Oil

- Oil prices remain elevated, even as the risk associated with US intervention in Iran has diminished.

- Concurrently, the United States is issuing guidance for tankers and other vessels to avoid maritime areas linked to Iran, most notably the Strait of Hormuz.

- The weakness of the US dollar is also providing a tailwind for the crude oil market.

- Theoretically, India’s pivot away from Russian crude will reduce available market supply, as additional Russian barrels will face difficulties in securing alternative outlets.

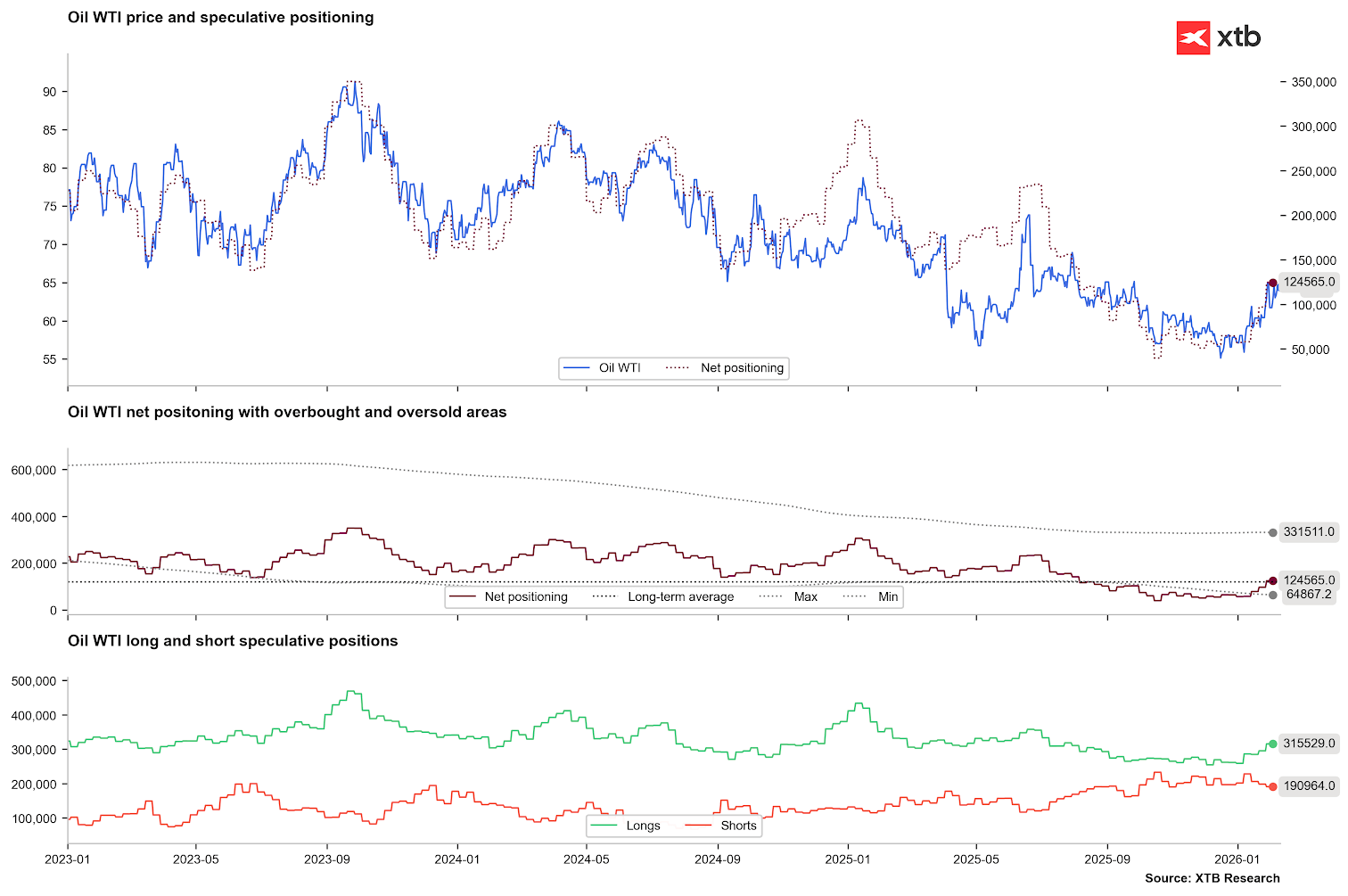

- Speculators have significantly increased their net long positions in oil. A similar trend was observed last June. This increased speculative positioning was driven by expectations of a potential geopolitical premium tied to the Middle East.

- Currently, the geopolitical premium in the oil market may range between USD 5 and USD 10 per barrel.

Oil positioning is rebounding sharply and is now nearing its long-term average. Crude had been extremely undervalued for an extended period. Source: Bloomberg Finance LP, XTB

