Commodity Talk – Oil, Silver, Natgas And Cocoa

Oil WTI

- Tariff threats: Donald Trump has indicated that nations trading with Iran could be subject to additional tariffs.

- Iranian unrest: Anti-government protests in Iran have resulted in at least several dozen fatalities. Mr. Trump has not ruled out U.S. involvement to resolve the current situation involving civilian casualties.

- Production and exports: Iran produces slightly over 3 million barrels per day (mbpd), with the majority of its exports destined for China.

- Venezuelan instability: Following recent U.S. intervention, the treatment of the populace remains unchanged. Citizens face sanctions for criticizing the regime or supporting the U.S.-led abduction of Maduro.

- OPEC+ Policy: The alliance continues its policy of maintaining production levels through the first quarter of this year. OPEC forecasts suggest the market should be relatively balanced by 2026.

- Diverging forecasts: The IEA maintains its forecast of a massive 3.8 mbpd oversupply, while the EIA points to an oversupply of approximately 2 mbpd.

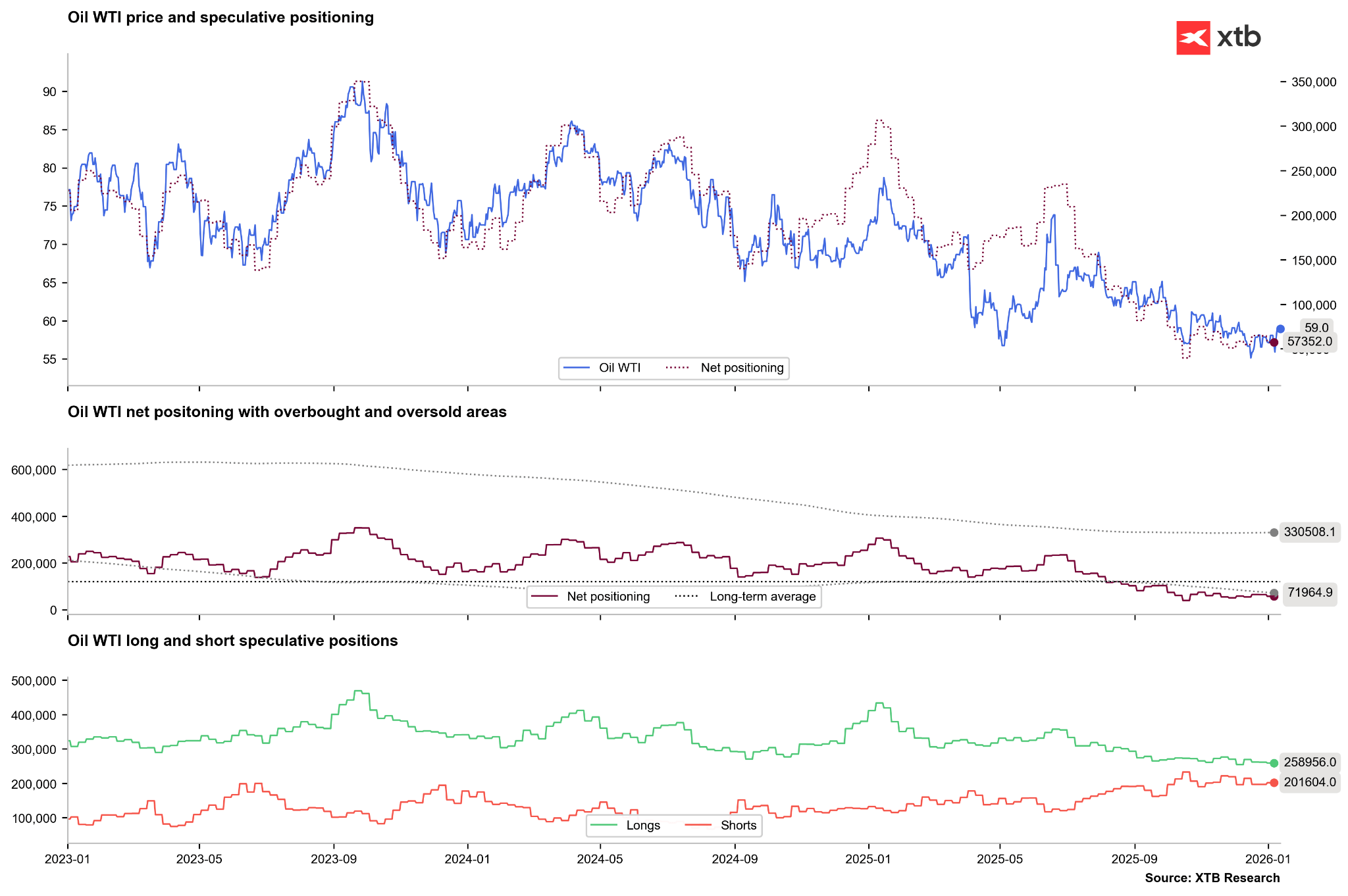

Speculative positioning in WTI crude remains relatively low, with net long positions at minimal levels. Source: Bloomberg Finance LP, XTB

Speculative positioning in WTI crude remains relatively low, with net long positions at minimal levels. Source: Bloomberg Finance LP, XTB

