Chart of The Day – NATGAS

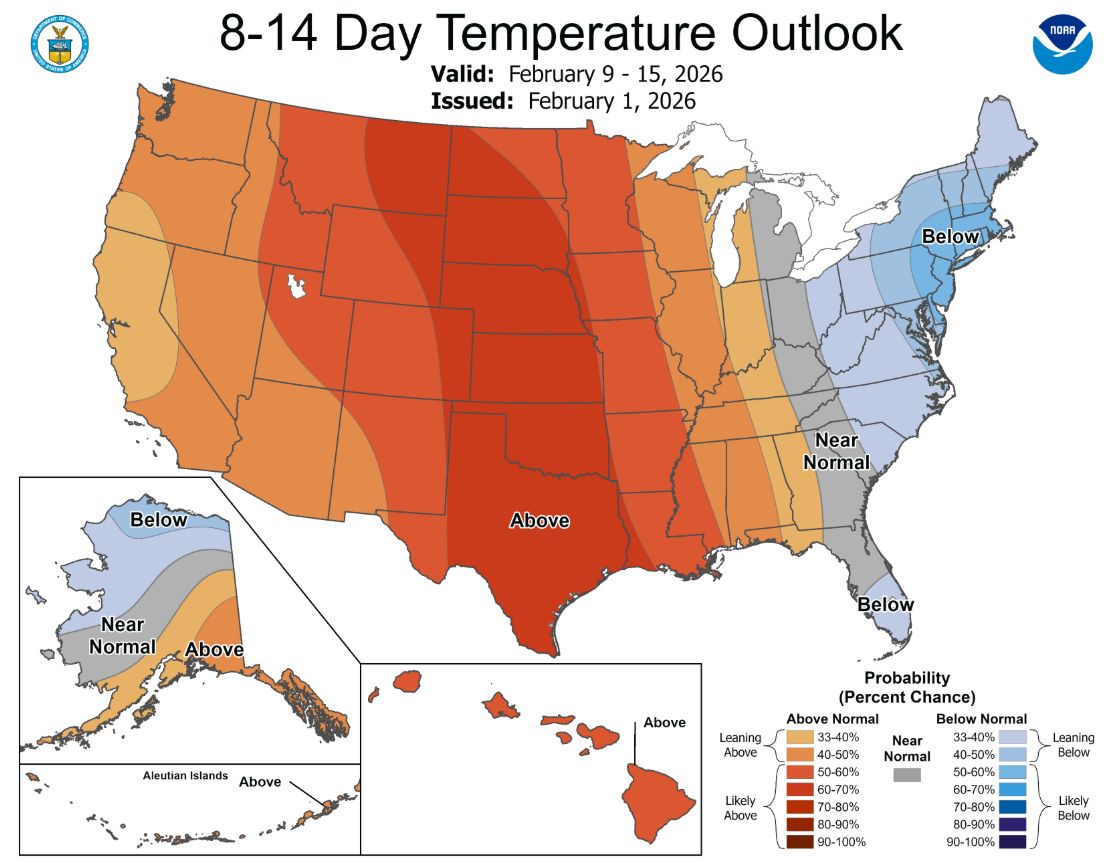

NATGAS prices fell sharply, losing nearly 17% to around 3.62–3.65 USD/MMBtu, reversing earlier strong gains driven by a cold snap and a surge in heating demand. The key factor is the warming weather forecast – the NOAA map for 9–15 February shows above-average temperatures across most of the US, which limits the expected demand for gas for heating and power generation, while supporting the recovery of production and a significant increase in gas flows to LNG terminals, including Freeport LNG in Texas.

Source: NOAA

The change in forecasts from “record cold” to milder conditions caused the market to almost completely erase the earlier weather-driven boom: the February contract reached a three-year high before expiry, and the March contract rose sharply on Friday after a bullish inventory report, before now turning sharply lower. A similar reaction is visible in Europe, where the benchmark Dutch TTF is falling to around EUR 34-35/MWh (approx. -11%) following milder forecasts and an improvement in the supply balance, which together shows how much NATGAS pricing remains dependent on short-term weather models.

