Commodity Talk – Oil, Cocoa, Silver And Gold

Crude Oil:

- Crude oil has come under significant pressure due to a de-escalation in the Middle East and the prospect of a renewed trade war between China and the US.

- Donald Trump threatened to raise tariffs on Chinese products to 100% in response to new export regulations concerning rare earth metals. Although communication softened before the start of the new week, markets remain uncertain about the future of US-China trade relations.

- China is significantly increasing its exports in every direction except the US, while trade between the US and China has seen a double-digit decline in the past two months, also pointing to reduced demand for oil.

- It is also suggested that China has already substantially replenished its strategic reserves, meaning demand from the country may remain limited in the coming months.

- Despite the reduction in Middle Eastern tensions, the war between Ukraine and Russia continues, and President Trump is considering supplying Ukraine with long-range Tomahawk missiles.

- Ukraine has recently carried out a series of attacks on oil infrastructure in Russia, which has disabled up to 40% of the country’s processing capacity.

- OPEC+ recently agreed to another production increase of 137k barrels per day in November. However, Goldman Sachs believes that some countries, such as Russia and Iran, will be more flexible in raising production, considering recent problems.

- OPEC production in September reached 29 million barrels per day, the highest level in 2.5 years. According to IEA data, production reached nearly 29.5 million barrels per day.

- The IEA slightly revises its demand forecast for this year down by 0.1 million barrels per day to 103.8 million barrels per day. Demand is also revised down for next year to 104.5 million barrels per day (a 0.1 million barrels per day cut). Growth in 2026 compared to 2025 is projected to be a modest 0.7 million barrels per day.

- The IEA believes that the demand for OPEC crude oil in 2026 will be 0.8 million barrels per day lower than in 2025.