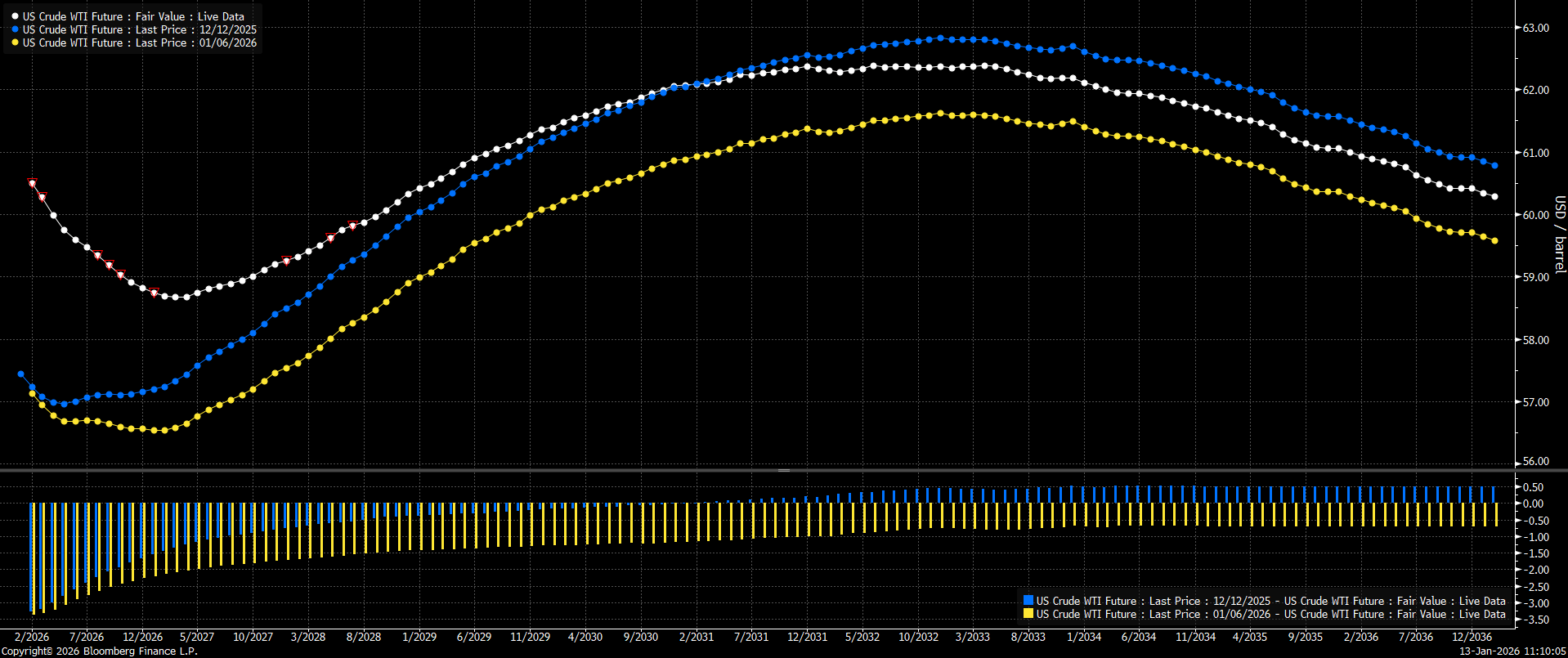

The forward curve has returned to backwardation through March 2027, compared to minimal backwardation observed a week and a month ago. Given the low probability of a market deficit this year, prices are expected to retreat in the coming weeks, barring a geopolitical escalation in Venezuela, Iran, or Russia. However, should the U.S. decide to intervene in Iran, WTI prices could find a short-term range of $62–$65 per barrel. Source: Bloomberg Finance LP

The forward curve has returned to backwardation through March 2027, compared to minimal backwardation observed a week and a month ago. Given the low probability of a market deficit this year, prices are expected to retreat in the coming weeks, barring a geopolitical escalation in Venezuela, Iran, or Russia. However, should the U.S. decide to intervene in Iran, WTI prices could find a short-term range of $62–$65 per barrel. Source: Bloomberg Finance LP

Natural Gas

- Price correction: Gas prices fell to approximately $3.3/MMBTU due to subdued demand in late December and early January. However, an expected return to lower temperatures could lead to more significant inventory draws.

- Inventory data: The latest EIA report showed a much larger-than-expected decline in inventories, despite limited demand.

- European support: Cold weather in Europe is providing a modest floor for European prices, which may eventually support U.S. benchmarks.

- Record production: U.S. production hit a record 114 bcfd on Monday, nearly 9% higher than a year ago. Conversely, demand stood at 101 bcfd, down 6% year-on-year. However, LNG exports reaching 20 bcfd suggest that summer inventory injections may be lower than in previous years amid increased cooling demand.