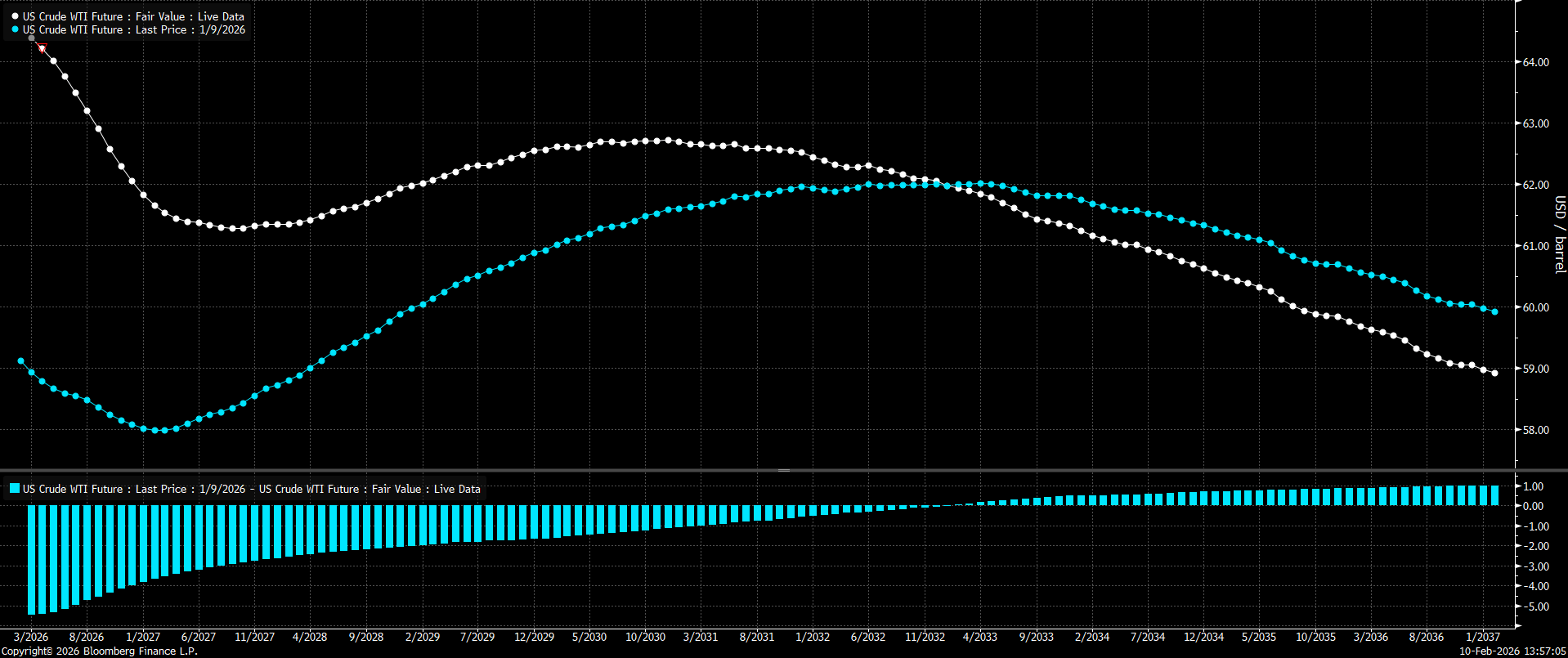

The forward curve remains in a distinct backwardation through October 2027. Furthermore, current spot prices are the highest across the entire curve, a shift from just one month ago. This indicates that despite expectations of a vast oversupply, the market is pricing in a significant geopolitical premium. Source: Bloomberg Finance LP

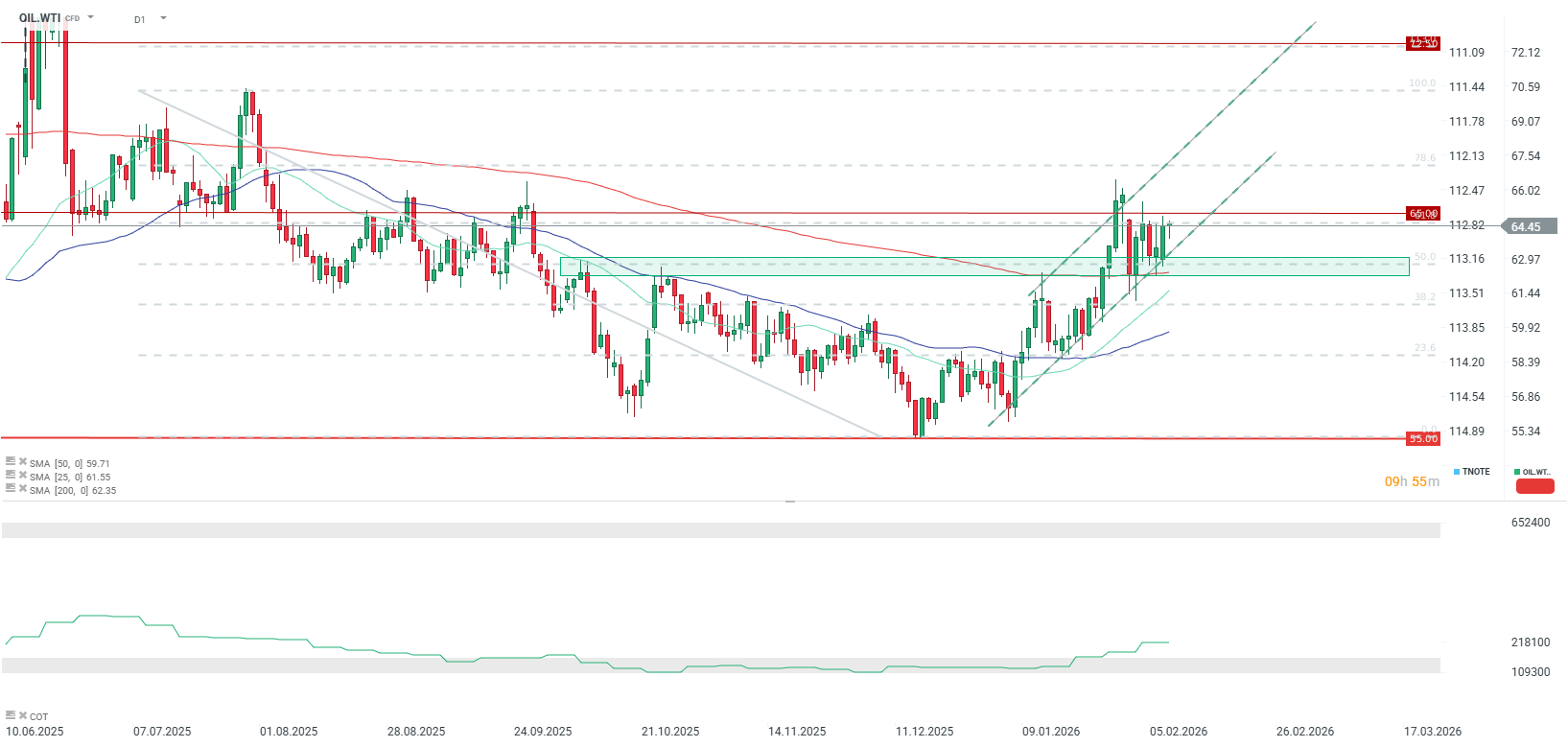

The price of crude oil remains at elevated levels but sits below USD 65 per barrel. Key support for the price is located at the USD 63 per barrel level. Source: xStation5

