Eli Lilly (LLY.US) Reports Upbeat Phase III Results as Obesity Drugs Sector Strenghtens

Eli Lilly (LLY.US) published the results of phase III trials of its experimental new-generation drug, retatrutide, which showed an impressive average weight loss of 23% (and in the highest dose group even close to 29%) over 68 weeks. These results exceeded the expectations of Wall Street analysts, who had predicted weight loss of 20-23%, which immediately translated into a rise in the company’s share price of around 3% in pre-market trading. This success strengthens Lilly’s position as a leader in the anti-obesity drug market, which is expected to reach $100 billion by 2030.

In response to these reports, shares in Novo Nordisk (NOVOB.DK), the main competitor, temporarily came under downward pressure, although they ultimately recovered some of their losses, rising by around 1.6-2.2%. Investors are comparing the success of retatrutide with the recent disappointment surrounding Novo Nordisk’s CagriSema, which achieved only a 20.4% weight reduction in trials compared to the promised 25%. Retatrutide, a triple agonist (GLP-1, GIP and glucagon), has an advantage over existing drugs such as Zepbound and Wegovy, also offering significant pain reduction in patients with knee osteoarthritis. Despite promising results, side effects remain a risk, forcing 18% of subjects on the highest dose to discontinue treatment. Lilly plans to complete another seven Phase III trials in 2026, which could be another catalyst for the share price in the medium term.

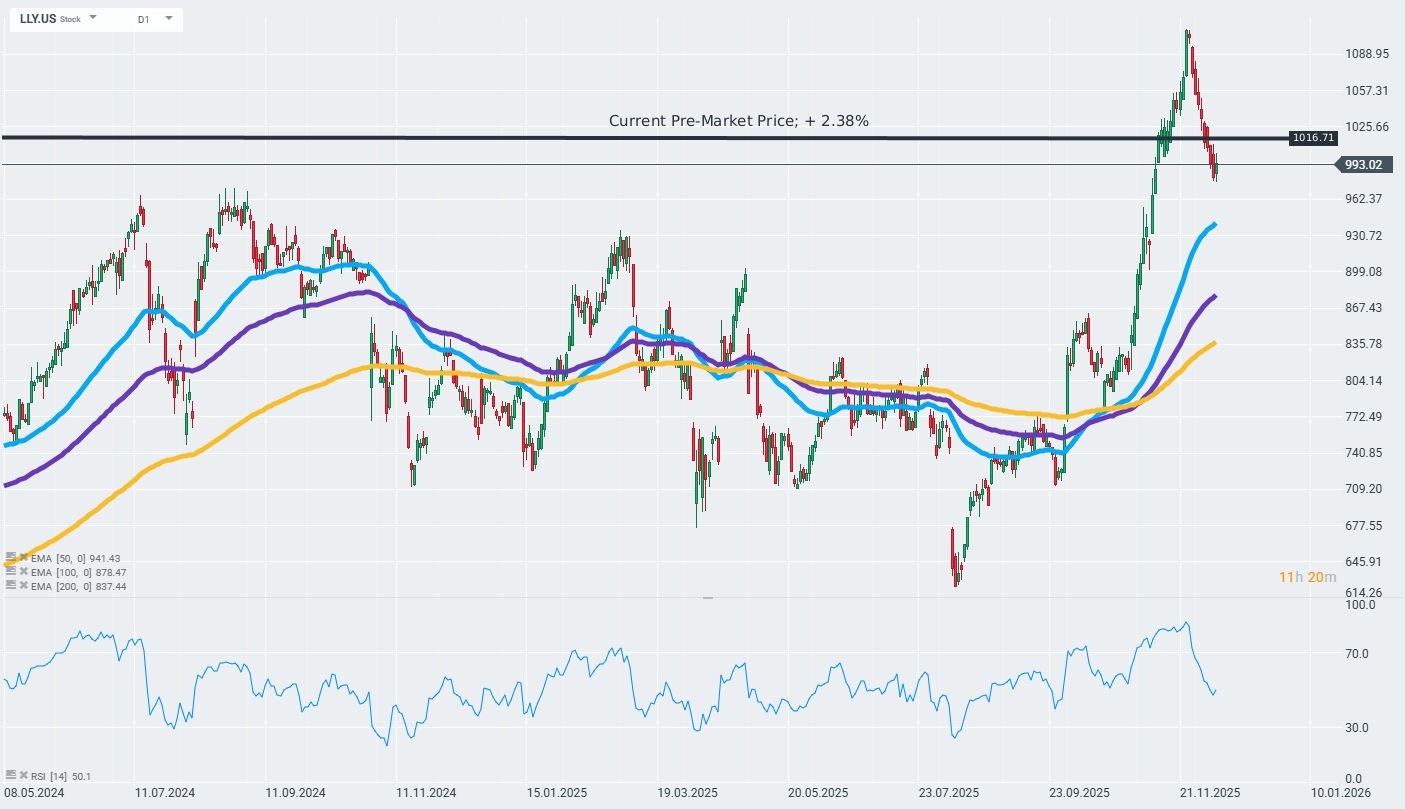

The company’s shares are returning above the psychological barrier of $1,000 per share after a recent prolonged series of declines. In the long term, the upward trend continues to dominate.

Source: xStation

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.