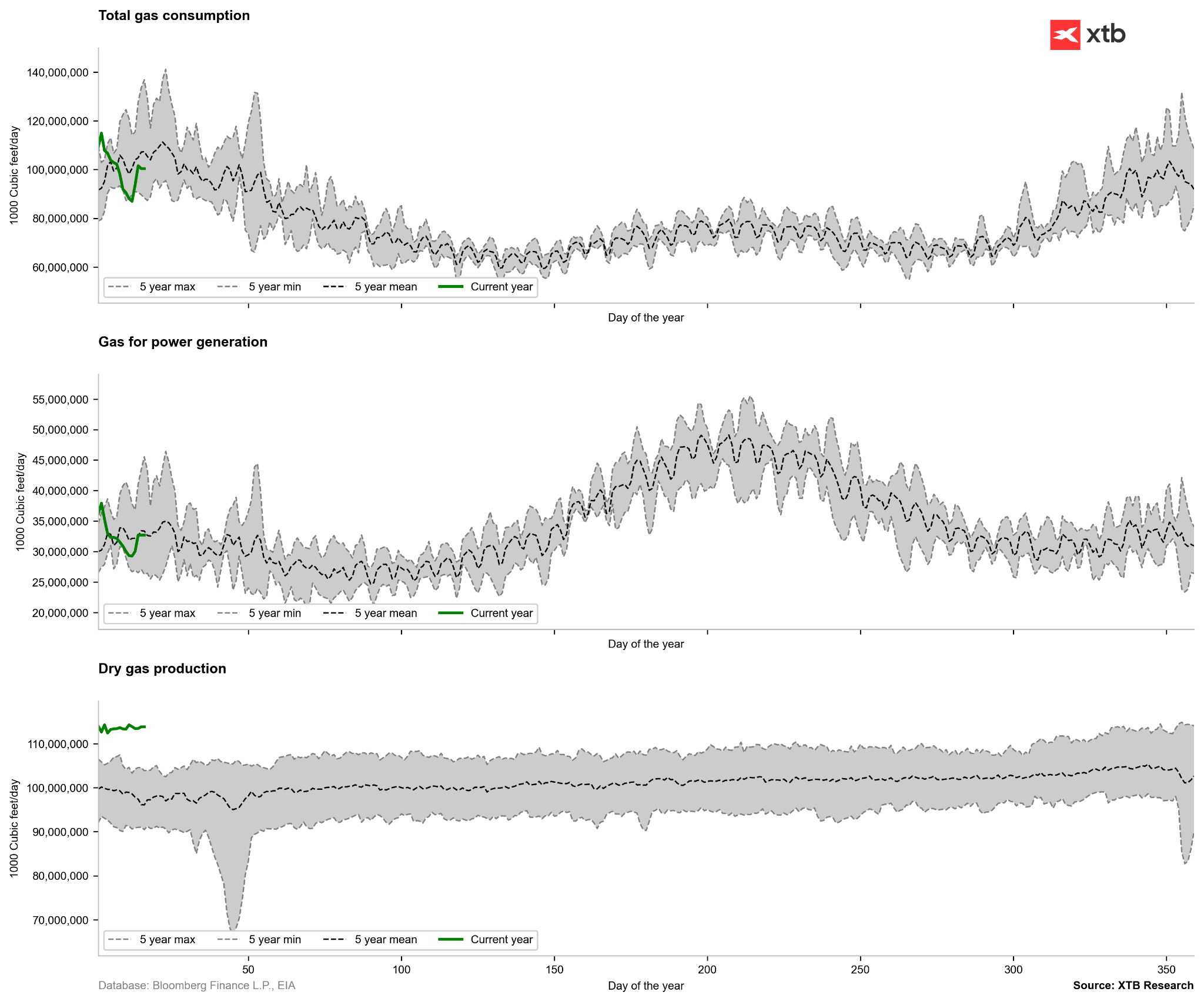

Gas demand is currently slightly below the 5-year average, but a clear increase in heating degree days suggests a demand rebound by late January. Source: Bloomberg Finance LP, XTB

Gas demand is currently slightly below the 5-year average, but a clear increase in heating degree days suggests a demand rebound by late January. Source: Bloomberg Finance LP, XTB

