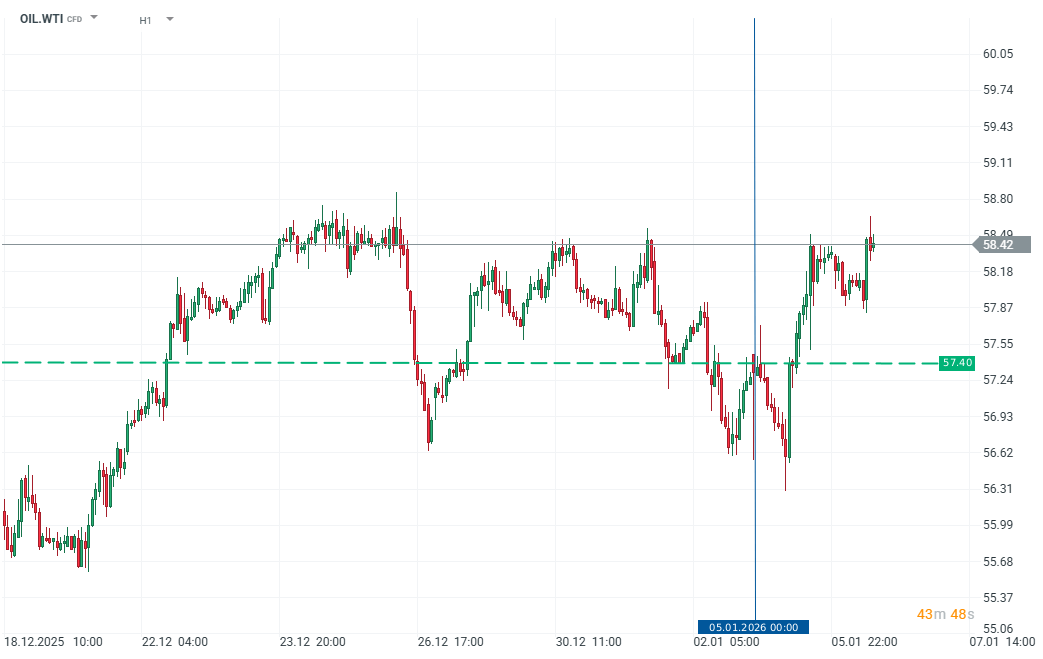

Chart of The Day – OIL.WTI

US actions in Venezuela following the seizure of power from Nicolás Maduro are now focused on rebuilding the country’s devastated oil sector. Energy Secretary Chris Wright is expected to meet this week with major US oil companies. The administration hopes that Chevron, ConocoPhillips and others will help restore production after years of neglect and corruption. Oil companies, however, are approaching the situation cautiously and are seeking guarantees of political stability, rule of law and long-term US backing before committing to multibillion-dollar investments, which experts estimate at around USD 10 billion per year over the next decade.

President Donald Trump said that elections will not be held in the near term, arguing that the country must first be “nursed back to health.” He also suggested that the US may subsidize the reconstruction of the oil sector and claimed that operations could be restarted in under 18 months, with companies potentially reimbursed by the US government or by future production revenues. Trump framed the strategy as a way to lower oil and fuel prices for American consumers while strengthening US energy and geopolitical leverage.

For the oil market, it is unlikely that developments in Venezuela will have a significant short-term impact. Refineries in the US Gulf Coast — designed to process heavy Venezuelan crude — could handle imports if supplies gradually return. However, the outlook is very long-term. Any additional Venezuelan supply would likely exert only moderate downward pressure on prices over the coming years. The scale and pace of recovery will depend on financing, political stability, and whether companies ultimately decide to commit to large-scale investment — a decision that will likely require US guarantees.

Oil prices not only recovered their initial post-weekend losses, but have now risen above Friday’s closing levels.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.