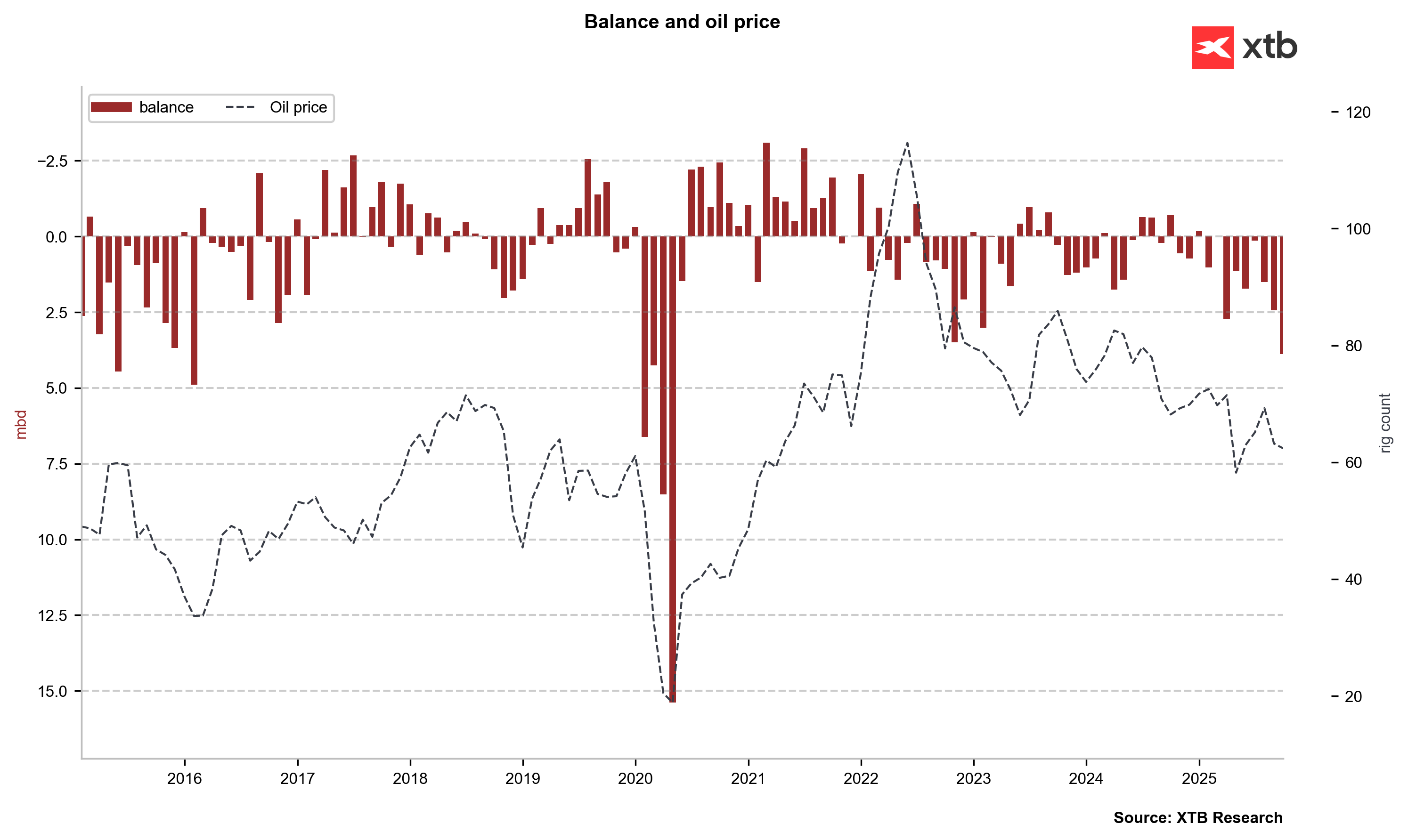

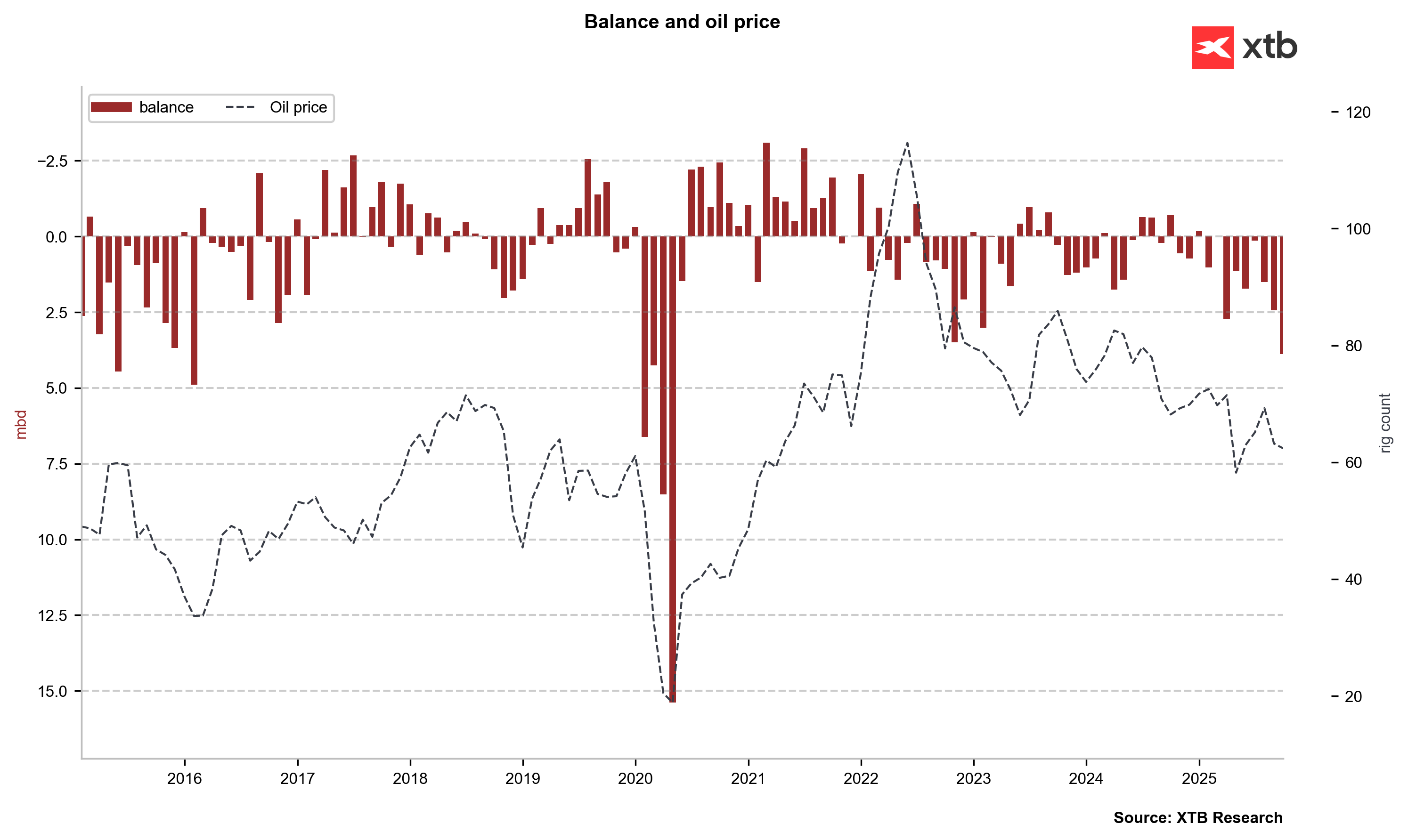

Production in the US rises to new historical highs, despite the decline in the number of drilling rigs and low prices. Source: Bloomberg Finance LP, XTB

The current oversupply in the crude oil market is growing strongly and will increase in the coming months unless demand revives or supply collapses, e.g., from Russia. Source: Bloomberg Finance LP, XTB

