Trade of The Day – Copper

Facts:

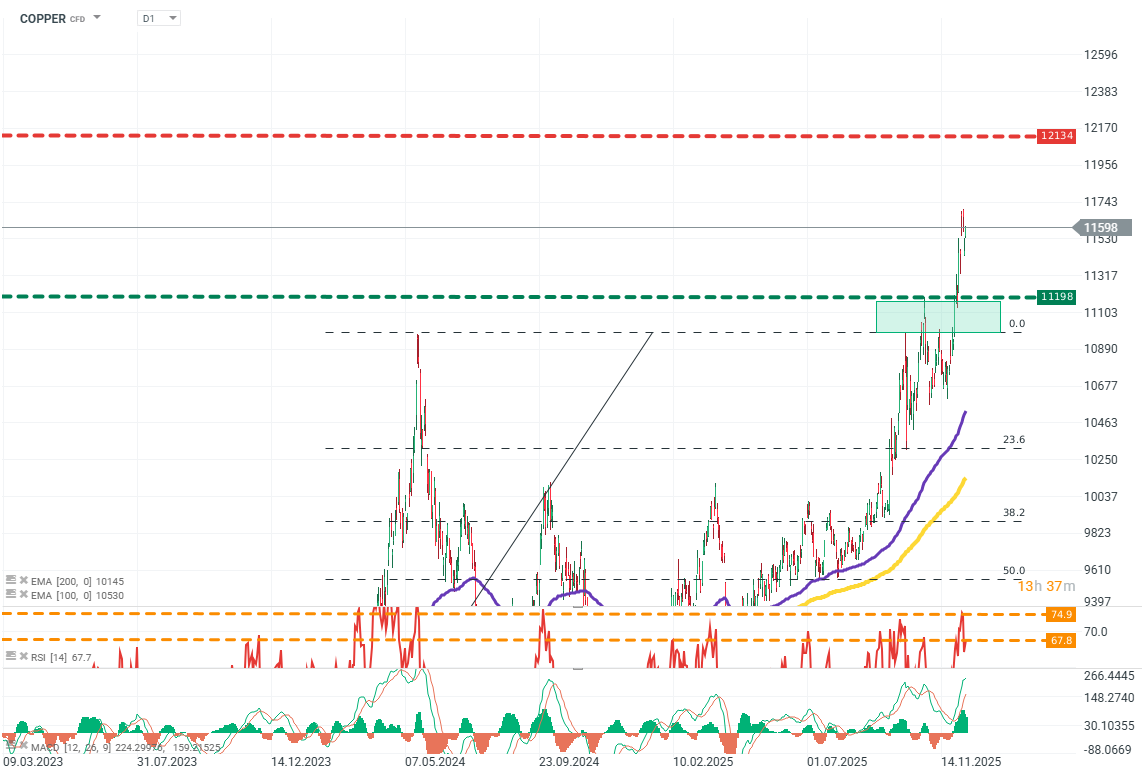

- RSI (14) reached a local maximum at 74.9, after retreating from the peak, it maintained an elevated level of 67.8.

- Commodity exchanges have accumulated a record amount of raw material stocks.

- Demand for copper in China (the largest consumer of copper) remains below peaks—a year-on-year decline in imports of over 12%.

Trade: Short position on COPPER at market price.

- Target: 11198

- Stop: 12134

COPPER (D1)

Source: xStation5

Opinion: Current copper valuations have accounted for most of the demand-driven, long-term trends in the commodity and copper markets. These include, among others, the expansion of data center infrastructure, increased demand from the renewable energy and electric vehicle sectors, and structural shortages/underinvestment on the part of entities extracting the raw material. However, the market does not account for threats to the market. At current levels, even a small change in discount can cause a significant correction. The main party interested in copper demand does not signal increased demand. Industry and consumption in China remain in a slowdown phase. At the same time, stocks on commodity exchanges do not indicate a real shortage. Copper refinery activity in China does not indicate this either. Naturally, the long-term trend will support copper valuations due to the disparity between demand and supply, but in the short term, there is an opportunity to take advantage of the temporary overvaluation of the raw material.

Methodology and assumptions:

- The recommendation was based on technical analysis of the chart, particularly the RSI indicator, Fibonacci levels, MACD, and fundamental analysis of the copper market.

- The target level was set above the FIBO 0 level of the last upward wave, which could be too strong a resistance for declines. The target level is around the last peak from October.

- The defensive stop-loss order was based on the possible range of the upward trend, above which the realization of the correction scenario could be threatened — and which simultaneously offers a favorable risk-reward ratio.

You can read more about this methodology here:

Employees of the Analysis Department, as well as other persons involved in the preparation of this report do not have any knowledge about positions of TM in financial instruments. In addition, Trading Department employees are not taking part in preparation of reports and/or market commentaries.

There is a conflict of interest between TM and the Client resulting from the fact that TM draws up General Recommendations regarding the Financial instruments, which TM also has in its offer. In addition, if as a result of the General recommendation obtained, the Client concludes a transaction in TM, there is a conflict of interest in that TM will be the other party to the transaction entered