Chart of The Day – AUD/USD

The RBA kept interest rates at 3.6% as expected, but the key change lies in a dramatic shift in rhetoric towards possible hikes in 2026. Governor Michele Bullock stated outright that further cuts are not on the horizon, and the scenario assumes either a long pause or a transition to a cycle of increases. Australia is going through the shortest and shallowest cycle of cuts in the 30-year history of the central bank, with only three cuts in February, May and August. of the central bank, with only three cuts in February, May and August. The market is already pricing in almost two hikes for next year, and NAB’s chief economist warns that a hike could even come as early as the February meeting on 2-3 February. The decision was unanimous, underscoring the RBA’s determination on inflation, which stood at 3.8% y/y in October, well above the bank’s 2-3% target.

The fundamental problem facing the Australian central bank’s monetary policy is that the most stubborn element of inflation is linked to housing, utility bills and insurance, i.e. factors that are not very responsive to interest rate hikes; higher rates will dampen demand and investment, but at the same time discourage new housing construction and increase the shortage of rentals, reinforcing inflationary pressures in the housing market. For Australian households, this means a frustrating scenario – after 13 increases in 2022-2023, they received only three cuts, and now they face a potential normalisation towards higher rates, which will be another blow to tight household budgets and government policy, which must simultaneously contend with pressure on fiscal spending.

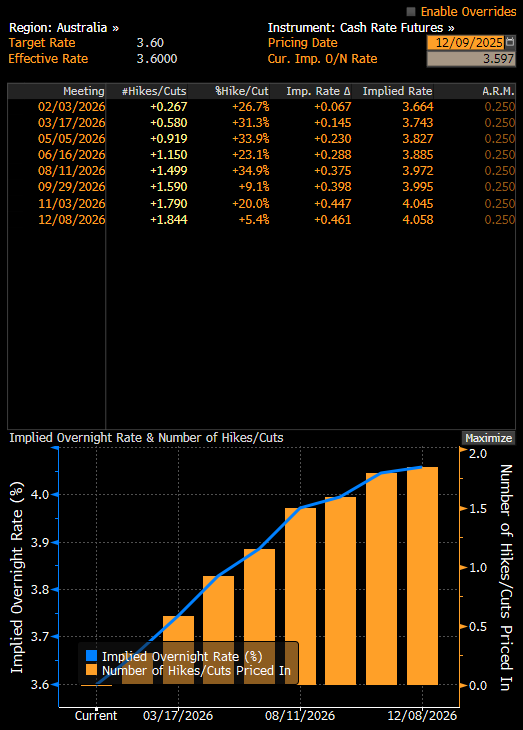

As shown in the table above, which represents the valuation of swaps for the future path of interest rates in Australia, the market already gives an almost 84% probability that interest rates in that country will be raised twice next year by 25 basis points. Source: Bloomberg Financial No.

The AUDUSD pair has had several trading sessions that brought dynamic increases in the exchange rate of this currency pair. Interestingly, the scale and pace of the increases led to the RSI indicator for the 14-period historical average oscillating in the 70-point zone, which from a textbook point of view is often referred to as an overbought area. In the past, at the beginning of September, a similar scenario triggered a downward correction in the pair. The two charts also show divergences between the RSI indicator and the price, which may indicate that, in recent history, bears have more often controlled the market. However, this does not change the fact that Bullock’s hawkish rhetoric may change the market picture and lay the groundwork for maintaining the medium-term uptrend. Much will depend on future data releases from Australia, but also from the US. In this regard, it is worth paying attention to tomorrow’s Fed decision at 20:00 GMT+1. Source: xStation

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.