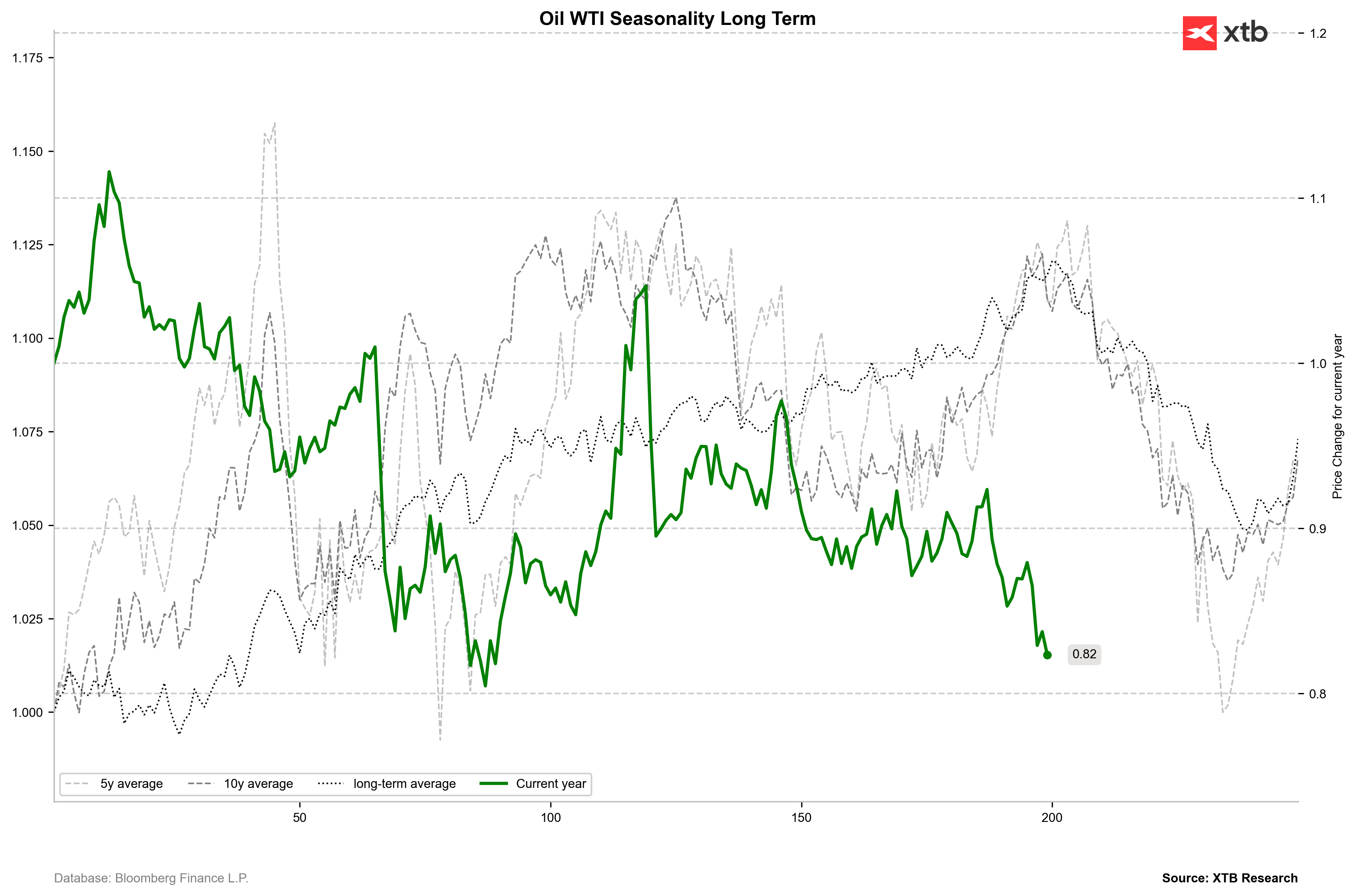

Seasonality indicates that we should currently be at the price peak, while the coming weeks should bring a sell-off. Source: Bloomberg Finance LP, XTB

Gold:

- The rise in gold prices is currently motivated by significant uncertainty regarding the future of international trade between the US and China.

- Additionally, the market is attempting to hedge against a potential return to correction in the equity market.

- Gold is also driven by expectations for interest rate cuts from the Fed. Although the market prices in a high probability of two cuts, a change in communication from the Fed could lead to a sharp correction.

- Most forecasts point to prices reaching as high as $5,000 next year.