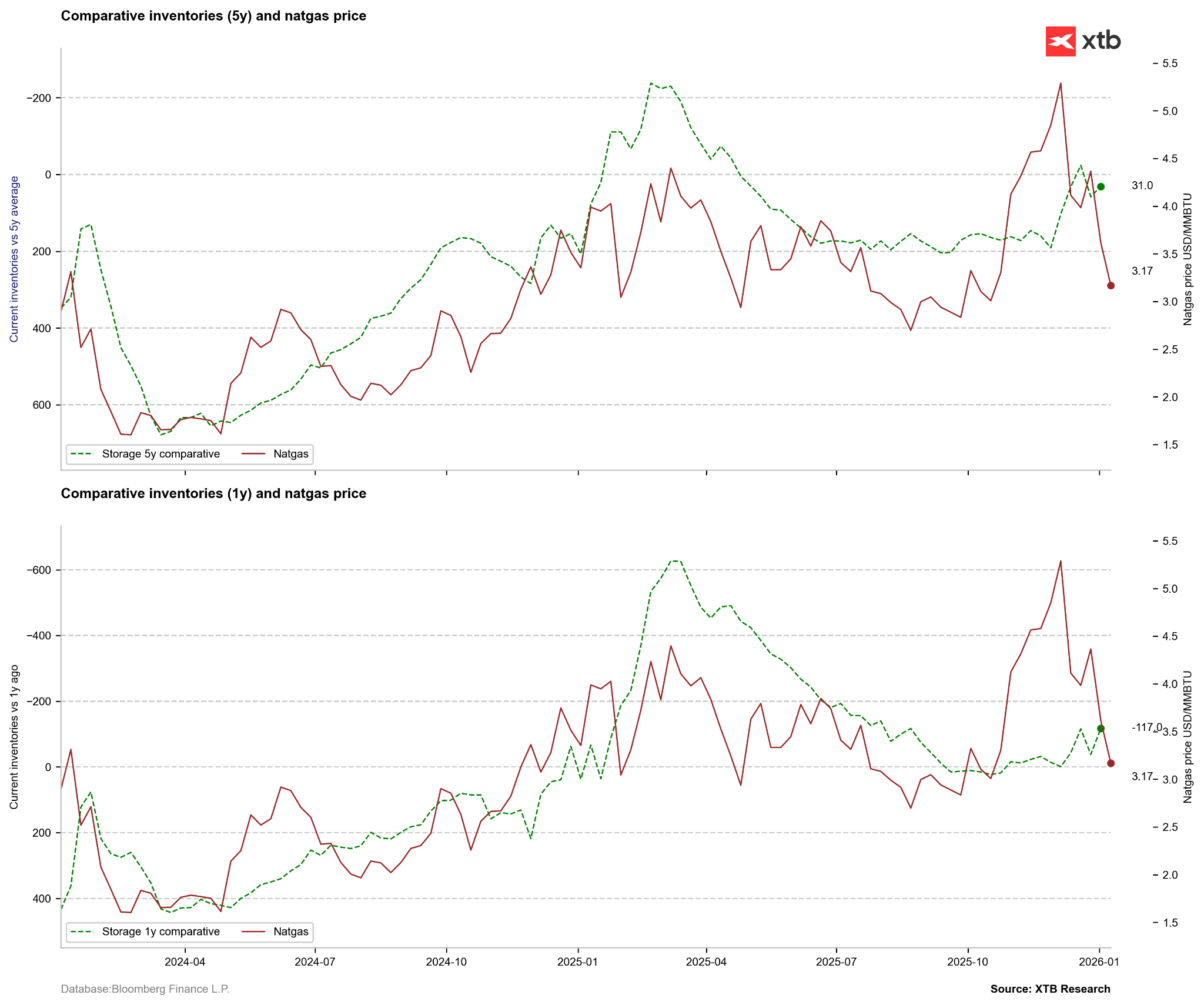

Comparative inventories suggest prices may have overextended their recent decline. If inventories continue to fall, there is a chance for a price recovery. Source: Bloomberg Finance LP, XTB

Comparative inventories suggest prices may have overextended their recent decline. If inventories continue to fall, there is a chance for a price recovery. Source: Bloomberg Finance LP, XTB

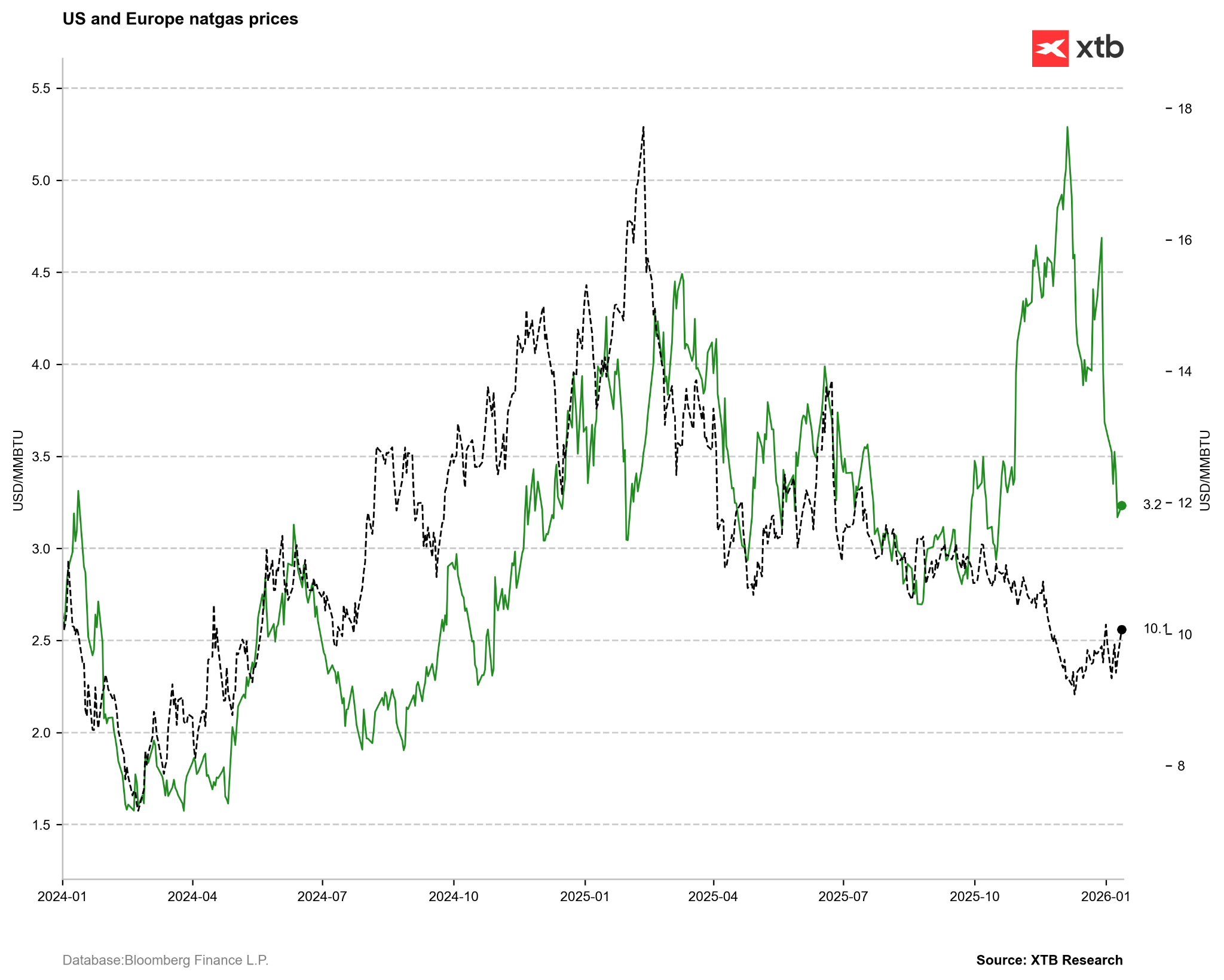

U.S. gas prices are falling sharply, while European prices remain low. However, given cold weather and low inventories, there is room for a recovery in European prices, which could end the current correction in the U.S. Source: Bloomberg Finance LP, XTB

U.S. gas prices are falling sharply, while European prices remain low. However, given cold weather and low inventories, there is room for a recovery in European prices, which could end the current correction in the U.S. Source: Bloomberg Finance LP, XTB