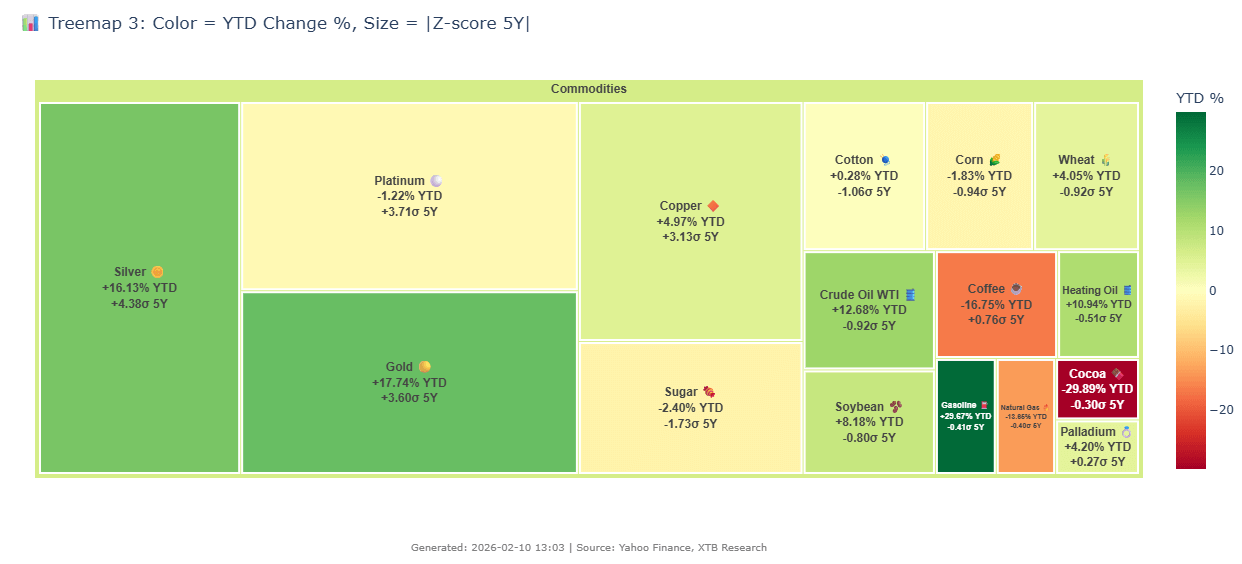

Silver

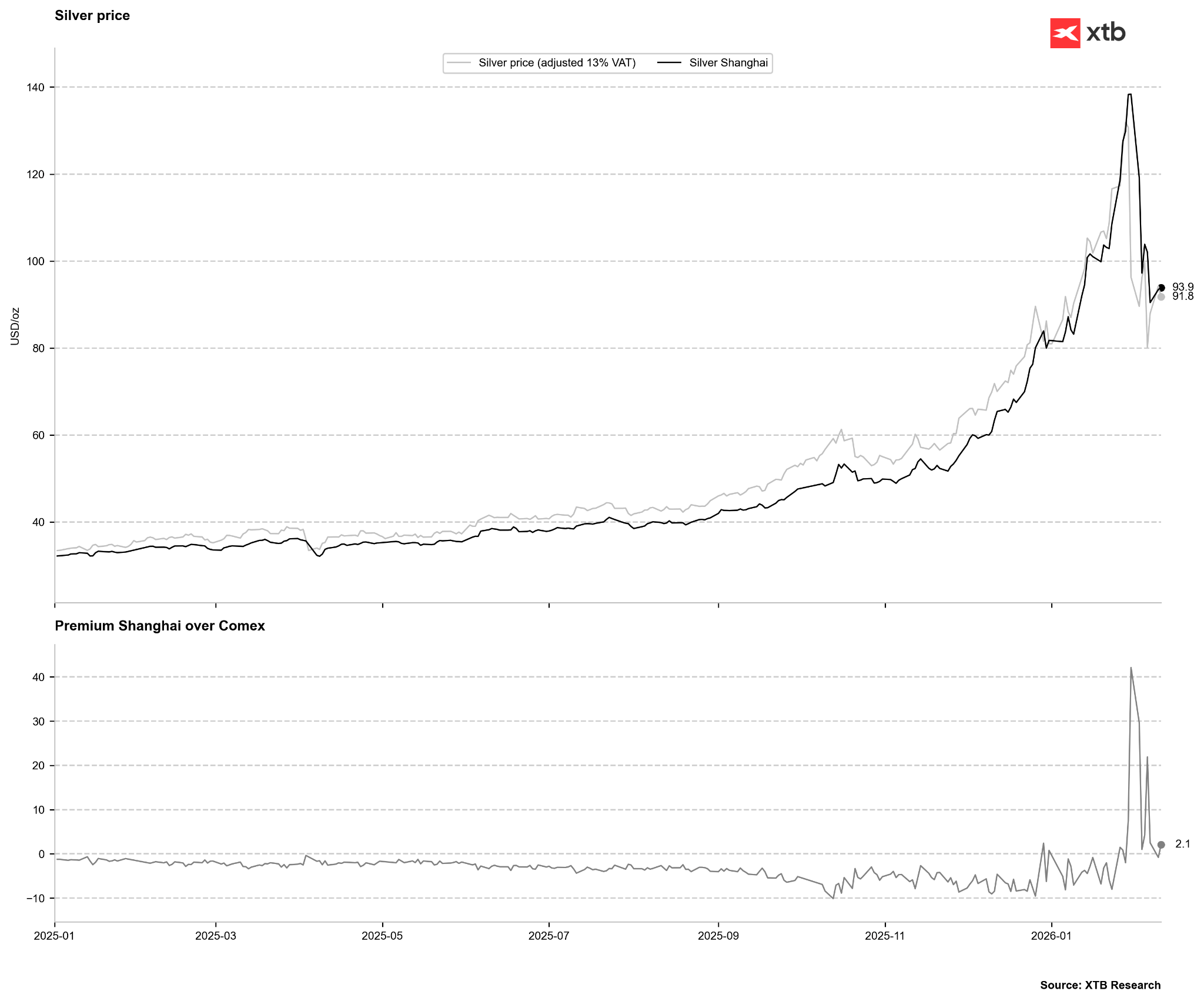

- Silver, unlike gold, has failed to neutralize 50% of its last major price correction and remains under pressure.

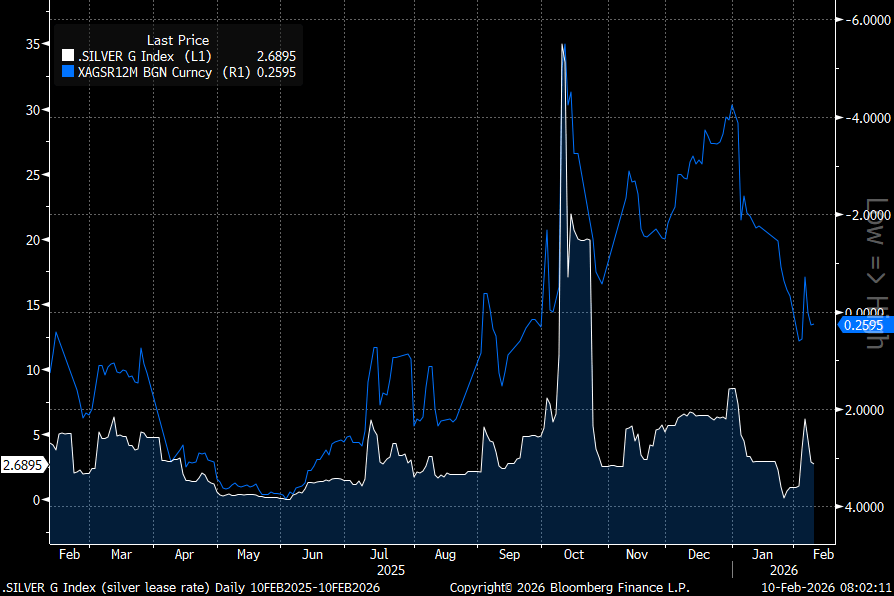

- Looking at the options market, silver is no longer in extremely overbought territory. We are again seeing a decline in lease rates, and the 12-month swap is returning to positive levels, meaning silver is trading higher 12 months out than it is today (investors are unwilling to pay a premium for immediate delivery, signaling a return to normal contango).

- Speculators have slightly reduced their short positions. Net positions are now close to the long-term average.

- Open Interest on the March contract is falling sharply, reflecting rolling into subsequent futures contracts. Approximately 30% of positions have already been reduced, significantly lowering the risk of massive deliveries from the March contract.

- Current expectations suggest that China is significantly curbing its demand for industrial metals (including silver) due to the Lunar New Year celebrations. The festivities begin on February 17 and are set to last until February 27, with a large portion of industrial plants expected to remain closed.

Silver borrowing rates have fallen significantly. The 12-month swap also indicates that the market is not paying a premium for current delivery versus future delivery (a return to normal contango—where future prices incorporate costs such as storage and insurance). Source: Bloomberg Finance LP, XTB

The tax-adjusted premium in China is now minimal. Additionally, the upcoming Lunar New Year celebrations in China may lead to reduced demand for metals for processing. Source: Bloomberg Finance LP, XTB

