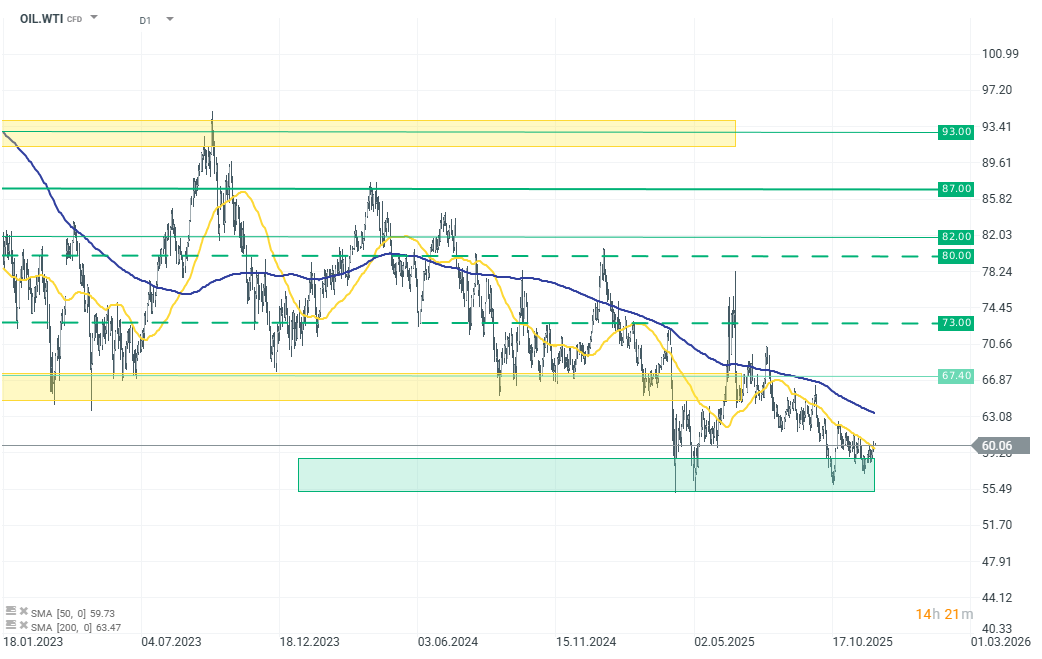

Chart of The Day – OIL.WTI.

WTI crude prices have stabilized around 60–61 USD per barrel. The market is trying to balance India’s renewed purchases of discounted Russian oil with concerns about global oversupply. India is once again buying crude through intermediaries at a deeper discount of around 5 USD per barrel, and President Putin has pledged “uninterrupted fuel supplies” as part of expanded economic cooperation. The renewed India–Russia trade partnership provides steady demand for Russian barrels at a time when OPEC+ and non-cartel producers — such as the U.S., Brazil, and Guyana — are increasing output.

At the same time, Ukrainian attacks on Russian energy infrastructure — including strikes on refineries, ports, and the CPC Black Sea export terminal — are putting upward pressure on physical crude prices and sharply raising shipping insurance rates in the Black Sea, in some cases by more than 200–250%. These disruptions constrain regional supply and discourage shippers, although the broader crude market remains calmer. Given these developments, oil prices continue to trade in a relatively stable range slightly above 60 USD per barrel.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.