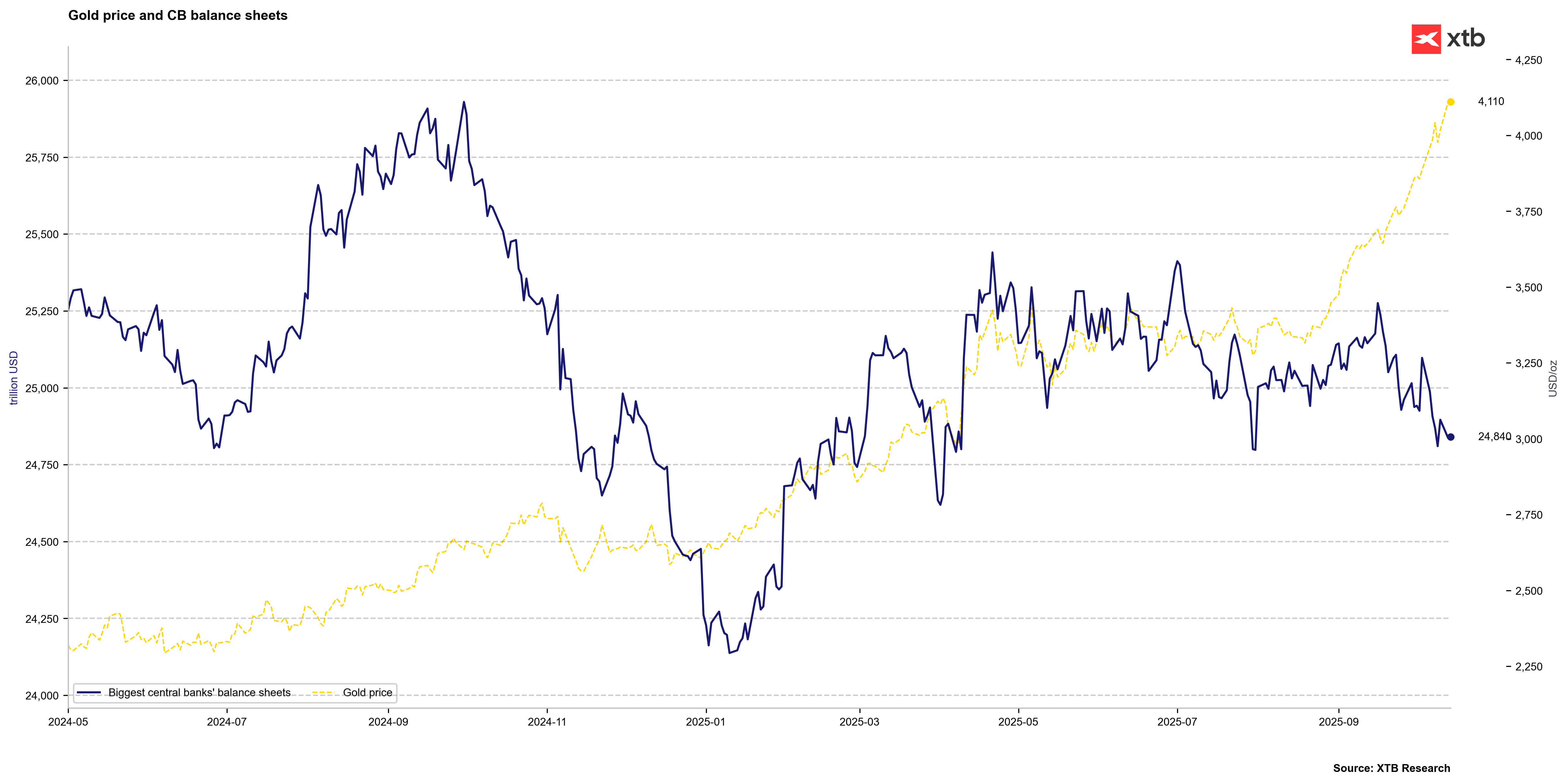

Recently, we have observed a clear decrease in the balance sheets of the 4 largest central banks in the world. Although this is not necessarily a negative factor, considering the prospect of interest rate cuts, it should be noted that the growth phase at the beginning of this year was related to the loosening of the monetary situation. Source: Bloomberg Finance LP, XTB

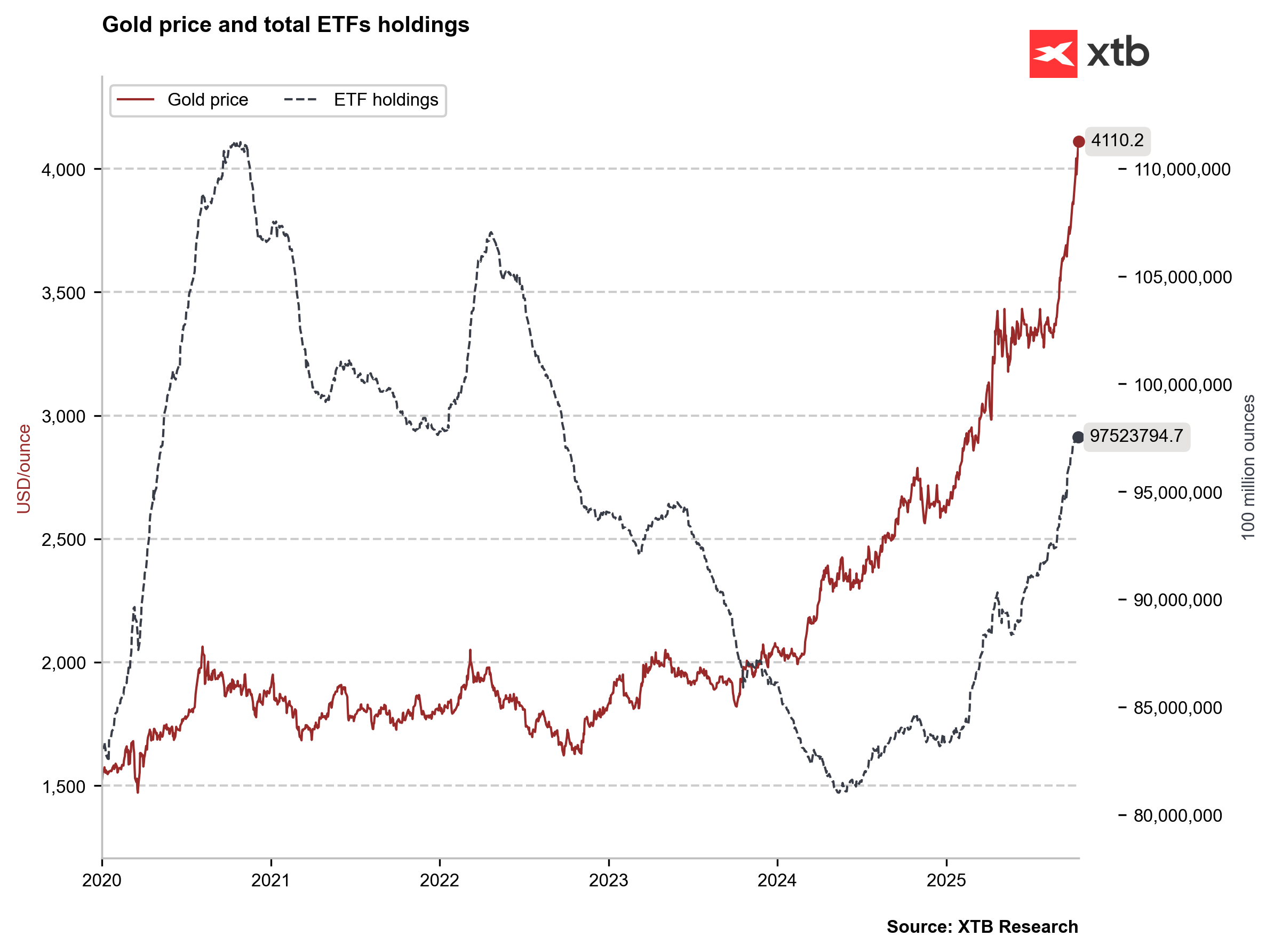

ETFs continue to purchase gold at a very high pace, although at a slightly slower rate than the record year of 2020. The behaviour of ETFs will be an important signal for the continuation of the uptrend or a correctional signal. Source: Bloomberg Finance LP, XTB