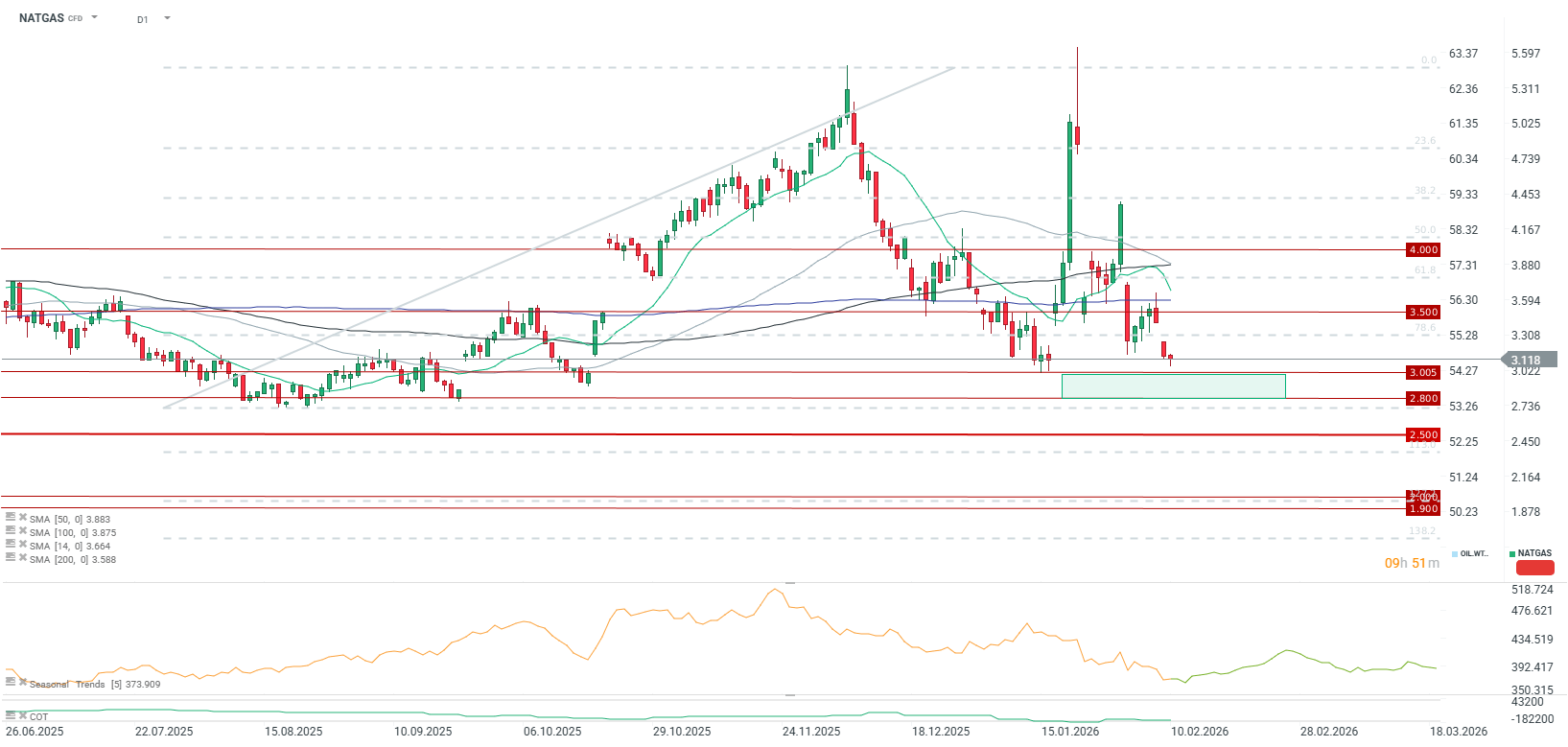

Natgas

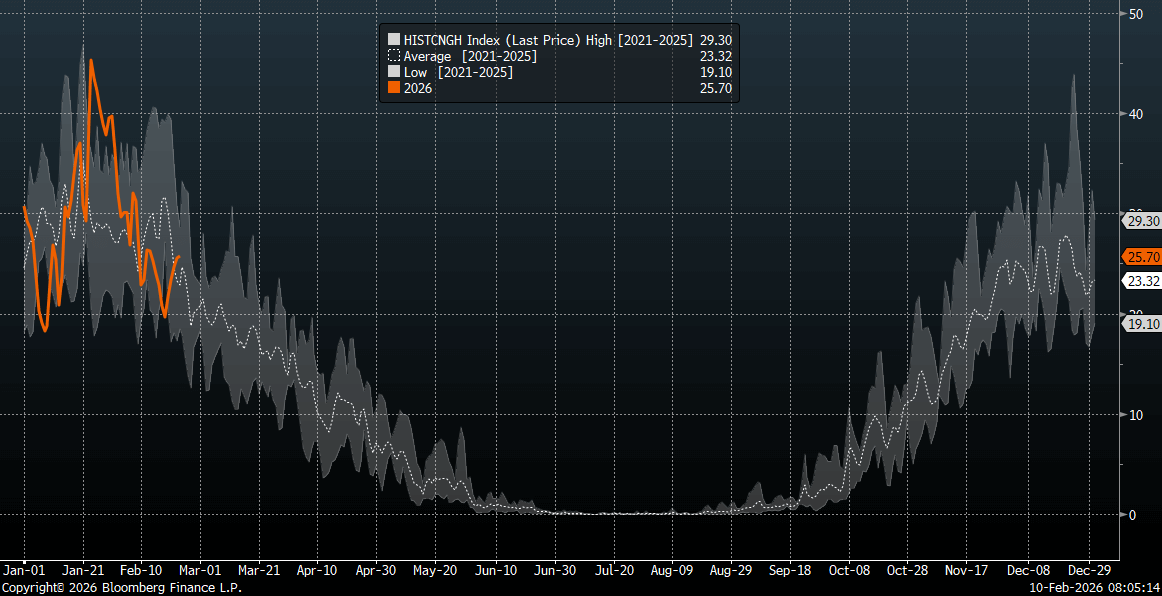

- Weather forecasts for February point to a marked rise in temperatures, suggesting that the Arctic winter blast in the US may be behind us.

- Higher temperatures are expected to persist until February 20, though the end of the month may turn slightly colder.

- The projected number of heating degree days for February 22 has returned above the 5-year average but remains within a downward trend.

- The gas-directed rig count has increased to its highest levels in 2.5 years, indicating further potential production growth in the coming months.

- Production at the start of this week reached 113.4 bcfd, up 2.2% year-on-year, showing that nearly all losses related to the recent cold snap have been recovered. Demand stood at 104 bcfd, up 3.3% year-on-year. LNG exports are nearing 20 bcfd.

- Inventories for the week ending January 30 fell by a substantial 360 bcf, though this was less than projected (market consensus pointed to a drop of up to 378 bcf). This decline exceeded the 5-year average, which indicated a drop of approximately 190 bcf. The coming weeks are expected to bring significantly smaller inventory draws, which could return stock levels to the 5-year average.

