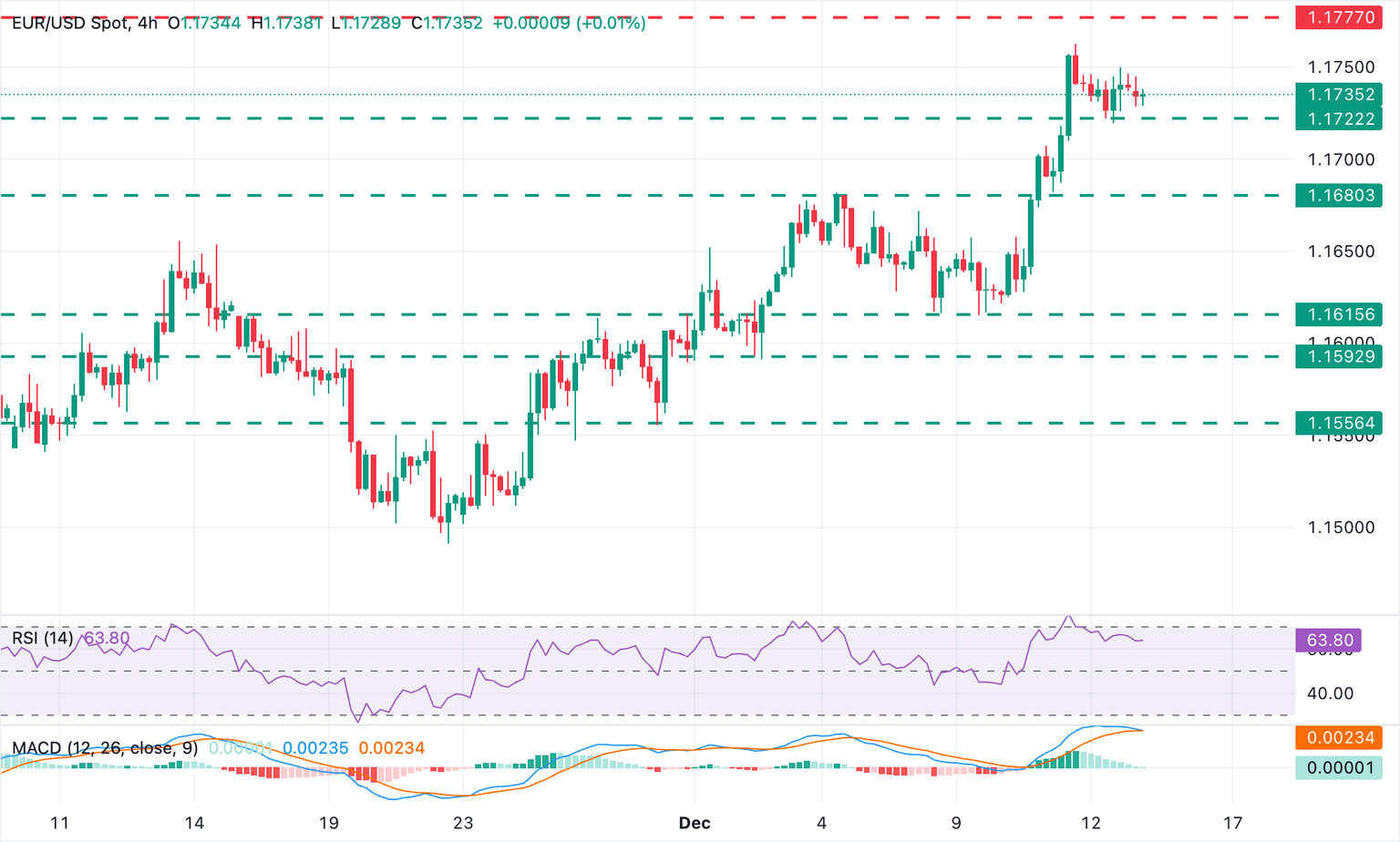

EUR/USD fluctuates near highs in cautious markets ahead of a busy week

- EUR/USD is consolidating recent gains on Monday, supported above 1.1720

- The increasing monetary policy divergence between the ECB and the Fed is underpinning support for the Euro.

