Nvidia: near perfect earnings report sends stocks soaring

Nvidia has reported Q3 results, and the numbers are huge. The company reported revenues of $57bn, net income of $31.76bn, and earnings per share is $1.30. The ‘piece de resistance’ was forward guidance. Nvidia is predicting that sales will generate revenue of $65bn plus or minus 2% for Q4, significantly higher than the $62bn expected by analysts, which was 10 times what it was just three years ago.

AI sustainability fears put to bed by stunning results

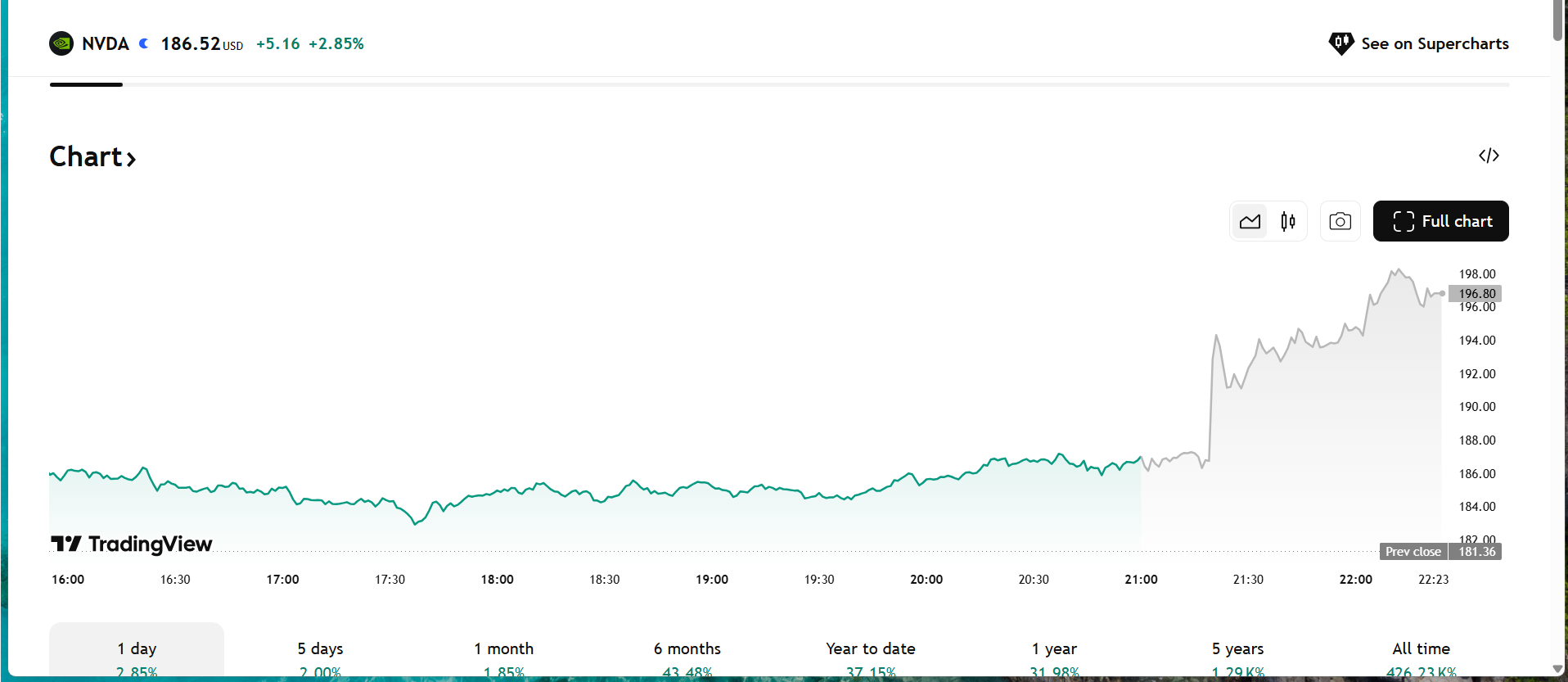

Any concerns about demand or capex spending on the AI trade have been put to bed for now, and Nvidia’s share price surged in after-market trading, rising by more than 6% at one stage. When Nvidia predicts strong demand, this has a knock-on effect for other sectors of the AI market. AMD, CoreWeave, and Broadcom are all significantly higher in the post-market.