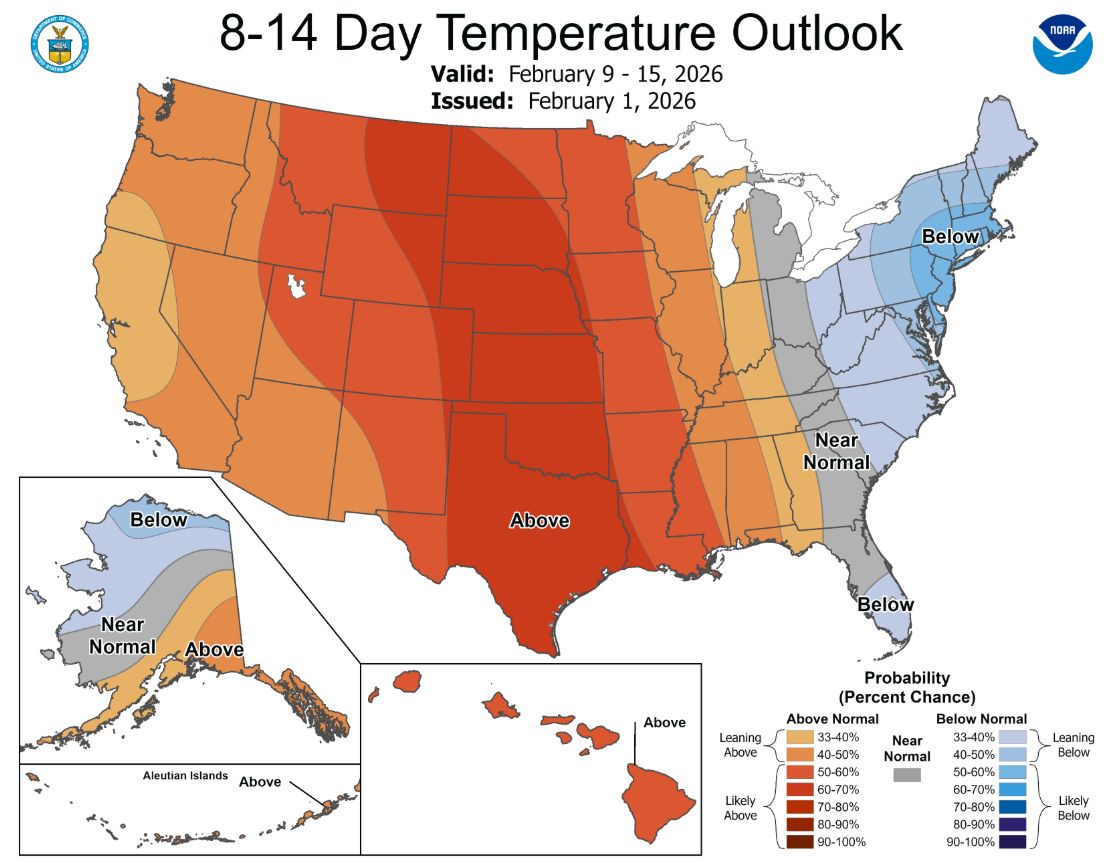

Today, NATGAS is falling towards the 200-day exponential moving average (the gold curve on the chart), which has been an important local support point for commodity prices several times in the past. Seasonally, February remains relatively weak for commodity prices, which is related to the decline in heating demand and the start of the waiting cycle for the cooling season. Source: xStationNATGAS prices fell sharply, losing nearly 17% to around 3.62–3.65 USD/MMBtu, reversing earlier strong gains driven by a cold snap and a surge in heating demand. The key factor is the warming weather forecast – the NOAA map for 9–15 February shows above-average temperatures across most of the US, which limits the expected demand for gas for heating and power generation, while supporting the recovery of production and a significant increase in gas flows to LNG terminals, including Freeport LNG in Texas.

Source: NOAA

The change in forecasts from “record cold” to milder conditions caused the market to almost completely erase the earlier weather-driven boom: the February contract reached a three-year high before expiry, and the March contract rose sharply on Friday after a bullish inventory report, before now turning sharply lower. A similar reaction can be seen in Europe, where the benchmark Dutch TTF is falling to around EUR 34-35/MWh (approx. -11%) following milder forecasts and an improvement in the supply balance, which together shows how much NATGAS pricing remains dependent on short-term weather models.

Today, NATGAS is falling towards the 200-day exponential moving average (the gold curve on the chart), which has been an important local support point for commodity prices several times in the past. Seasonally, February remains relatively weak for commodity prices, which is related to the decline in heating demand and the start of the waiting cycle for the cooling season. Source: xStation

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.