The number of heating degree days through most of February is expected to be much lower than the 5-year average, pointing to potentially lower gas consumption for heating purposes. Source: Bloomberg Finance LP

The price remains above important support at USD 3.0/MMBTU. The key support zone lies around USD 2.8-3.0/MMBTU. If the weather improves more aggressively in the coming weeks, downward pressure could push prices toward USD 2.5/MMBTU. Another winter blast could trigger a price spike into the USD 3.5-4.0/MMBTU range. Source: xStation5

Soybeans

- Heavy rainfall in Brazil has caused crop losses across several agricultural commodities, including soybeans.

- The prospect of drought in the United States, particularly in the Midwest, is weakening the outlook for crops such as soybeans and corn.

- Expectations for the 25/26 season suggest that the oversupply in the soybean market will persist for a fourth consecutive year, though it will be minimal. Worsening weather in the US and South America could mean the subsequent 26/27 season brings a decline in inventories.

- Although China began purchasing US soybeans last year, Brazil continues to dominate the export market, accounting for up to 60% of the total market.

- Recent data indicate that the Brazilian harvest is progressing more slowly than usual. Up to 30% of crops may also face quality issues (mold, damage, excessive moisture).

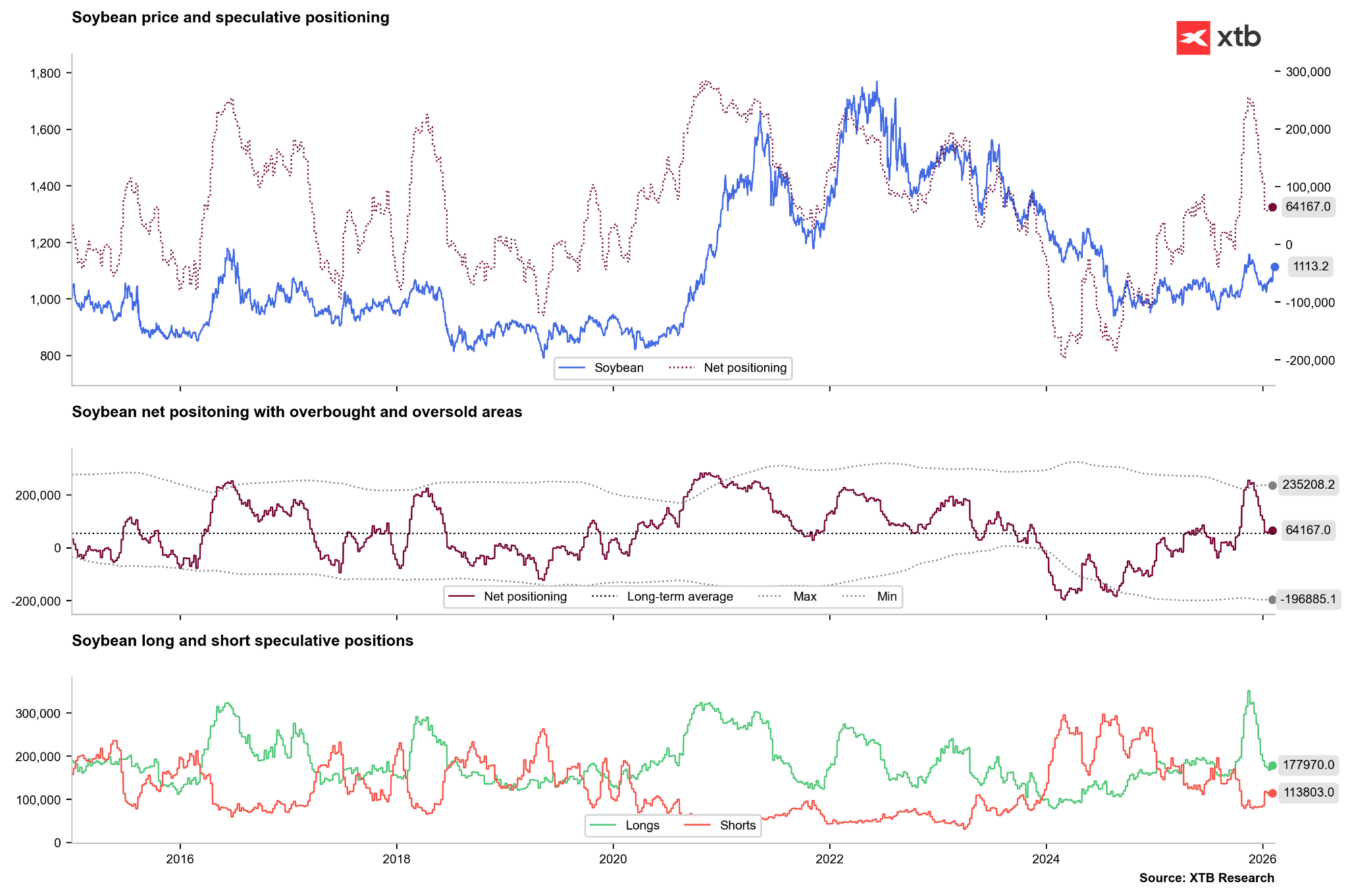

- Speculative investors have sharply reduced their long positions in soybeans, following disappointment over smaller-than-expected Chinese purchases of US beans.

