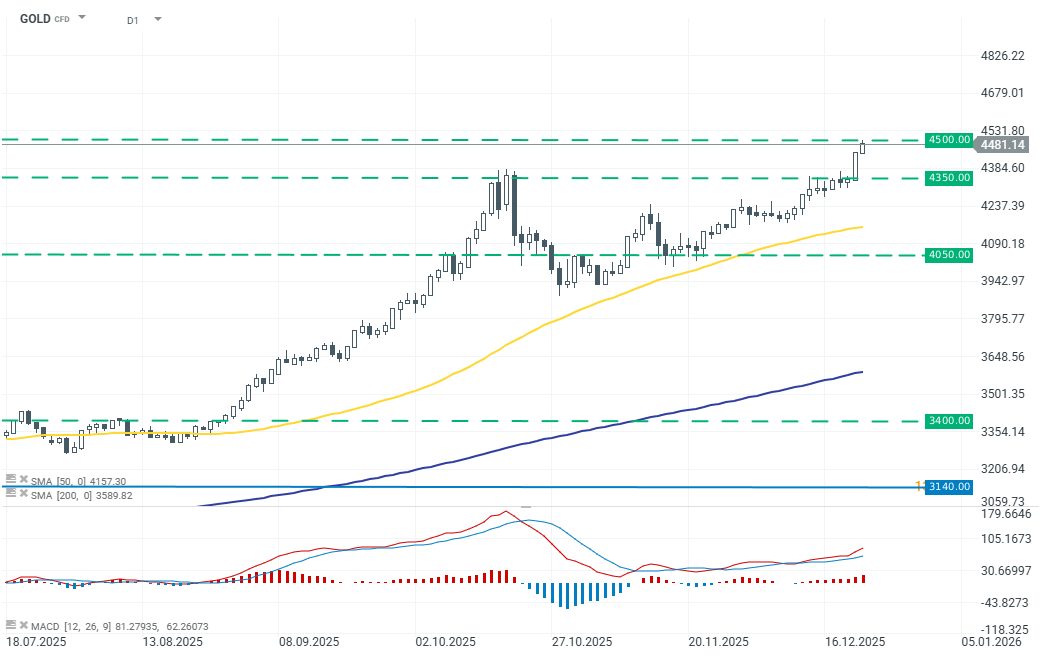

Chart of The Day – GOLD

Gold continues its wave of dynamic gains, adding 0.82% today. The price of gold briefly approached another major milestone at 4,500 USD per ounce (4,495 USD). The rally is supported by a clear increase in demand for safe-haven assets and ongoing geopolitical turbulence during Donald Trump’s presidency. The immediate catalyst remains rising geopolitical uncertainty, including tensions between the US and Venezuela, which are curbing risk appetite.

Investors are also increasingly positioning for a more dovish Fed stance in 2026, supported by recent US inflation readings that came in below expectations.

From a technical perspective, gold futures have broken through a key resistance level around 4,350 USD, aligning with the prevailing upward channel. Holding above this level will be crucial to sustaining the current rally. At the same time, the prospect of further monetary easing lowers the opportunity cost of holding gold relative to yield-bearing assets. Combined with continued purchases by central banks — particularly in emerging markets — and growing interest from retail investors, this keeps structural demand for gold elevated.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.