European Defense Stocks Leading The Way Today

European indices are performing mixed at the start of the second phase of Monday’s trading session. Germany’s DAX is up 0.29%, while France’s CAC40 is down 0.19% and the UK’s FTSE100 is down 0.17%. Once again, defence companies are leading the way in today’s session, this time driven by the dispute over Greenland.

European investors are still maintaining a risk-on sentiment ahead of US inflation data and the start of the earnings season, as evidenced by the heavily overbought Stoxx 600 index and Europe’s relative advantage over the S&P 500 since the beginning of the year. Investment bank strategists suggest a “rotate, not retreat” approach for Q1 – increasing exposure to value-cyclicals (banks, real estate, materials, industry, small and medium-sized companies) while maintaining, but not increasing, positions in the “Magnificent 7”. Geopolitical tensions and Trump’s pressure on the Fed are currently boosting defensive stocks rather than spoiling the overall market picture. However, it is worth bearing in mind that, measured by momentum indicators, the recent upward movements on indices, including the German DE40, are creating the basis for possible downward corrections.

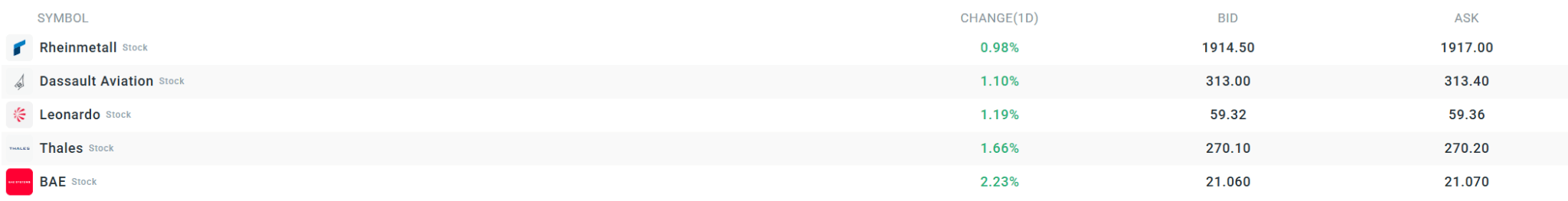

Current quotations for major contracts. Source: xStation

Current volatility observed on the broader European market. Source: xStation

During Monday’s trading session, the DAX continued its upward trend and broke through the previously mentioned barrier of 24,780 points, which was the main resistance level in 2025. What is more, the current bullish momentum, which managed to break the contract above the 50-day exponential moving average (blue curve on the chart) and the 100-day exponential moving average (purple curve), is, from a technical perspective, an indication of a short-term upward trend in the instrument. As long as DE40 remains above these support barriers, the current trend is likely to continue. Source: xStation

Key corporate news:

European military companies are gaining value today as investors anticipate rising defence spending amid tensions in the Arctic. A group of European countries, led by Germany and the United Kingdom, is considering increasing its military presence in Greenland to respond to US threats to take over the territory and to emphasise the importance of Arctic security.

Source: xStation

Abivax (ABVX.FR), a French biotech company, rose 25% following reports that pharmaceutical giant Eli Lilly is preparing a takeover bid of around €15–17.5 billion ($17–20 billion). The company’s key asset is obefazimod (ABX464), which has shown promising results in late-stage clinical trials for the treatment of colitis – in July 2025, shares rose by as much as 510% in a single day after the announcement of positive data, which attracted the attention of big pharma. Eli Lilly has not yet made a formal offer, but is awaiting guidance from French authorities on foreign investment controls. However, speculation alone about the interest of such a powerful player looking for acquisitions in immunology is sending shares higher as the market speculates on the valuation and likelihood of a deal.

Activities of investment bank analysts:

INCREASES:

- Carlsberg upgraded to “above average” by BNP Paribas; target price 1,000 Danish kroner.

- L’Oreal upgraded to “hold” by Deutsche Bank; target price €360

DISCOUNTS:

- Barry Callebaut downgraded to “sell” by Deutsche Bank

- Danone downgraded to “sell” by Deutsche Bank; PT €67

- Heineken downgraded to “neutral” by BNP Paribas; PT €73

- Holcim downgraded to “neutral” by BofA

- Pandora downgraded to “hold” by Nordea.

- Pernod Ricard downgraded to “underperform” by BNP Paribas; target price €67.

- Sartorius Stedim downgraded to neutral by Goldman; target price €246.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.