These results are not only revitalizing tech stocks, but futures prices across global indices are higher on Thursday, as signs that the AI trade is healthier than expected is the ship that could lift all boats as we move the end of the year.

The ‘virtuous cycle of AI’

Although forward guidance is significantly higher than expected, decent Q4 numbers were mostly baked in. Investors will be more impressed by Jensen Huang’s commentary that Blackwell sales are off the charts and cloud GPUs are sold out. He said that compute demand ‘keeps accelerating’ across training and inference models, which are continuing to grow exponentially. Huang calls this the ‘virtuous cycle of AI’. The AI eco system is scaling fast, according to Huang, and it’s not only the hyperscalers getting in on the act. Huang notes that there are new foundation model makers, more AI startups across more industries and in more countries.

This is a near perfect earnings report and outlook. It suggests that demand for Nvidia’s products will continue to grow and could beat expectations. Crucially, it aloso indicates that demand is broadening out and will be less concentrated among the largest hyperscalers in the future. This could also ease fears that AI uptake could be disappointing.

Strengthening fundamentals

This is music to the ears of Nvidia bulls, and those who were concerned about the AI trade and its sustainability. Its Q3 earnings report has confirmed that Nvidia strengthened its fundamentals last quarter. Revenue growth was a whopping 62.5% YoY last quarter, and gross margin jumped from 72.5% to 73.4%.

