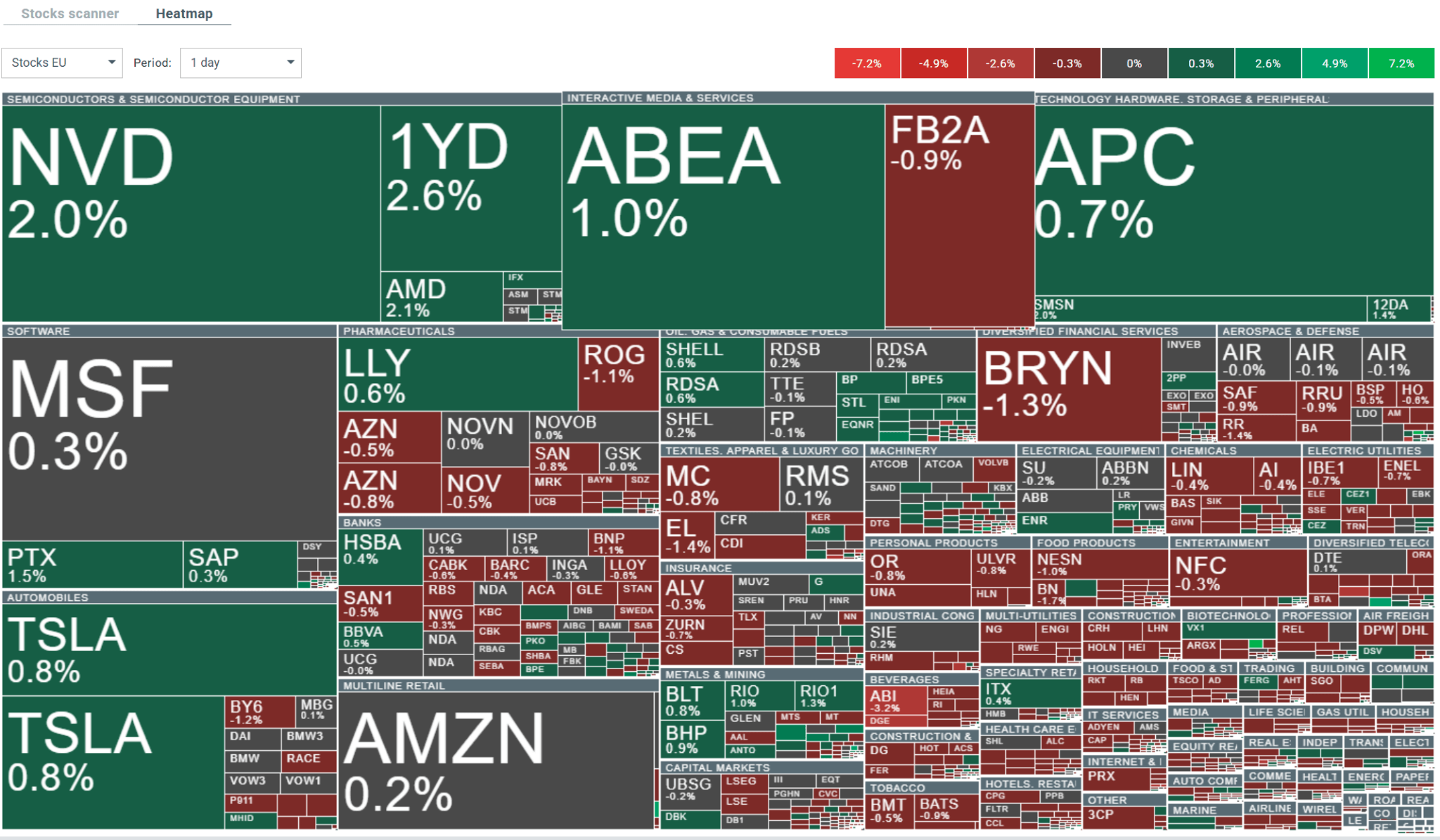

Over the last three months, it has basically provided the most support to biotech companies and banks, which in Europe are benefiting from the increased likelihood of the ECB maintaining its hawkish monetary policy. Source: Bloomberg Financial Lp