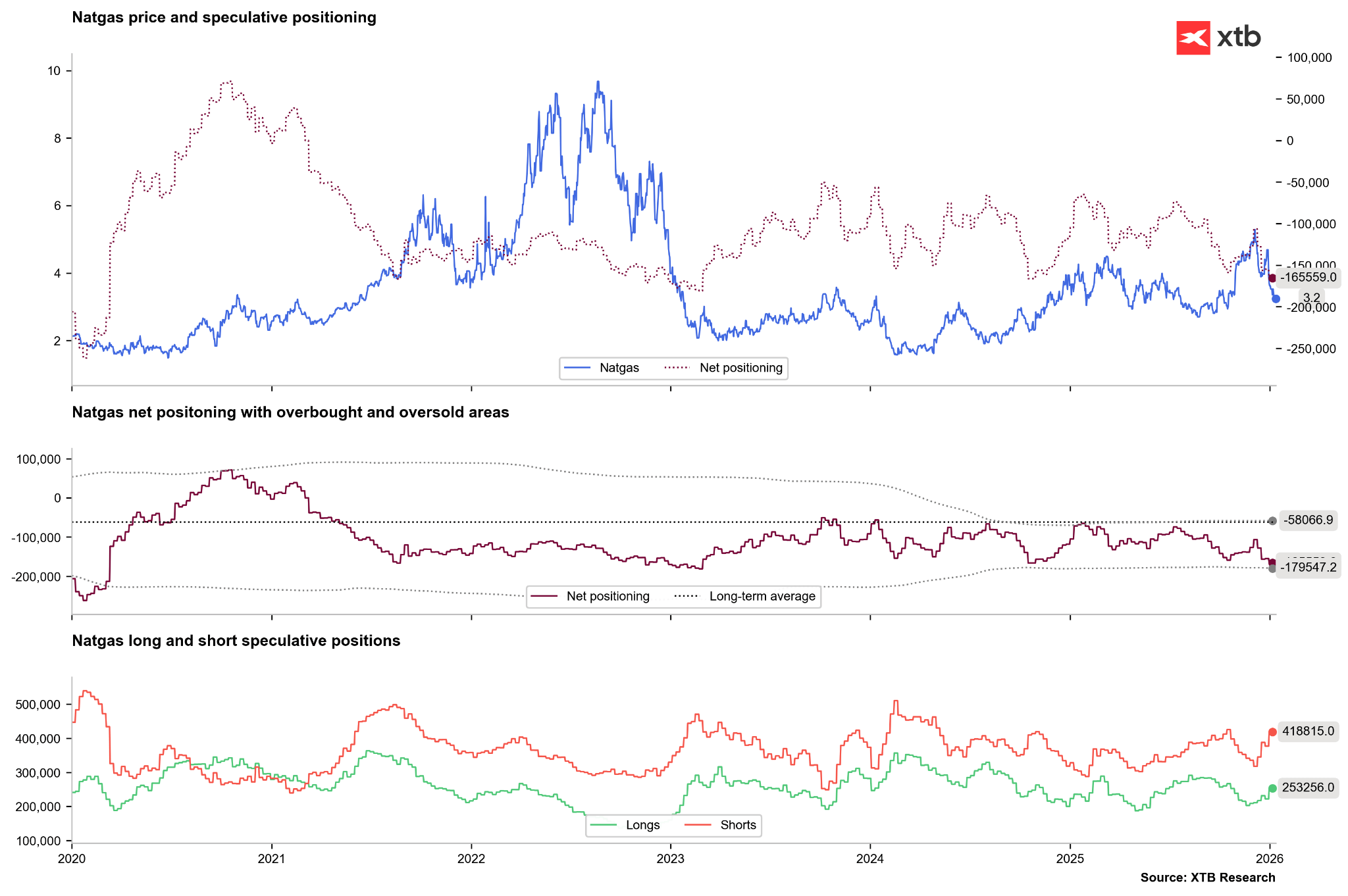

Speculative positioning in gas is falling sharply. Net positioning is nearing oversold levels last seen in late 2024—at that time, it served as a contrarian signal, though it coincided with a general decline in open interest. Currently, the situation is reversed, with both short and long speculative positions rising. Source: Bloomberg Finance LP, XTB

Speculative positioning in gas is falling sharply. Net positioning is nearing oversold levels last seen in late 2024—at that time, it served as a contrarian signal, though it coincided with a general decline in open interest. Currently, the situation is reversed, with both short and long speculative positions rising. Source: Bloomberg Finance LP, XTB

Silver

- Fed independence: Silver is reaching new record highs as the U.S. dollar faces risks from the erosion of Fed credibility. The DOJ has launched an investigation into Jerome Powell’s testimony regarding Fed building renovations—a move Powell described as a “pretext” for political pressure to resume rate cuts.

