Bayer (BAYN.DE) is seeing spectacular growth in its share price today, up more than 10% (reaching as high as 11.5% at the peak of the session), reaching EUR 30 and its highest level since September 2024. The company’s market value increased by approximately EUR 3 billion as a result of the positive results of the OCEANIC-STROKE clinical trial for asundexian announced yesterday evening. This 50-milligram oral medication, administered once daily in combination with standard platelet therapy, achieved the first successful completion of a Phase III trial in the history of Factor XIa inhibitors, demonstrating a significant reduction in the risk of recurrent ischaemic stroke without increasing the risk of major bleeding.

The significance of the result stems from the history of the previous failure. Just two years ago, Bayer halted a trial of the same drug in a group of patients with atrial fibrillation (OCEANIC-AF), where asundexian proved inferior to the competing Eliquis (apixaban) from Bristol Myers Squibb (BMY.US) and Pfizer (PFE.US). Today’s announcement is therefore a dramatic turnaround – asundexian is now a potential blockbuster in secondary prevention, addressing a significant pool of patients, among whom 20-30 per cent suffer a recurrent stroke, and one in five stroke patients experience a recurrence within five years.

Analysts at Jefferies described the result as a “material de-risking event” for Bayer’s portfolio, validating Factor XIa inhibition as a “differentiated approach to anticoagulation”. The outlook for asundexian is extremely optimistic, with estimates suggesting the drug could generate annual sales in excess of USD 1 billion, and some analysts suggesting potential in the region of EUR 3 billion. Bayer has already received Fast Track Designation from the FDA, which will expedite the approval process. For CEO Bill Anderson, who has been grappling with enormous financial liabilities from glyphosate and PCB contamination lawsuits for years, asundexian represents a long-awaited opportunity to restore growth in the pharmaceutical division and rebuild investor confidence.

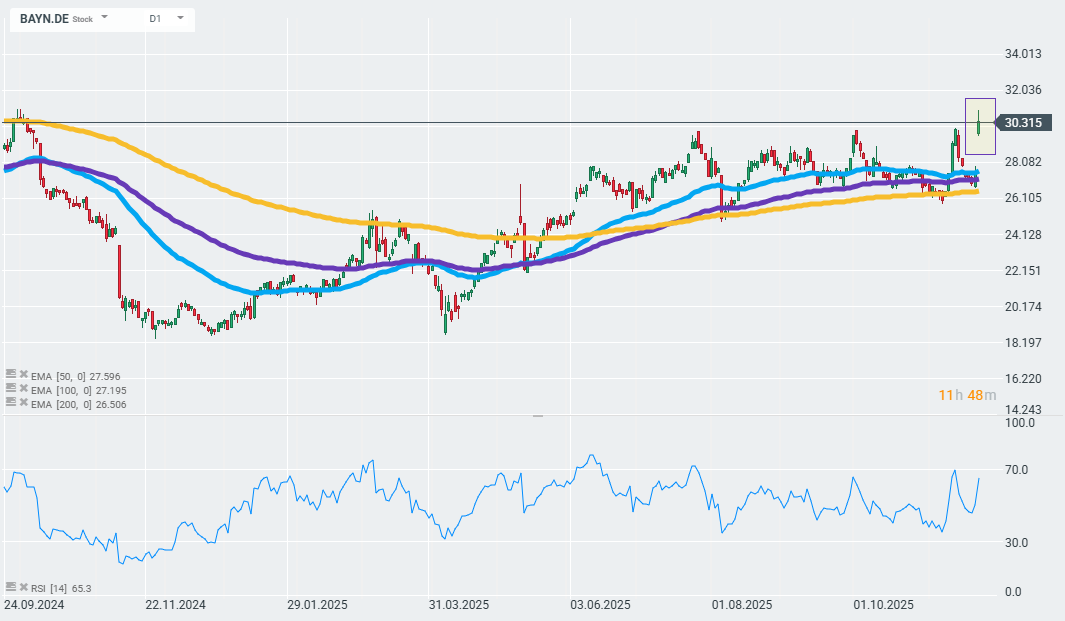

Today’s gains are significant, with the RSI returning to around 70 points on a 14-day average. However, the company maintains a long-term upward trend, and the positive news prolongs this movement. Source: xStation

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.