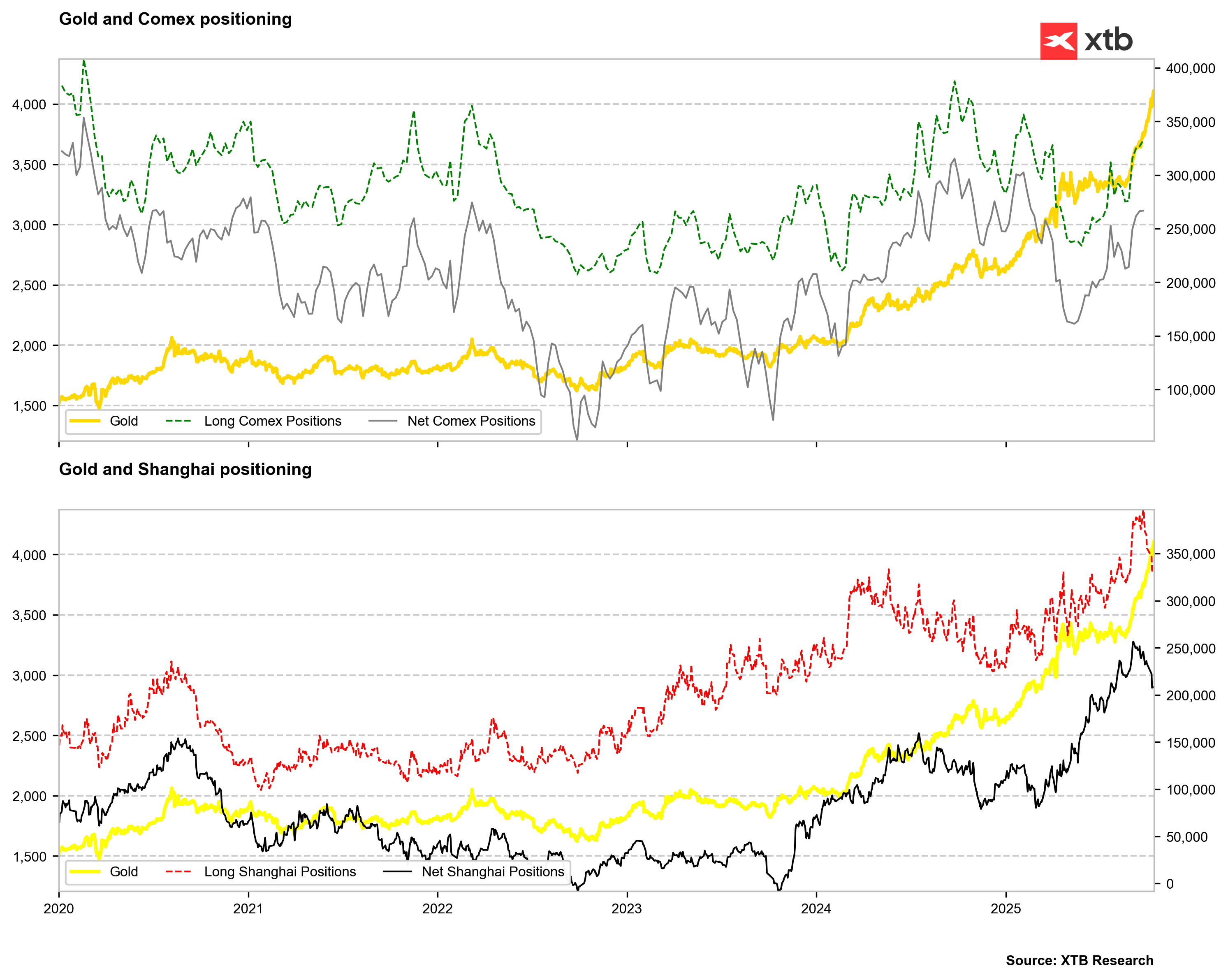

China continues to reduce long speculative positions. CFTC data is unavailable due to the government shutdown. Source: Bloomberg Finance LP, XTB