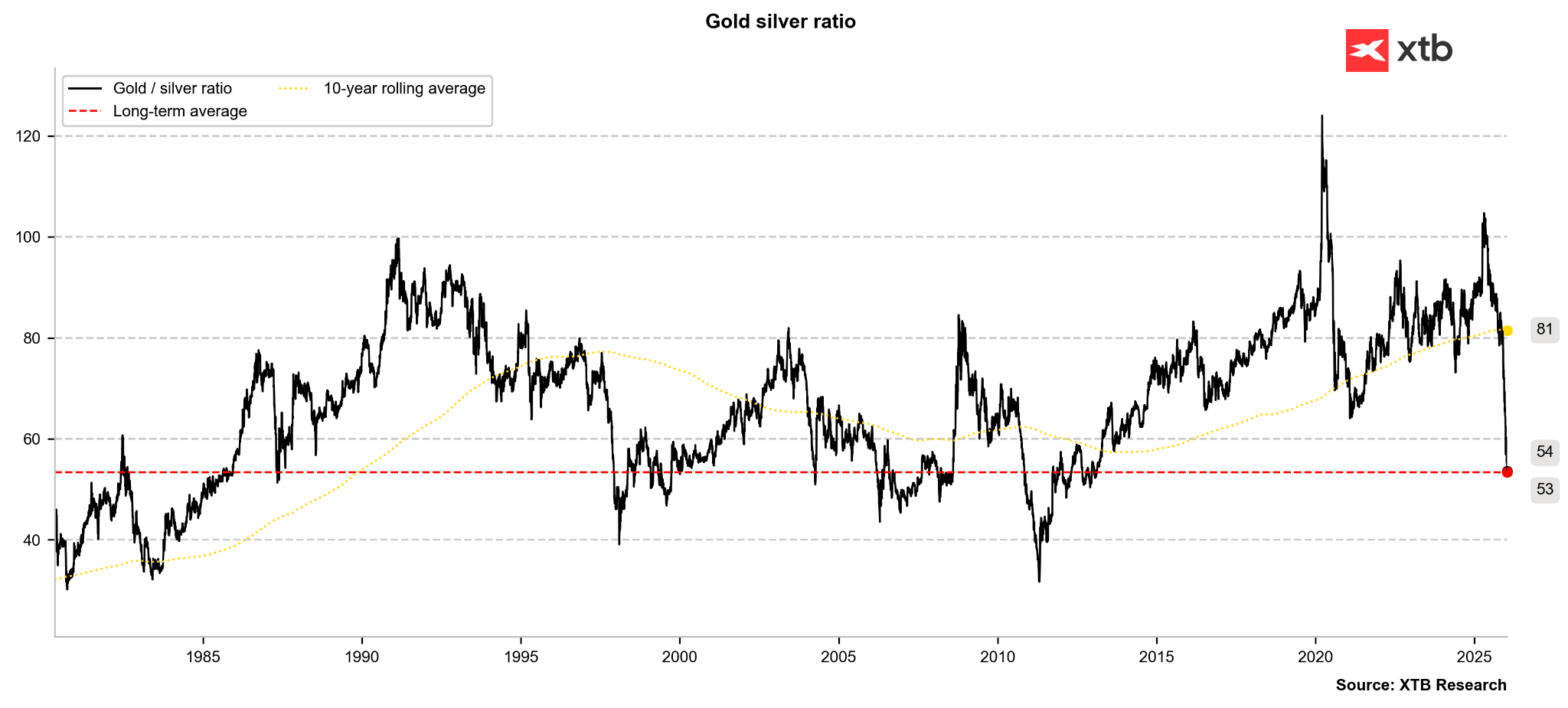

- Gold/Silver ratio: The ratio has dropped to 54 points, nearing its long-term average. Historically, during bull markets, this ratio has fallen significantly below the average. At a ratio of 40 and a gold price of $4,800, silver could reach $120/oz.