Current quotes for major contracts. Source: xStation

Current volatility observed on the broader European market. Source: xStation

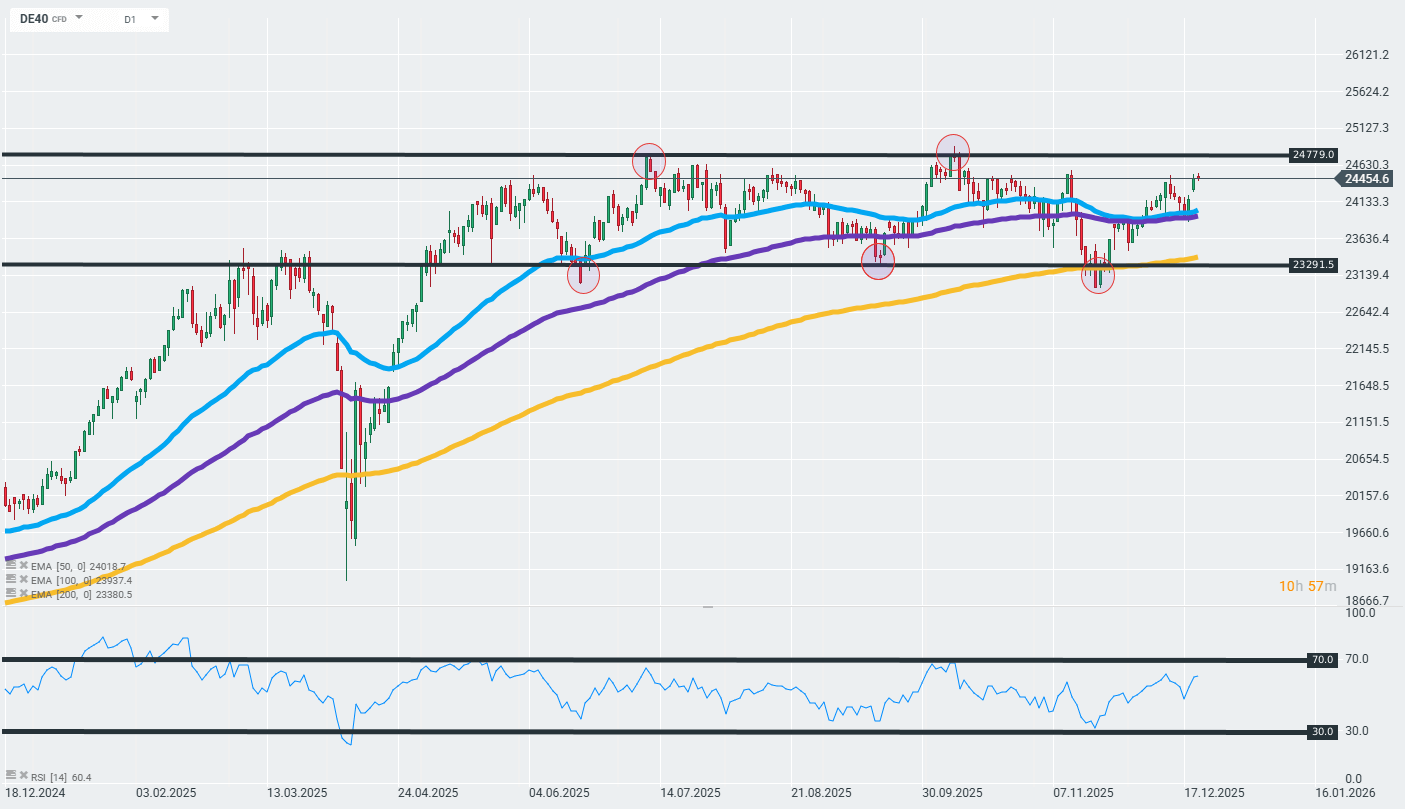

At the beginning of the week, the DAX stabilized close to Friday’s closing levels of around 24,450 points. However, this does not change the fact that the current bullish momentum, which managed to push the contract above the 50-day exponential moving average (blue curve on the chart) and the 100-day exponential moving average (purple curve), is, from a technical perspective, an indication of a short-term upward trend prevailing on the instrument. In the medium term, however, it is worth bearing in mind that the contract has been moving in a relatively narrow consolidation channel since May this year, which is why the local highs set by this zone may be the next important resistance points. Source: xStation

Company news published today:

During today’s session, some of the best performing sectors in terms of daily returns are fuel and mining companies, which are benefiting from sharp increases in the prices of precious metals, gold, silver, and platinum, as well as crude oil following tensions in Venezuela.

- Telecom Italia (TIT.IT) plans to convert costly savings shares into ordinary shares, which is expected to simplify its capital structure, reduce costs, and increase share liquidity. The move was made possible by a successful lawsuit and €1 billion in damages, which also paves the way for the resumption of dividend payments from next year. The main holder of preferred shares, Davide Leone, and key shareholder Poste Italiane support the proposal, even though Poste’s stake will fall from 27.3% to 19.6%. Preferred shareholders will receive one common share for each preferred share and €0.12 in cash upon voluntary conversion, while the remaining shares will be converted at the same ratio with a lower premium of €0.04.

- AstraZeneca (AZN.SE) has withdrawn Andexxa from the US market effective December 22, 2025, following a series of fatal thromboembolic events in patients during regulatory trials. This decision was a consequence of the FDA’s concerns about the benefit-risk ratio, as in the ANNEXA-I study, the rate of thrombotic events was more than twice as high in the Andexxa-treated group than in the control group, and there were also more deaths in this group. AstraZeneca voluntarily withdrew its application for approval of the drug, which had previously been approved on a priority basis for the treatment of acute bleeding caused by the anticoagulants Eliquis and Xarelto. Andexxa is still approved for use in Europe and the UK, but the troubling data from the US may influence the decisions of other regulators.

- The FDA has granted Roche (ROG.CH) accelerated approval for Lunsumio VELO™, a new subcutaneous form of the drug used in adult patients with relapsed or refractory follicular lymphoma after at least two lines of systemic therapy. The decision is based on the results of the GO29781 study, which showed a high complete response rate in patients, and the new formulation allows the drug to be administered in about one minute, significantly reducing the duration of the procedure. Full approval is contingent upon confirmation of clinical benefit in further confirmatory studies.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.