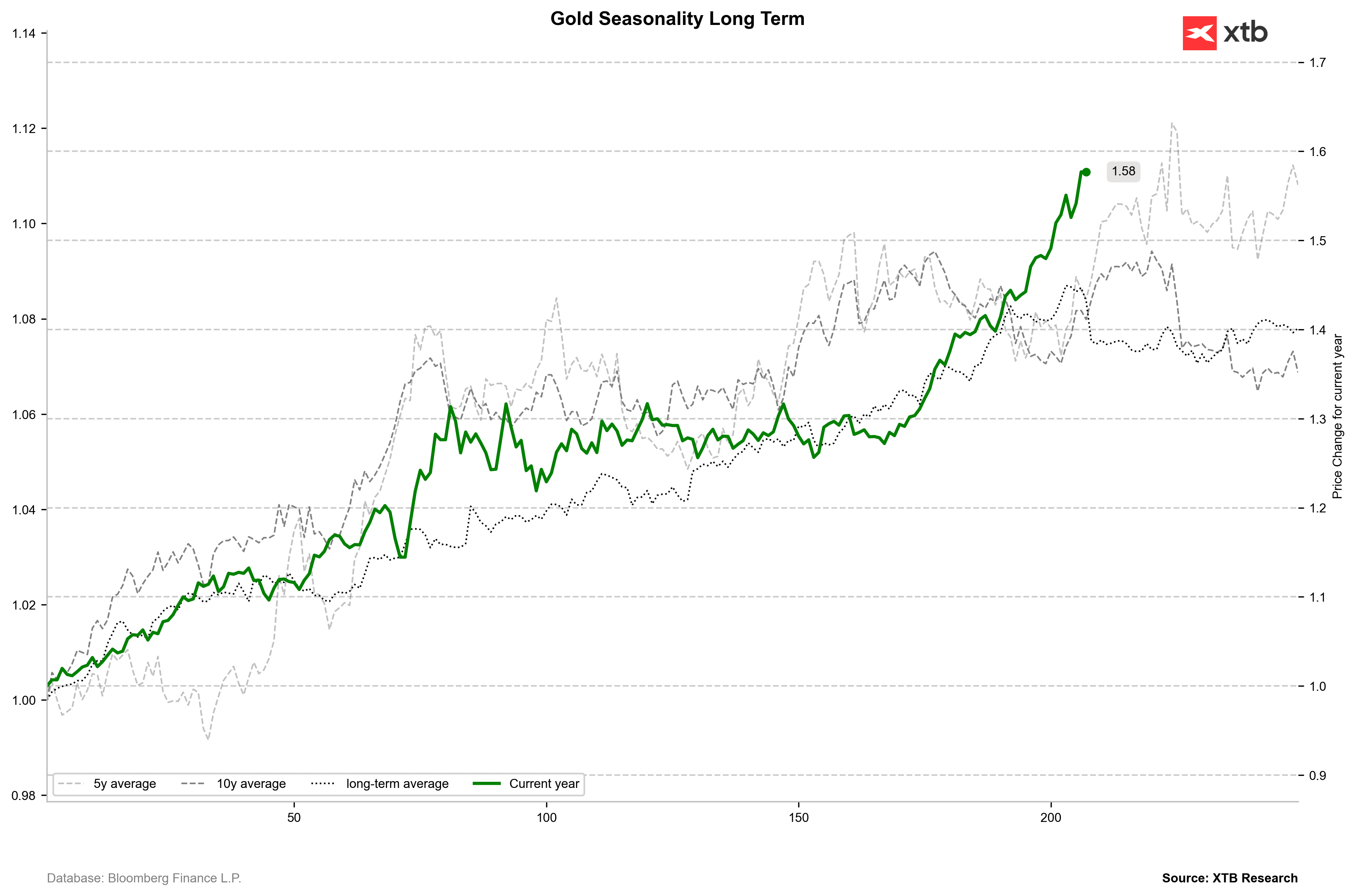

5- and 10-year seasonality indicates possible local peaks around the 220th market session of the year. Source: Bloomberg Finance LP, XTB

5- and 10-year seasonality indicates possible local peaks around the 220th market session of the year. Source: Bloomberg Finance LP, XTB

Silver:

- Silver, along with gold, is hitting new historical highs, at one point increasing the year-to-date gain to almost 70% (looking at futures contracts).

- Silver is having a highly volatile start to the day, suffering a 6% correction from the $53 per ounce level, which was later neutralised.

- The current surge in silver is linked to a lack of liquidity in the market, particularly in the UK, where there is a scarcity of physical silver for delivery.

- Borrowing rates for silver against futures contracts are rising to 30% per month, which is also driving a short-squeeze in the market.

- Bank of America anticipates a price of $65 next year along with gold rising to $5,000 per ounce. Goldman Sachs warns against volatility and a potential stabilisation, which could be related to the return of physical silver from New York to London.

- Silver is vulnerable to double-digit percentage drops in the event of a correction in gold, which would be possible with a decrease in risk, such as the resumption of US government work, an agreement between the US and China on trade, and a reduction in the chances of two Fed rate cuts this year.