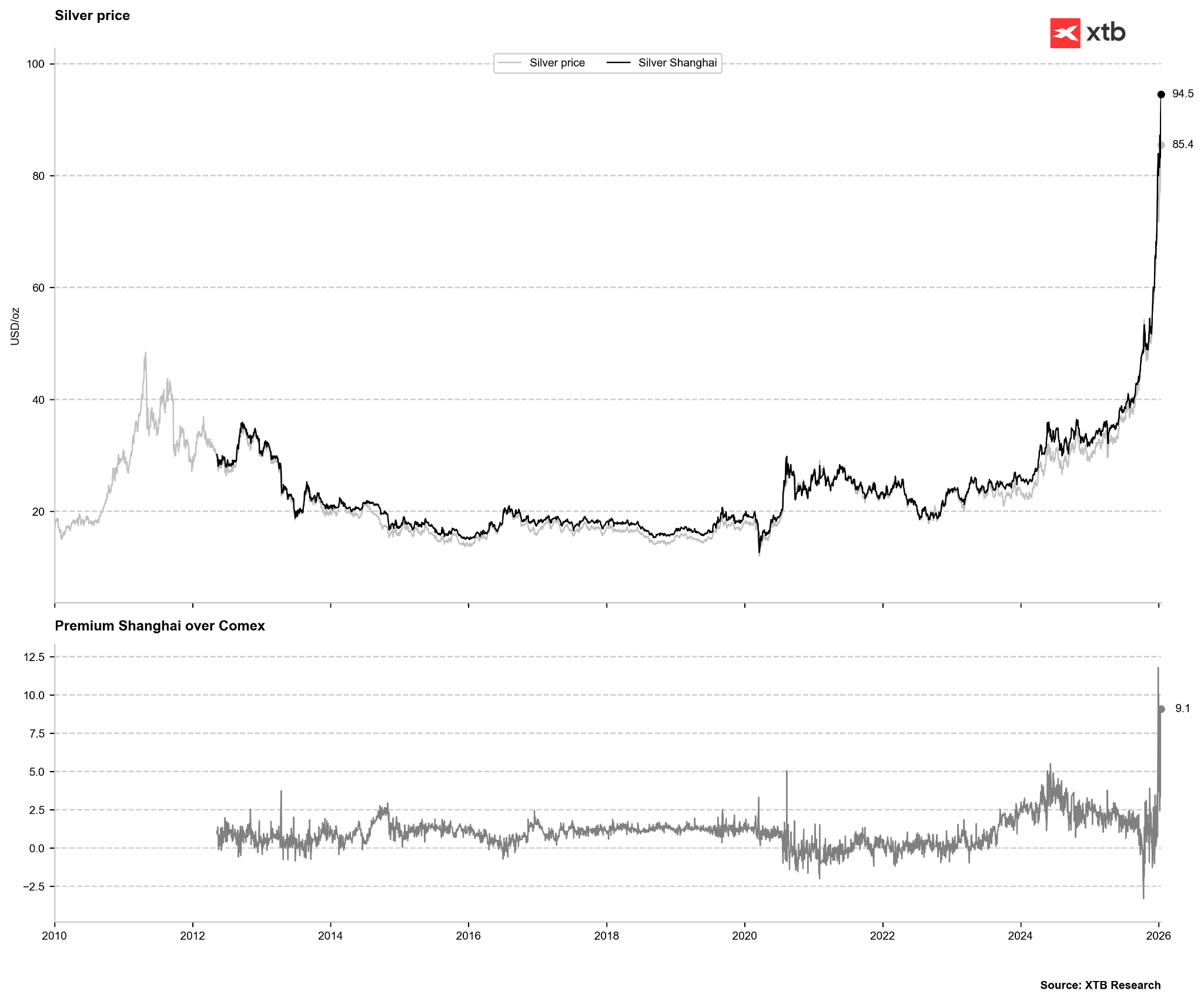

- Shanghai Premium: The premium on the Shanghai exchange compared to COMEX is rising sharply again. As long as the premium remains above $5, the price should be protected from major declines. A drop in the premium would signal a short-term decline in physical demand.

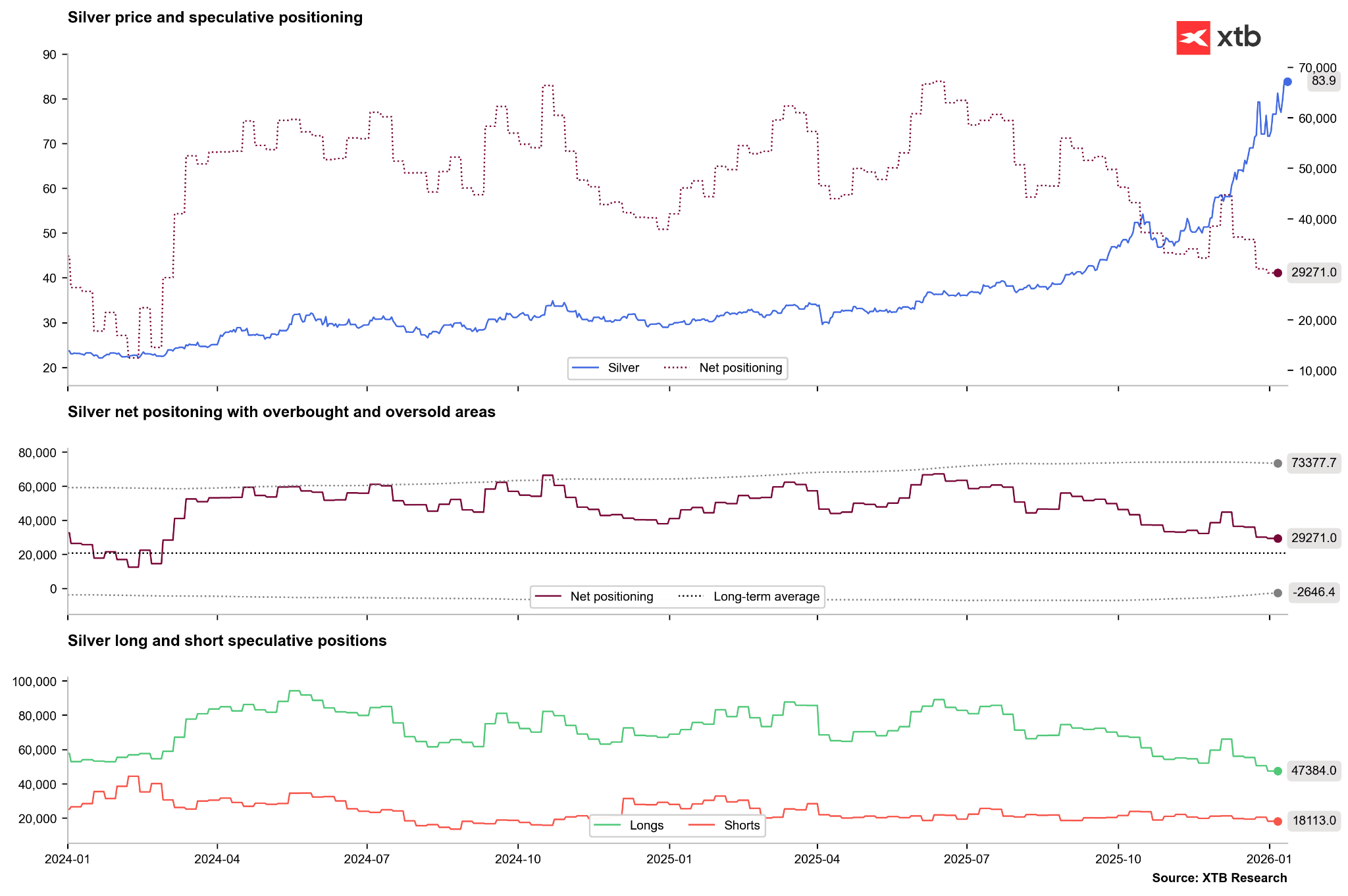

Long positions in silver have been reduced since November, suggesting that commodity index funds or swap providers front-loaded positions after the late-2025 index weightings were revealed. Net positions are now nearing the long-term average, potentially suggesting a trend reversal and a fresh influx of long positions. Source: Bloomberg Finance LP, XTB

Long positions in silver have been reduced since November, suggesting that commodity index funds or swap providers front-loaded positions after the late-2025 index weightings were revealed. Net positions are now nearing the long-term average, potentially suggesting a trend reversal and a fresh influx of long positions. Source: Bloomberg Finance LP, XTB

The price premium on the Shanghai Gold Exchange is rising to very high levels once again. Reaching $100/oz in Shanghai could serve as a short-term turning point for speculators. Source: Bloomberg Finance LP, XTB

