European stock markets continued their New Year rally into the second trading day of the week. The STOXX 600 index is up 0.20% to 603 points, after setting a new record high on Monday. Broader risk appetite remained intact despite geopolitical tensions surrounding Venezuela, supported by broad-based gains in Asia — particularly among Chinese technology stocks. Capital continues to rotate toward markets perceived as more attractive in terms of valuation and growth prospects.

Market attention is currently focused on the potential repercussions of the weekend events in Venezuela as well as on upcoming US macroeconomic data — this week brings key US labor-market releases, including ADP and NFP. The US dollar stabilized after yesterday’s pullback triggered by weak US manufacturing PMI data, while euro-area bond yields declined following mixed inflation readings from France and Germany.

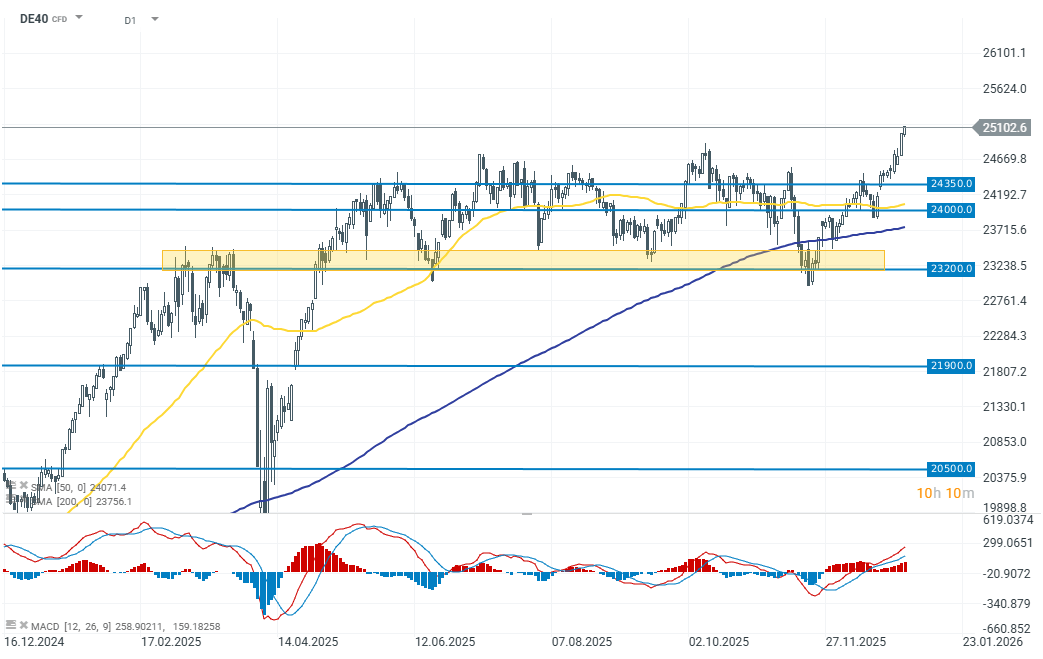

DAX (D1 interval)

The German index is up 0.40% today and has decisively broken above the 25,000-point level. As a result, DE40 has moved out of the previous consolidation range to the upside — a range that persisted for more than eight months.

Company news

- InPost gained more than 10% after confirming that it had received a non-binding proposal to acquire all outstanding shares; the company noted, however, that there is no certainty the talks will result in a transaction.

- Novo Nordisk is up over 5% after launching sales of the oral version of its Wegovy weight-loss drug in the United States, extending the strong gains from the previous session.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.