Bullish Ferrari Shares

We are slowly coming to the end of the first phase of the European trading session.

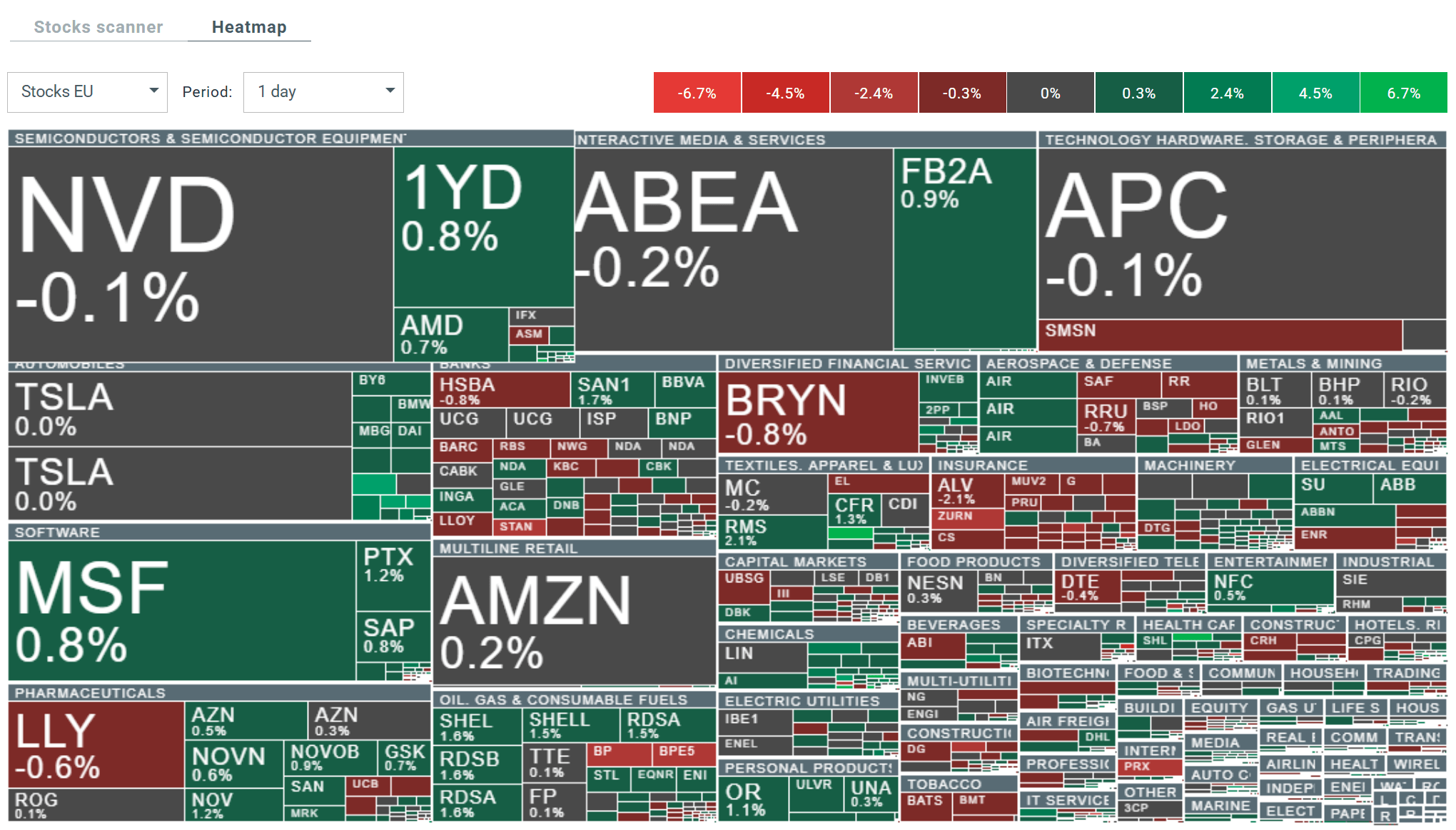

At the moment, shares are performing relatively well, and most sectors of the economy are recording moderate growth.

Source: xStation

The German DE40 is currently up 0.05%. At the same time, the FRA40 is up 0.2% and the Italian ITA40 is up nearly 0.15%.