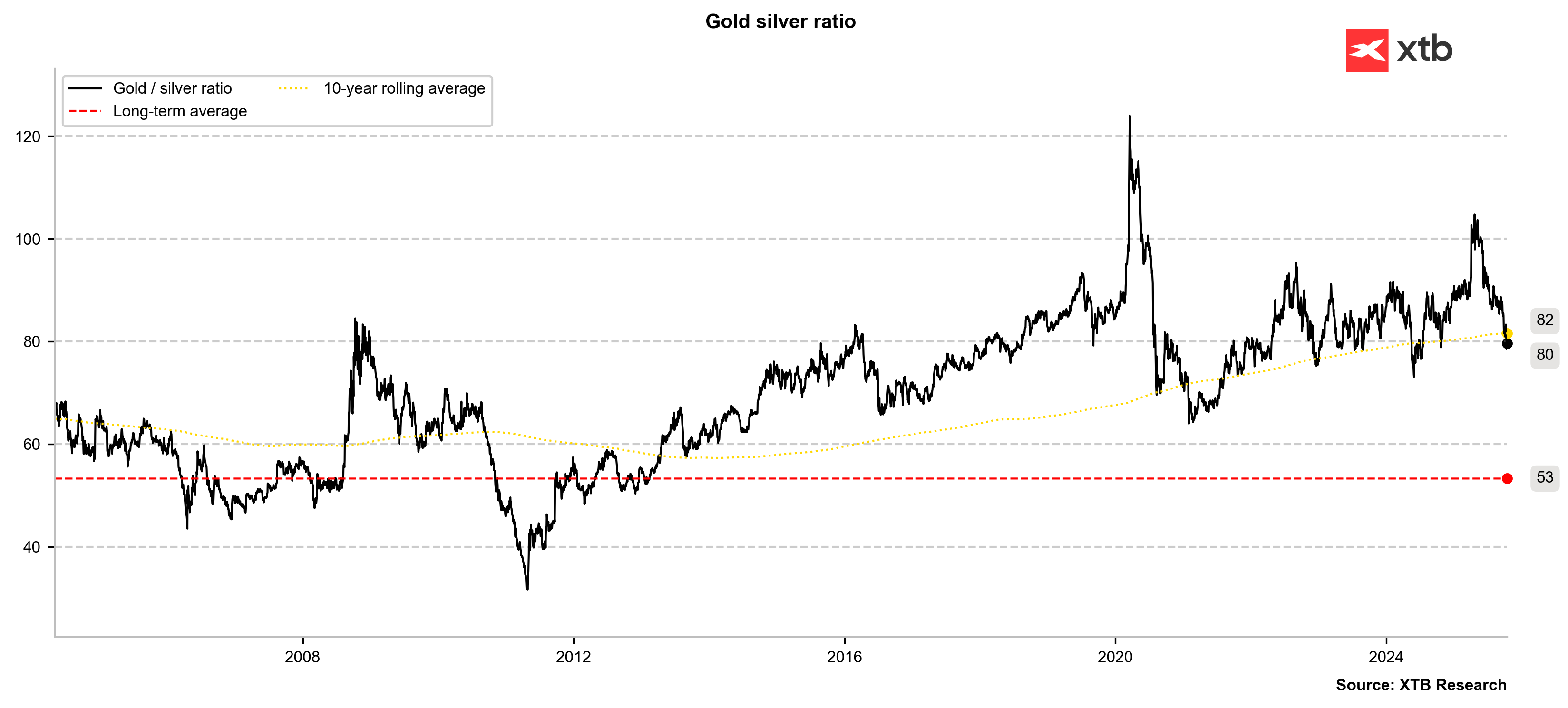

- The gold-to-silver price ratio remains below the 10-year moving average, which may indicate a chance for a continuation of the stronger uptrend in silver. Nevertheless, in the last 4 years, a rebound from the vicinity of 78–80 points has often occurred, bringing larger corrections in silver.

The gold-to-silver price ratio remains below the 10-year moving average, which may indicate a chance for a continuation of the stronger uptrend in silver. Nevertheless, in the last 4 years, a rebound from the vicinity of 78–80 points has often occurred, bringing larger corrections in silver. Source: Bloomberg Finance LP, XTB

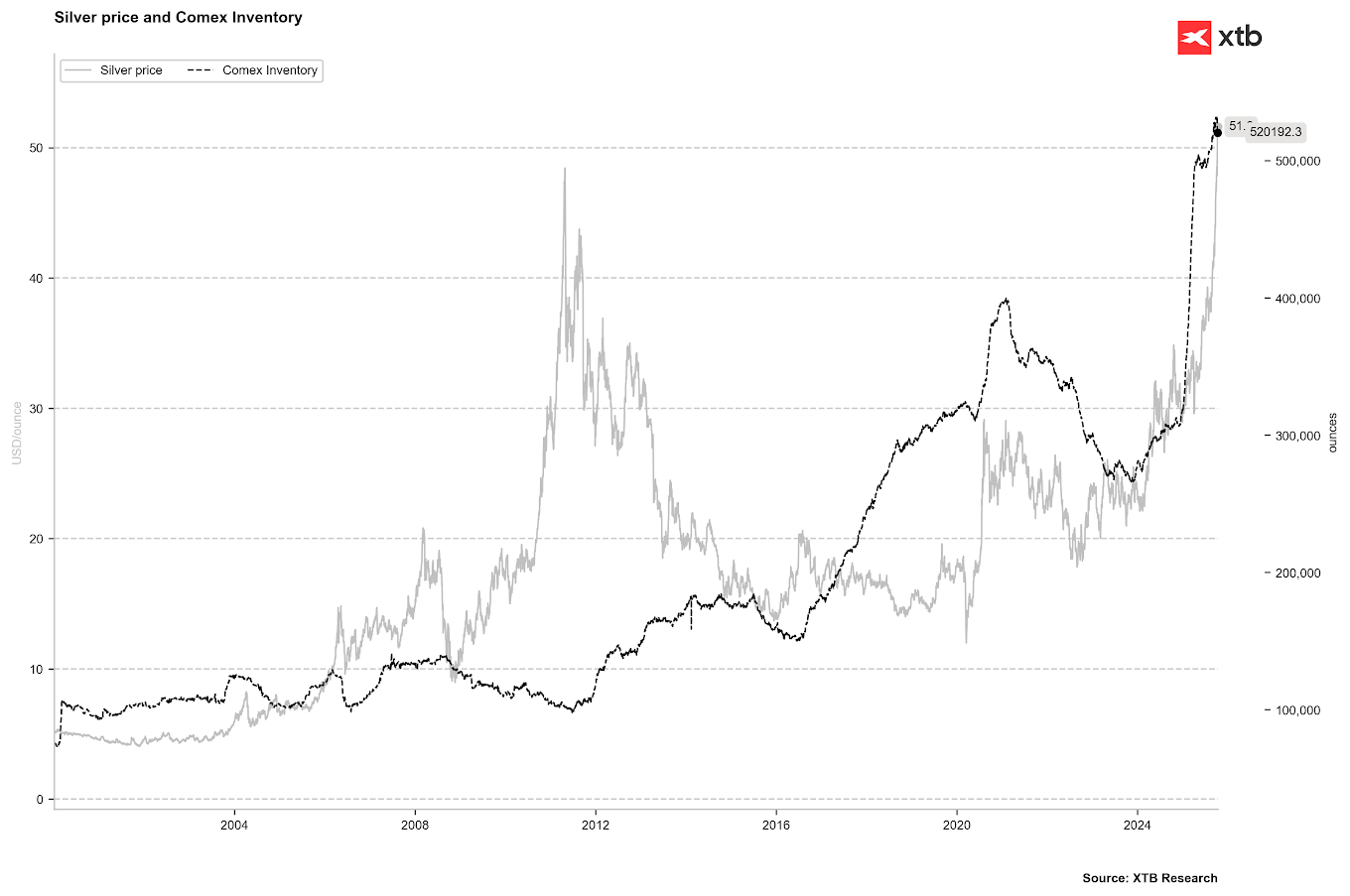

Silver inventories on COMEX have started to be minimally reduced. If there is a larger return of the metal from New York to London, market liquidity may improve. Source: Bloomberg Finance LP, XTB

ETFs continue to buy silver, although the momentum of increase is less than in 2020. Source: Bloomberg Finance LP, XTB

Cocoa:

- Cocoa prices remain under pressure due to expectations regarding the current season, although the initial data from Côte d’Ivoire do not look promising.