- Technical indicators suggest that the recent EUR/USD rally has lost steam.

EUR/USD trades with moderate losses, although it remains near 1.1730 at the time of writing, with the 1.1762 multi-month high at a short distance. Investors turn cautious ahead of an array of delayed US macroeconomic releases and the European Central Bank’s (ECB) monetary policy decision.

The pair consolidates gains after rallying nearly 2% over the last three weeks, as investors positioned for last week’s interest rate cut by the US Federal Reserve (Fed) and for US President Donald Trump’s pick to replace Fed Chairman Jerome Powell, who is expected to be a dovish loyalist.

Investors, however, have shown a cautious mood during Monday’s Asian session, reluctant to take excessive risks ahead of key macroeconomic releases later this week, namely the delayed October and November’s US Nonfarm Payrolls (NFP) reports on Tuesday, and November’s Consumer Prices Index (CPI) on Thursday. In between, the ECB will release its monetary policy decision also on Thursday.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.01% | -0.02% | -0.50% | -0.04% | 0.00% | 0.26% | -0.01% | |

| EUR | -0.01% | -0.04% | -0.51% | -0.04% | -0.01% | 0.24% | -0.02% | |

| GBP | 0.02% | 0.04% | -0.46% | -0.02% | 0.03% | 0.28% | 0.01% | |

| JPY | 0.50% | 0.51% | 0.46% | 0.44% | 0.49% | 0.74% | 0.47% | |

| CAD | 0.04% | 0.04% | 0.02% | -0.44% | 0.05% | 0.30% | 0.03% | |

| AUD | -0.01% | 0.00% | -0.03% | -0.49% | -0.05% | 0.24% | -0.04% | |

| NZD | -0.26% | -0.24% | -0.28% | -0.74% | -0.30% | -0.24% | -0.26% | |

| CHF | 0.00% | 0.02% | -0.01% | -0.47% | -0.03% | 0.04% | 0.26% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily Digest Market Movers: Monetary policy divergence supports the Euro

- The Euro (EUR) holds most of the gains from the last three weeks on Monday, supported by the divergence in monetary policy between the ECB and the Fed. The Fed is expected to cut rates at least once in 2026, while the ECB has suggested that the next monetary policy change might be a rate hike.

- On Friday, President Trump stated in an interview that former Fed Governor Kevin Warsh is the best-positioned candidate to replace Chairman Powell at the end of his term in May. Trump has also mentioned White House economist Kevin Hassett as a candidate for the job. The President also said that the next central bank Chair should listen to his opinion when deciding the future direction of interest rates.

- Data from China released earlier on Monday revealed that Industrial Production slowed down against expectations in November, while retail consumption grew at its lowest pace in nearly two years. These figures have renewed concerns about the health of the world’s second-largest economy and hammered risk appetite during the Asian session.

- Also in China, news that the state-backed property developer China Vanke is struggling to find a way to avoid bankruptcy has brought concerns about the country’s property sector back to the table, further souring market sentiment.

- On the Eurozone calendar on Monday, the main focus will be on October’s Industrial Product figures, which are expected to show a 0.1% advance, following a 0.2% growth in September.

- In the US, the NY Empire State Manufacturing Index is seen dropping to 10.6 in December from 18.7 in the previous month. After that, Fed Governor Stephen Miran and New York Fed President John Williams will appear in public and might give further clues about the central bank’s monetary policy plans.

Technical Analysis: EUR/USD consolidates gains after a sharp rally

The EUR/USD is trading within a tight range, right below the multi-month highs of 1.1762 hit last week. This consolidation phase is allowing the 4-Hour Relative Strength Index (RSI) to retreat from overbought territory, yet still standing at levels consistent with a solid bullish trend. The Moving Average Convergence Divergence (MACD) indicator, however, shows an impending bearish cross, suggesting that a further correction might be ahead.

Immediate support is at the December 12 low, near 1.1720. Beyond that, Thursday’s low, at the 1.1680 area, and the December 9 low at 1.1615 will come into focus. To the upside, the December 11 high, at 1.1762, and the October 1 peak at around 1.1780 are likely to challenge bulls. Further up, the target is the September 23 and 24 highs near 1.1820.