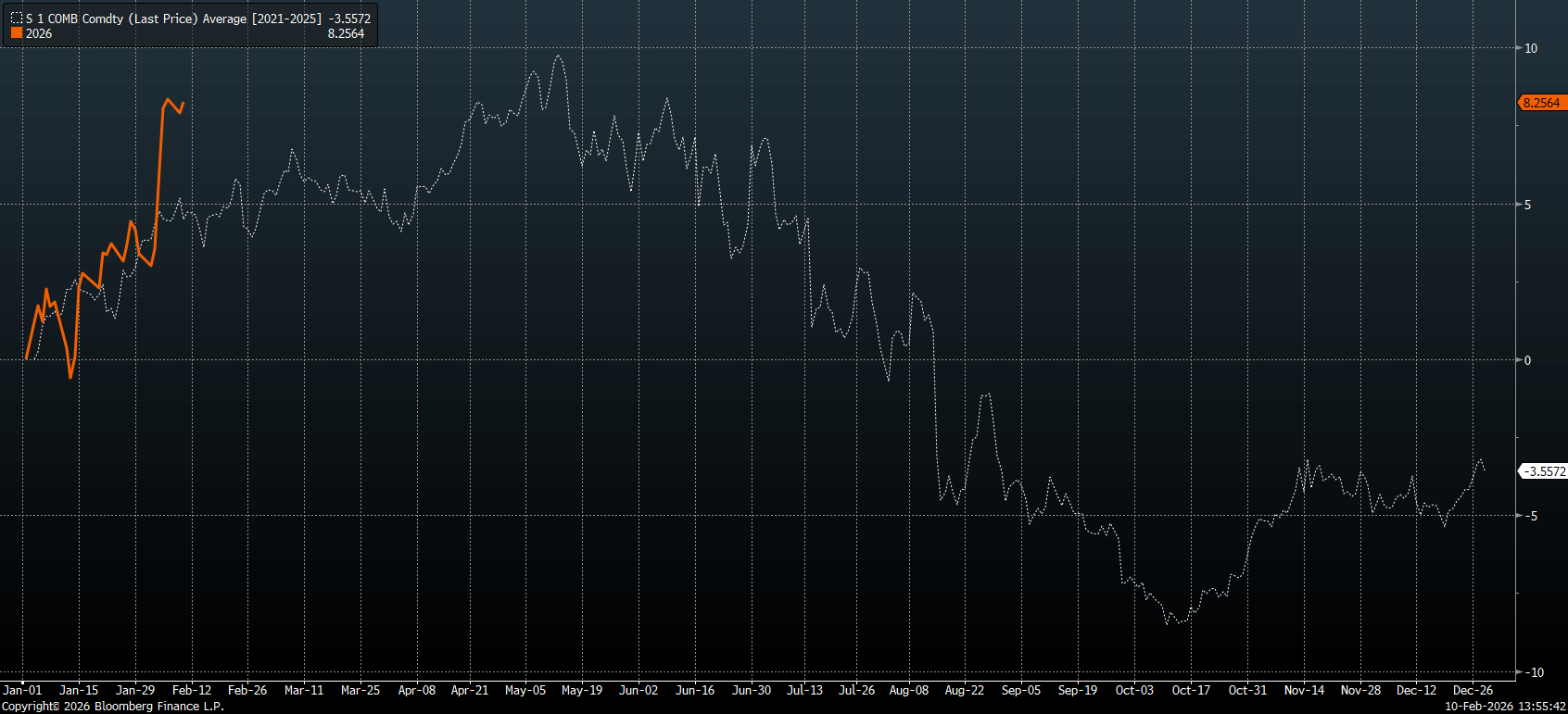

Soybeans remain one of the stronger markets this year in terms of return, excluding precious metals. However, soybeans remain below average levels of the last 5 years, meaning the market can still be viewed as significantly oversold. A potential rebound in oil prices could also drive up prices for commodities linked to biofuels. Source: Yahoo Finance, XTB

Speculators have markedly reduced long positions in soybeans following disappointment with Chinese purchases in 2025. Net positions are currently at the long-term average, and the number of long positions has returned to 2024/2025 levels. Source: Bloomberg Finance LP, XTB

Soybean prices have behaved in line with seasonality at the start of this year, but recent news of harvest weakness in Brazil has led to a distinct price increase. Source: Bloomberg Finance LP