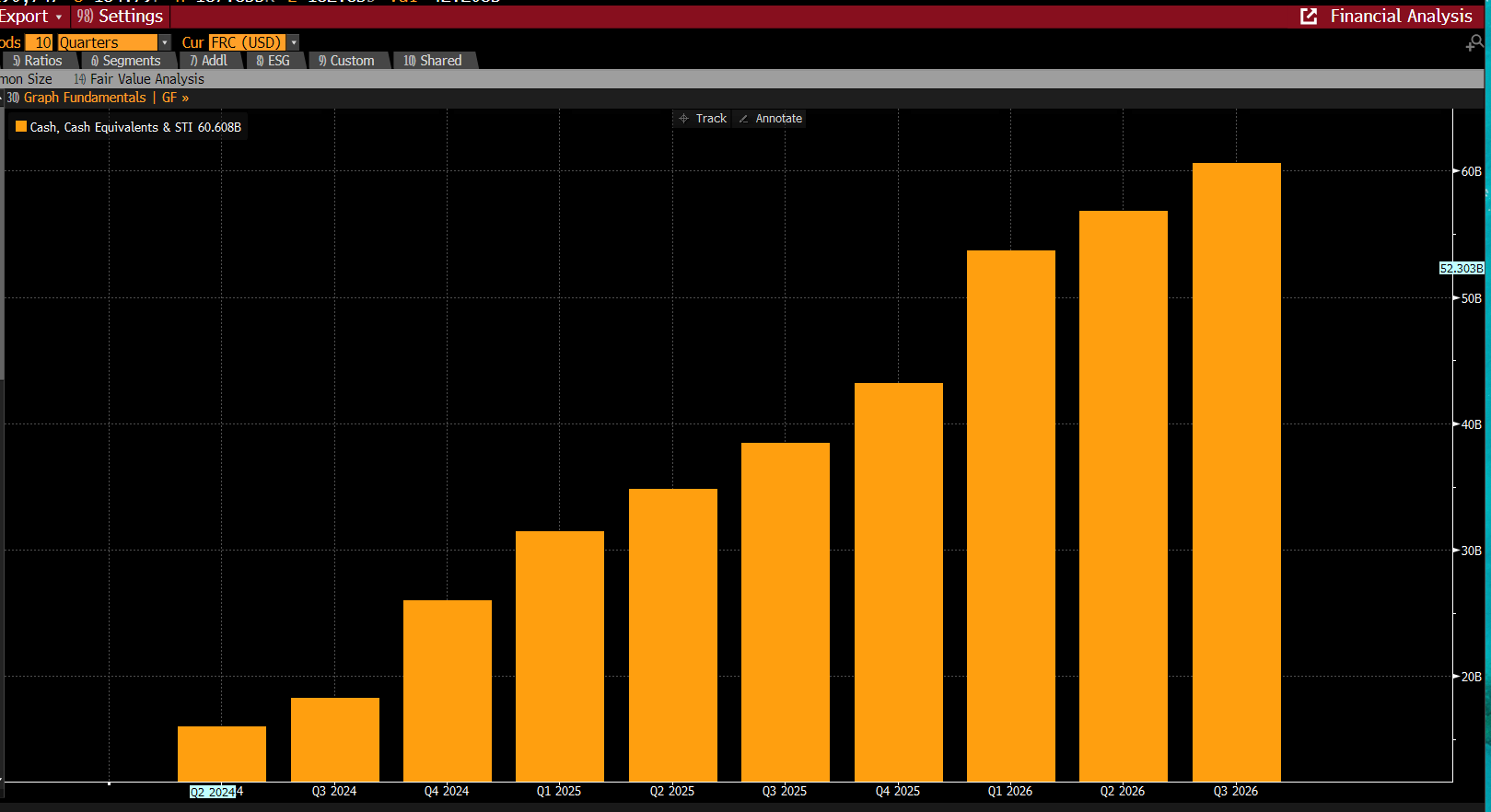

Nvidia: the cash generating machine

This company is a cash generating machine, it has $60.6bn of cash and cash equivalents on its balance sheet, up from $38.4bn a year ago. To put this into context, Apple has $54.69bn in cash and cash equivalents on its balance sheet. However, more important for Nvidia is the amount of cash Microsoft has on its balance sheet. It reported cash and cash equivalents of more than $102bn last quarter, which suggests that Nvidia’s single largest customer can well afford a long-term AI build out programme.

The strength of Nvidia’s balance sheet could ease anxiety about the ‘circular’ economy in the AI trade, with AI behemoths investing in their customers. This is not hitting revenue, and it is not hurting the exceptionally healthy cash positions of these companies. Thus, concerns about deals being made by Nvidia and others could be overblown.

Future demand for latest products ease concerns about depreciation

Concerns about excess capacity had started to weigh on the AI trade in recent weeks, as investors concerns about the depreciation of AI assets grew. However, Huang’s comments that ‘GPUs are sold out’ indicates that demand for Nvidia products remains strong and the company does not have any excess capacity. Regarding depreciation, Nvidia has a strong pipeline of new and more advanced products, and the stunning revenue forecasts suggest that production of the latest GB300 chip is ramping up and will drive future revenues.

Nvidia smashes expectations without China

This earnings report has pleased investors and eased fears about a bubble in the AI trade. China had been a cause of concern after Q2’s earnings, however, in Q3, although Nvidia’s business is essentially locked out of China, this did not stop revenues from swelling. Crucially, it appears that Nvidia does not need China to continue to grow sales, and its forecast that Reuben and Blackwell chips will generate $500bn of cumulative revenue by next year, does not include sales to China. Thus, if the trade relationship between the US and China improves, any future sales to China is all extra upside.

This fact alone is astonishing. Nvidia can generate hundreds of billions of revenues without the help of the world’s second largest economy. This gives some idea of the scope and scale of the demand for AI, which could be enough to help stocks recover and rally into year-end; overall US indices are rising on the back of this earnings report.

Results like these can unleash Santa rally at last

Nvidia’s results are treated like a macro event, so if we look to Nvidia to tell us about the strength of the economy, then the economy is strong, and fears of a slowdown are overdone. This could help to boost the market mood as we move towards the end of the week.

Chart 1: Nvidia is awash with cash

Source: XTB and Bloomberg

Chart 2: Nvidia’s stock price soared in post-market trading after the earnings release

Source: XTB and Bloomberg

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.