Chart of The Day – CHN.cash

The HSCEI futures are down 1.1% as risk appetite plunges. Anticipation of a series of key US labor market releases is generating caution worldwide, while geopolitical tensions are adding further pressure on Asian indices.

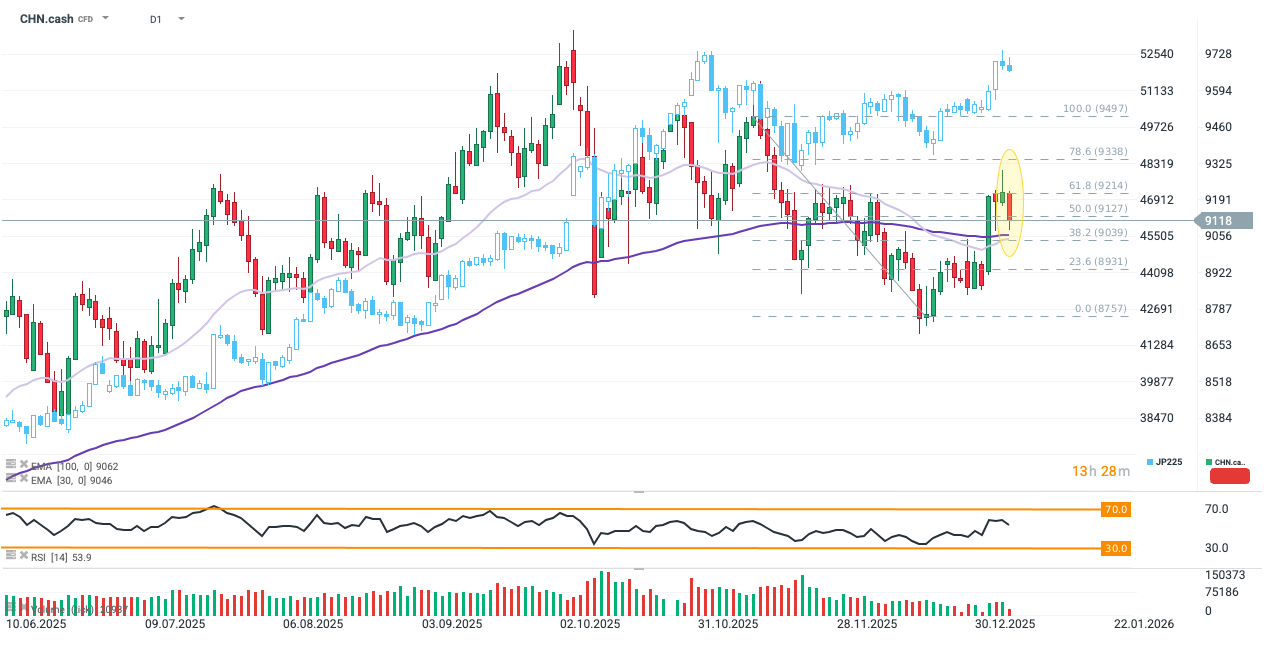

CHN.cash is trading below the 50% Fibonacci retracement of the last downward wave, but the sell-off has halted near the 100-day exponential moving average (EMA100; dark purple). Holding above this level will be crucial for continuing the rebound that began at the turn of 2025–2026. The blue line shows the Nikkei 225 futures, also under pressure from Beijing’s actions. Source: xStation5

What is driving CHN.cash today?

- China has halted exports of certain rare earth metals and dual-use goods to Japan, citing national security following comments by Japanese Prime Minister Sanae Takaichi on Taiwan. The restrictions took effect immediately and could disrupt supply chains in key sectors, including electronics, aerospace, and defense. China also launched an anti-dumping probe into Japanese chemicals used in semiconductor production.

- Beijing’s decision has rattled sentiment across the region. Chinese rare earths accounted for a staggering 63% of Japan’s imports in 2024, and the restrictions could seriously disrupt production in electronics, automotive, and defense sectors. For Chinese firms, this means losing a significant customer base, while investors face increased uncertainty across the supply chain and pressure on strategic component prices.

- CHN.cash is also weighed down by a slowdown in AI-driven optimism. Risk appetite is clearly declining as investors prepare for key US labor market data, which will be particularly relevant for Fed policy in the coming months. Expectations for Friday’s NFP report are relatively high – the market anticipates labor market stabilization and further job growth following months of mixed readings. Preludes to the report include today’s ADP and JOLTS releases, which are expected by consensus to confirm a stable employment narrative, though demand for new hires remains subdued.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.