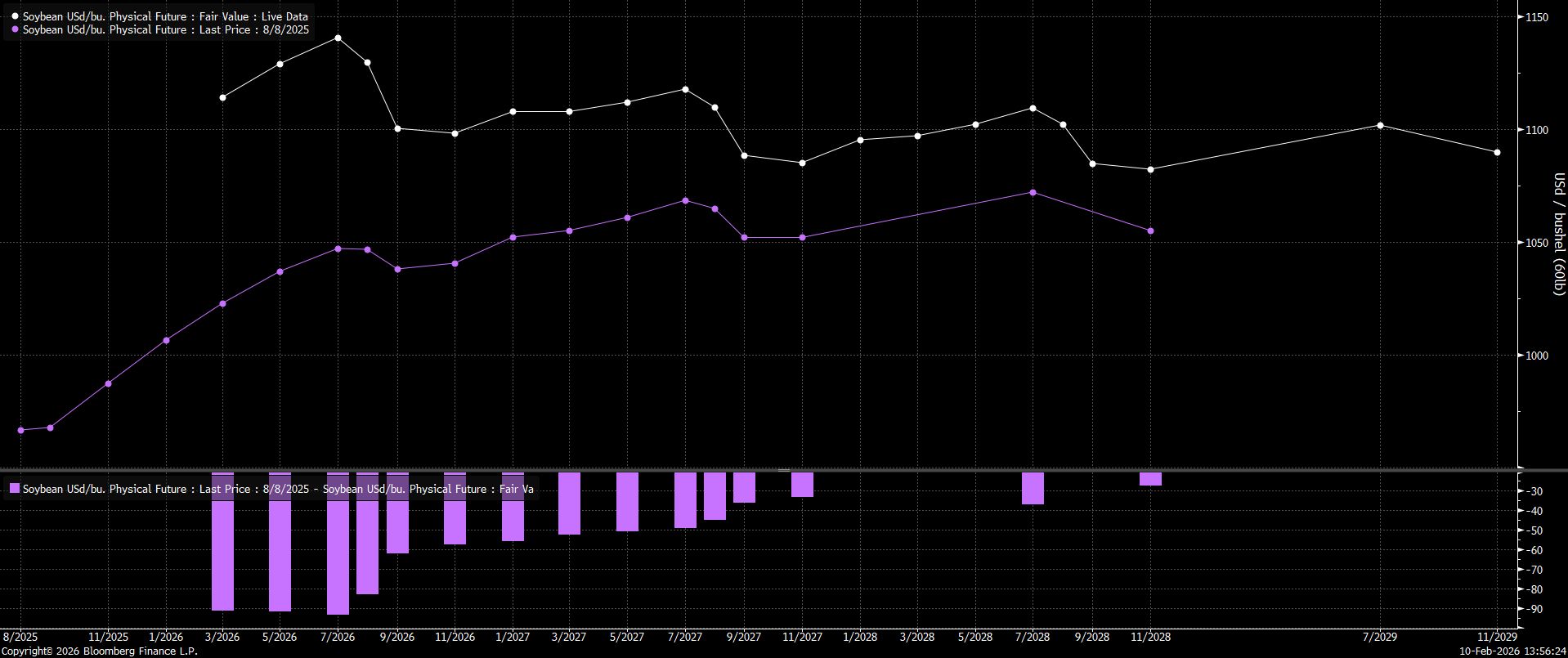

The price is in a minimal contango through July, followed by a slight backwardation. However, the forward curve from six months ago indicated much higher commodity availability in the market than is currently the case. Source: Bloomberg Finance LP, XTB

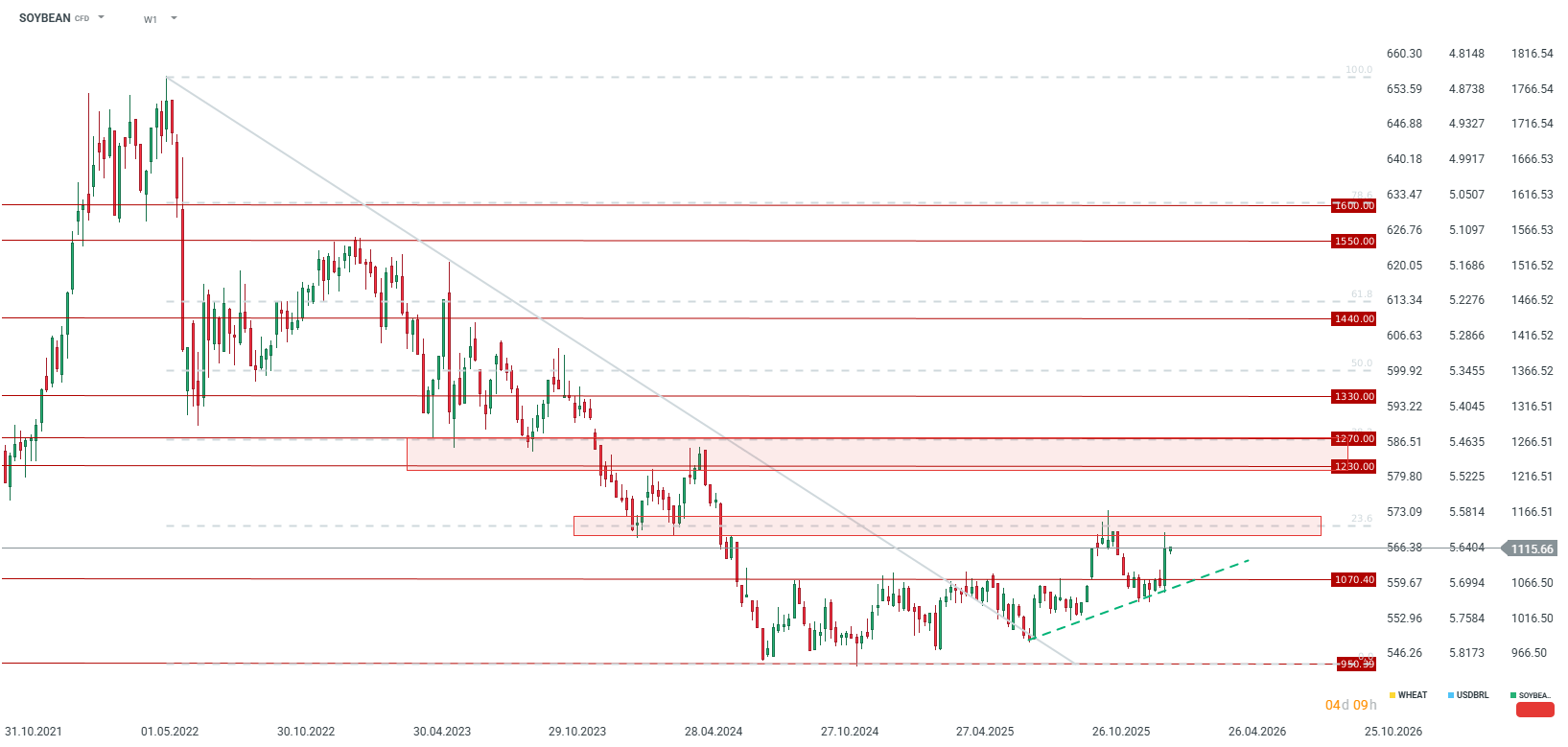

Prices rebounded strongly last week, and upward pressure continues. The price may react with increased volatility due to rolling and the publication of the WASDE report. Nevertheless, a sustained break above the zone associated with the 23.6 retracement could provide the impetus for a continued upward move toward the resistance zone between 1230 and 1270 cents per bushel. Currently, key support is located at 1070 cents. Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.