The price premium on the Shanghai Gold Exchange is rising to very high levels once again. Reaching $100/oz in Shanghai could serve as a short-term turning point for speculators. Source: Bloomberg Finance LP, XTB

The gold-to-silver ratio is near its historical average, though it has moved lower during past precious metals bull markets. Source: Bloomberg Finance LP, XTB

The gold-to-silver ratio is near its historical average, though it has moved lower during past precious metals bull markets. Source: Bloomberg Finance LP, XTB

Cocoa

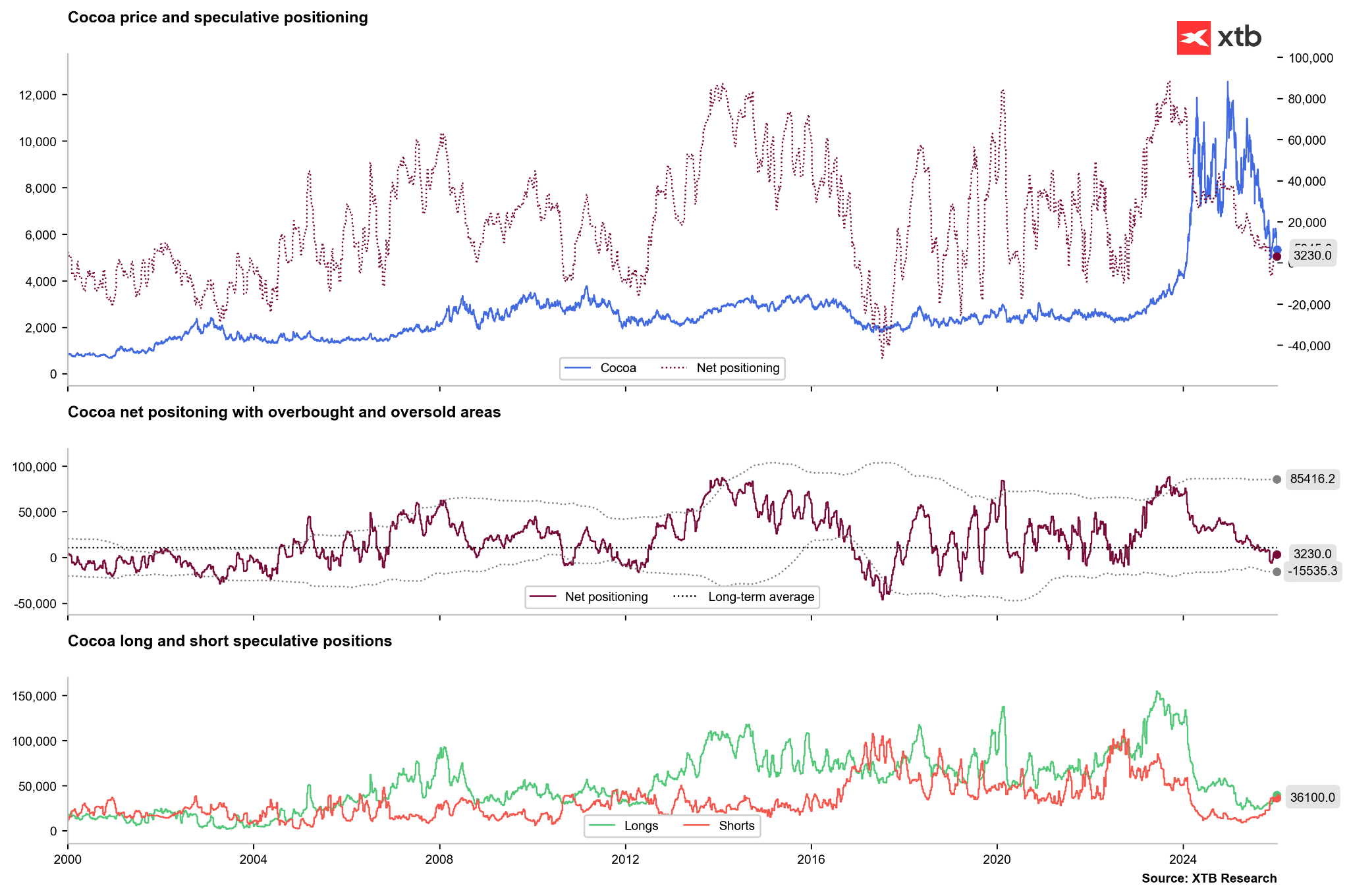

- Institutional buying: Cocoa had been supported by expectations of institutional ETF buying, with Citi estimating potential inflows of $2 billion. However, these assumptions were likely overestimated and spread over too many weeks.

- Flash crash: Prices fell 13% last Friday as speculators liquidated longs and exporters hedged at relatively high levels.

- Weather factors: After months of favorable conditions, Harmattan winds are now affecting crops in the western Ivory Coast. However, TGI Group suggests that overall good weather will likely lead to strong harvests in February and March.

- Demand watch: Critical cocoa processing data will be released this Thursday and Friday, offering a vital assessment of potential demand destruction.

Speculative long and short positions in cocoa have grown in recent months, but short positions have grown much faster. Cocoa remains extremely oversold, particularly on the London futures market. Source: Bloomberg Finance LP, XTB

Speculative long and short positions in cocoa have grown in recent months, but short positions have grown much faster. Cocoa remains extremely oversold, particularly on the London futures market. Source: Bloomberg Finance LP, XTB

The price saw a massive retracement on Friday due to speculative miscalculations. While fundamentals remain positive, there is a chance for a return toward the neckline of a potential inverse Head and Shoulders (oRGR) formation. Source: xStation5

The price saw a massive retracement on Friday due to speculative miscalculations. While fundamentals remain positive, there is a chance for a return toward the neckline of a potential inverse Head and Shoulders (oRGR) formation. Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.