Char of The Day – Nasdaq

US index futures, including the Nasdaq 100 (US100), have staged a powerful rebound, gaining more than 7.5% since November 25. The main drivers of the index include a strong Q3 earnings season, expectations of a major shift in Federal Reserve policy priorities in 2026 under a new chair, likely Kevin Hassett, who is expected to favor lower borrowing and debt-financing costs and the ongoing technological AI revolution. The rise in Alphabet shares (GOOGL.US) has almost fully offset the decline in Nvidia’s stock price, while intensifying competition in language models where Google Gemini is currently in the spotlight, is capturing investors’ imagination.

- Several banks, including J.P. Morgan and Barclays, have recently issued upbeat forecasts for 2026. Signals coming from U.S. institutions suggest that 2026 may continue to be dominated by gains in risk assets. Bank of America’s private wealth management division has recommended a 2–4% allocation to cryptocurrencies, aligning well with expectations of a weakening dollar and continued inflows into equity markets. Meanwhile, fears from spring 2025 have not materialized, and U.S. inflation has not risen as a result of higher tariffs. Lower oil prices are also supporting market momentum.

- Economic growth remains intact, and macro data does not point to rising recession risk. The latest jobless claims reading came in at 216,000—one of the lowest in many months. Moreover, yesterday’s ISM services data printed relatively strong figures, although the ADP report highlighted some cooling in the U.S. labor market. For financial markets, however, this is not a reason to take profits; in fact, this very dynamic increases the likelihood of more aggressive Federal Reserve rate cuts being priced in. The next cut, expected in December, is now assigned a probability close to 90%.

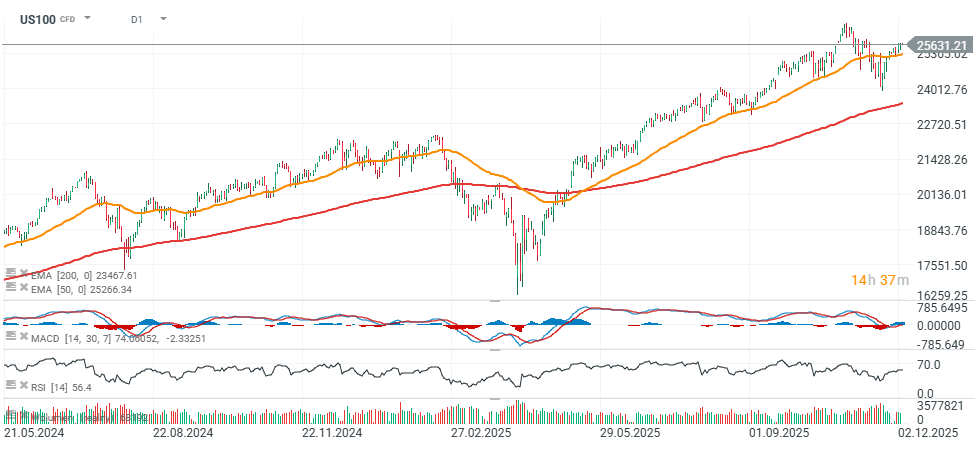

US100 (D1 interval)

U.S. indices are recording a slight decline of around 0.1% today, yet remain above the two key moving averages: the EMA50 (orange) and EMA200 (red). The index may theoretically consolidate between 25,500 and 25,900 points before determining its next direction. Should an upside breakout occur, the path toward the highs near 26,400 points will open. A downside failure, however, could bring a retest of 24,400 points and signal a longer trend reversal. Nonetheless, expectations for 2026 remain positive, which could support a “Santa Claus rally” on the U.S. trading floor.

Source: xStation5

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.