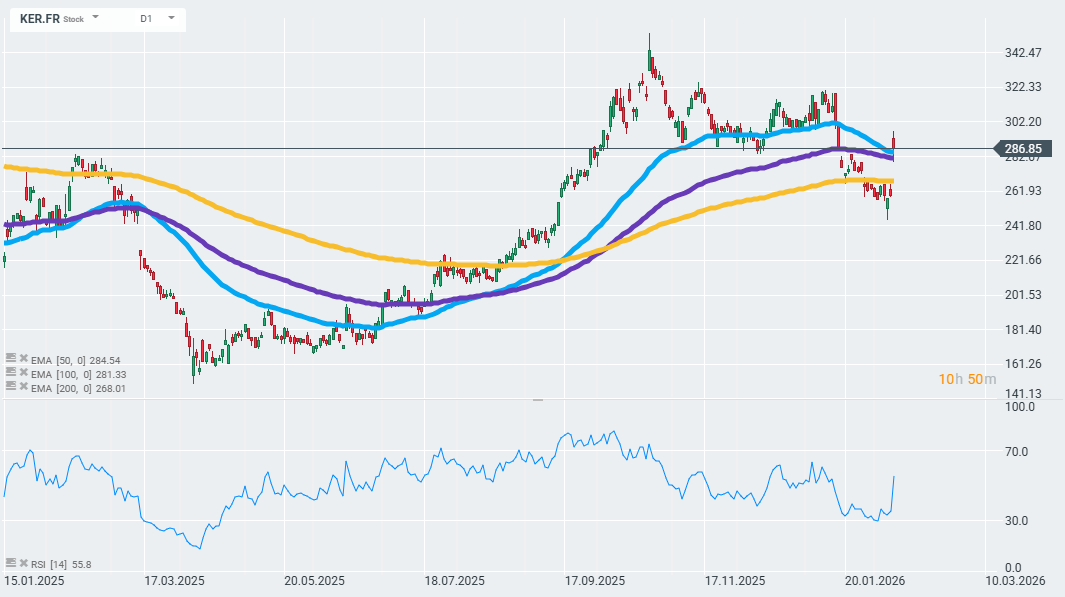

Investors are focusing on the results of Kering (KER.FR) and Ferrari (RACE.IT).

Kering reacted strongly on the stock market (share price up approx. 14%) after publishing better-than-expected results for Q4, particularly at Gucci, and announcing an exceptional dividend of €1 per share following the sale of its beauty division. The results still show a significant deterioration: revenues fell, operating profit for 2025 declined by approximately one-third, the operating margin fell to 11.1%, and the group reported a small net loss from continuing operations. Gucci continues to record double-digit sales declines (–10% like-for-like in Q4), albeit slightly less than the consensus, while the better performance of YSL and Bottega Veneta offsets the weakness of other brands and higher one-off costs. Analysts emphasise that the report shows a “slight improvement”, but the key will be whether the new management can actually restore growth and improve margins in 2026-2027; more details are expected to be revealed at Capital Markets Day on 16 April.

Kering shares started the session with a bullish gap up, which broke above important control points constructed by the 50- and 100-day exponential moving averages. Source: xStation

Ferrari posted very strong results, both for the quarter and for the whole of 2025: earnings per share in Q4 (USD 2.49) and revenues (USD 2.098 billion) clearly exceeded market expectations, growing by approximately 9% and 13% year-on-year, respectively. For the full year, revenue reached €7.15 billion (+7%), EBIT rose 12% to €2.11 billion, and the operating margin rose to a very high 29.5%, with an EBITDA margin of 38.8%. Particularly impressive was the increase in industrial free cash flow to €1.54 billion, up 50% year-on-year, highlighting the strength of the business model and discipline in volume management. The company looks to the future with great confidence, targeting approximately €7.5 billion in revenue and an EBITDA margin of 39% for 2026, with an order book filled until the end of 2027, confirming the very strong demand for the Ferrari brand.

Ferrari shares are currently testing the 50-day exponential moving average (blue curve). Source: xStation

The Japanese yen continues to perform best on the Forex market. The British pound and Australian dollar have seen the biggest declines.

The precious metals market is stabilising after yesterday’s gains. SILVER is down nearly 1.5% on a daily basis, while GOLD is down 0.2%.

The macro calendar for the rest of the day includes: US retail sales data, US export and import data, and API data on crude oil inventories, also in the US.

Coca-Cola, S&P Global and Robinhood Markets will present their quarterly results today.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.