- Cocoa arrivals between October 1–11 amounted to 48.7 thousand tonnes, compared to 100.2 thousand tonnes last year. Although this is only the beginning of the season, these figures point to a mixed supply situation. However, a recent report from Mondelez indicated that the number of cocoa pods is 7% higher compared to the 5-year average and significantly higher than last year.

- Extremely large short positions are being maintained in London cocoa. In the week ending October 7, the number of net short positions doubled.

- This week, we will learn the Q3 cocoa processing data, and the figures are expected to show negative changes in demand.

- Companies such as Lindt and Barry Callebaut are lowering their sales forecasts for this year.

- The weather in West Africa remains very good, which supports cocoa cultivation.

Cocoa is already extremely oversold compared to the 1-year average, deviating by more than 2 standard deviations. Cocoa was more oversold only in 2017 and 2022. The price is also approaching the 5-year average. Source: Bloomberg Finance LP, XTB

The price is at a point where a local trough was usually set before a rebound at the end of the month. The ultimate time for a rebound is the end of October. Source: Bloomberg Finance LP, XTB

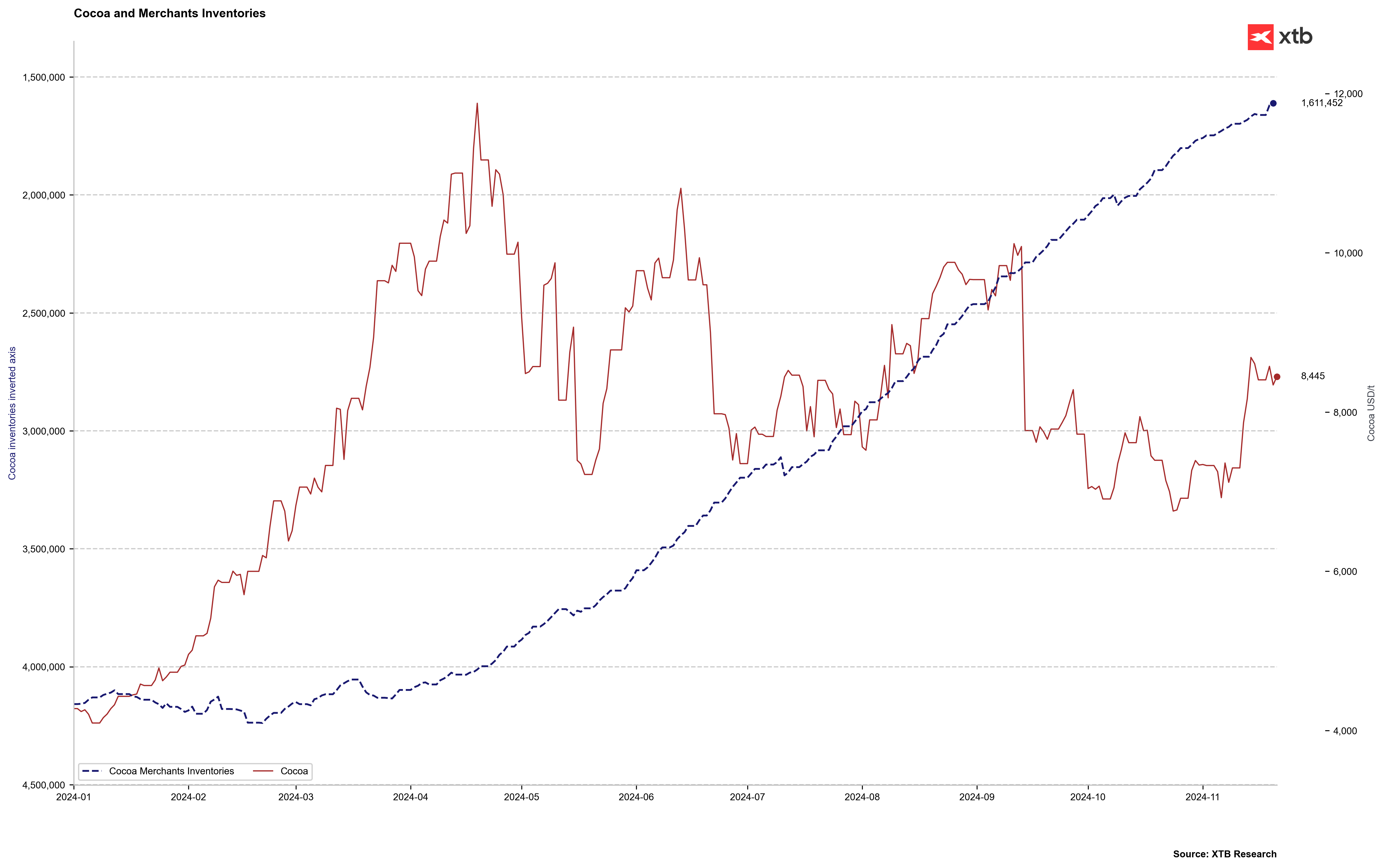

Interestingly, a divergence is currently forming in the form of a price decline and a clear drop in cocoa inventories, which are once again significantly below 2 million bags. Source: Bloomberg Finance LP, XTB

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.